Forex Technical Analysis & Forecast 14.08.2020

EURUSD, “Euro vs US Dollar”

After finishing another ascending wave at 1.1860 and then reaching 1.1818, EURUSD has formed a new consolidation range around the latter level just to break it to the downside and reach 1.1793; right now, it is growing to return to 1.1818 and break it. After that, the instrument may move upwards to break 1.1870 and then continue trading to the upside to reach at least 1.1930. However, if the price falls and breaks 1.1780, the market may start another decline with the target at 1.1700.

GBPUSD, “Great Britain Pound vs US Dollar”

After forming a new consolidation range at 1.3066, breaking it to the upside, and then reaching the target at 1.3127, GBPUSD has returned to 1.3045; right now, it is consolidating around 1.3066. If later the price breaks this range to the upside at 1.3095, the market may start a new growth to break 1.3128 and then continue trading upwards to reach 1.3222; if to the downside at 1.3040 – resume moving inside the downtrend with the target at 1.2970.

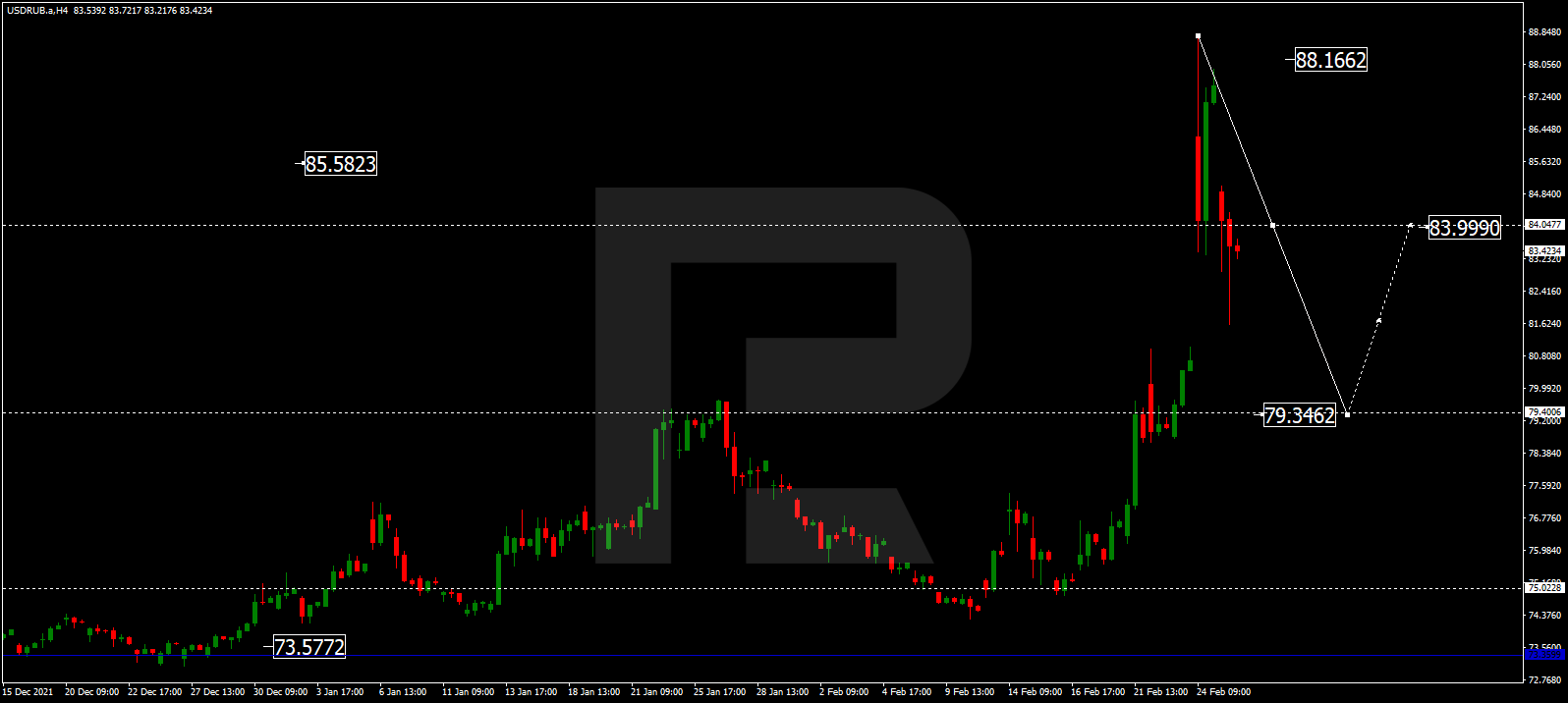

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is still consolidating around 73.73 without any particular direction. According to the main scenario, the price is expected to fall to break 72.30 and then continue trading downwards with the short-term target at 70.80.

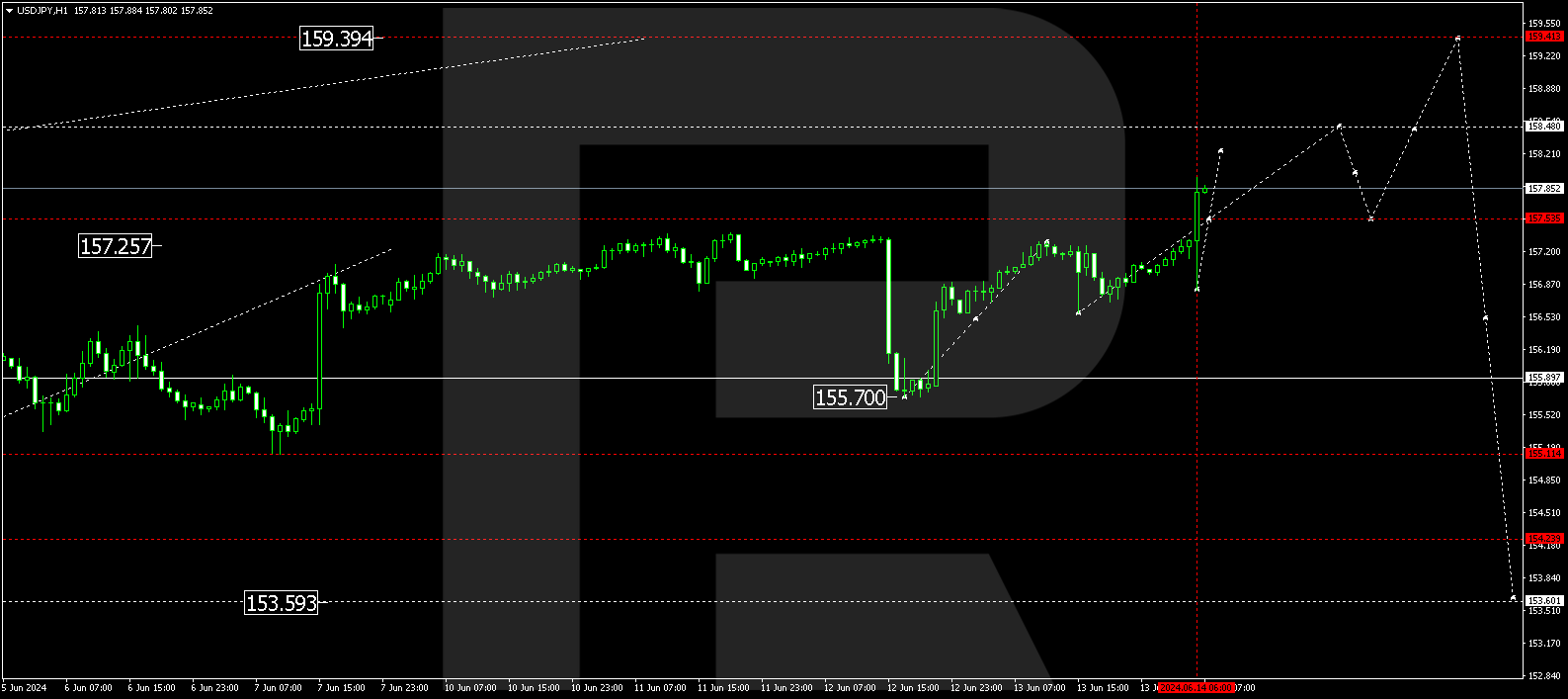

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is consolidating around 106.78. Possibly, today the pair may fall to reach 105.40 and then start another growth towards 106.78. If later the price breaks this range to the downside, the market may form a new descending structure with the target at 105.95.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is still consolidating around 0.9100. If later the price breaks this range to the downside, the market may start a new decline to reach 0.9050 or even 0.9000; if to the upside – resume moving upwards with the target at 0.9150 or even 0.9222.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is still consolidating around 0.7155. If later the price breaks this range to the upside at 0.7183, the market may start a new growth to reach 0.7222; if to the downside at 0.7130 – resume moving inside the downtrend with the target at 0.7100 or even 0.7070.

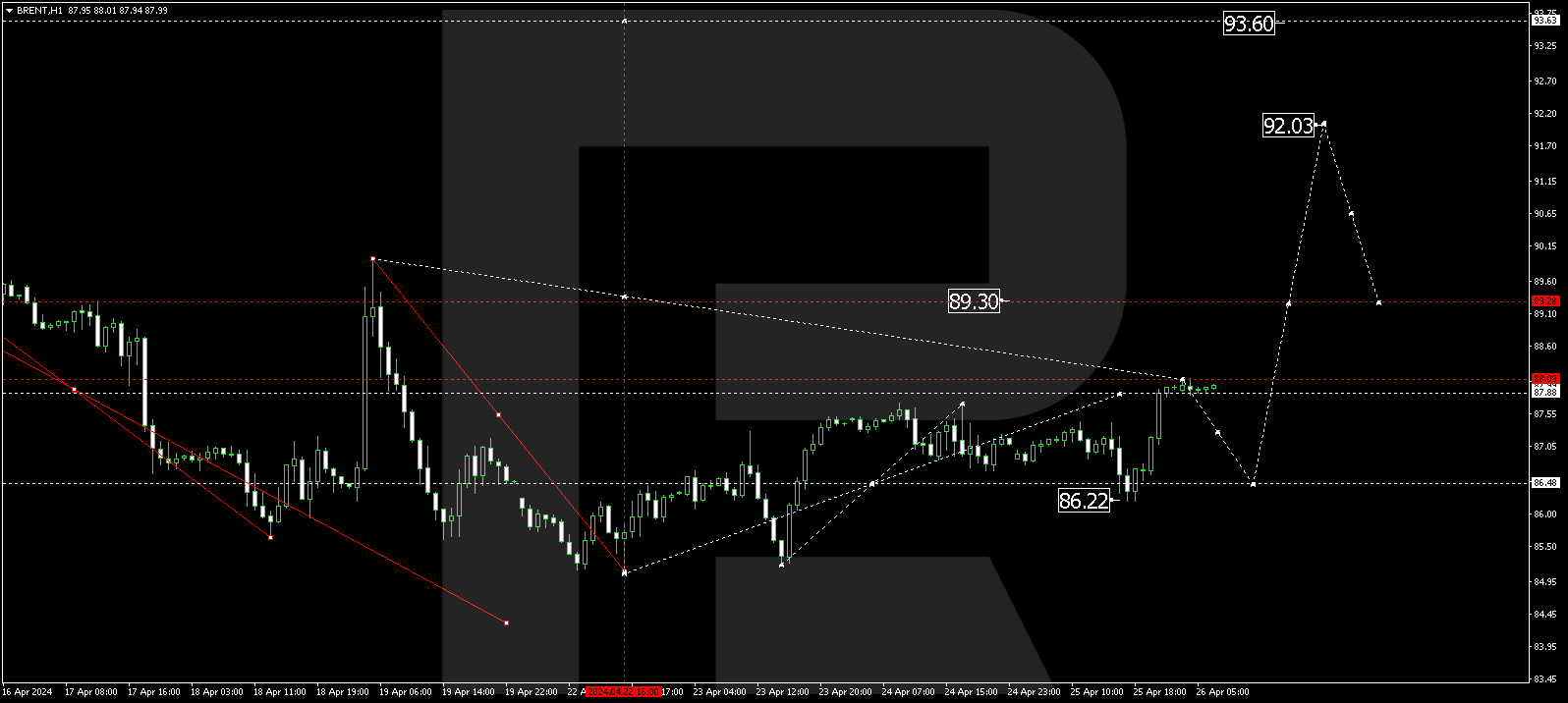

BRENT

After breaking 45.45 to the downside, Brent is expected to correct towards 45.00 and may later grow to break 45.95. After that, the instrument may continue growing with the short-term target at 47.00.

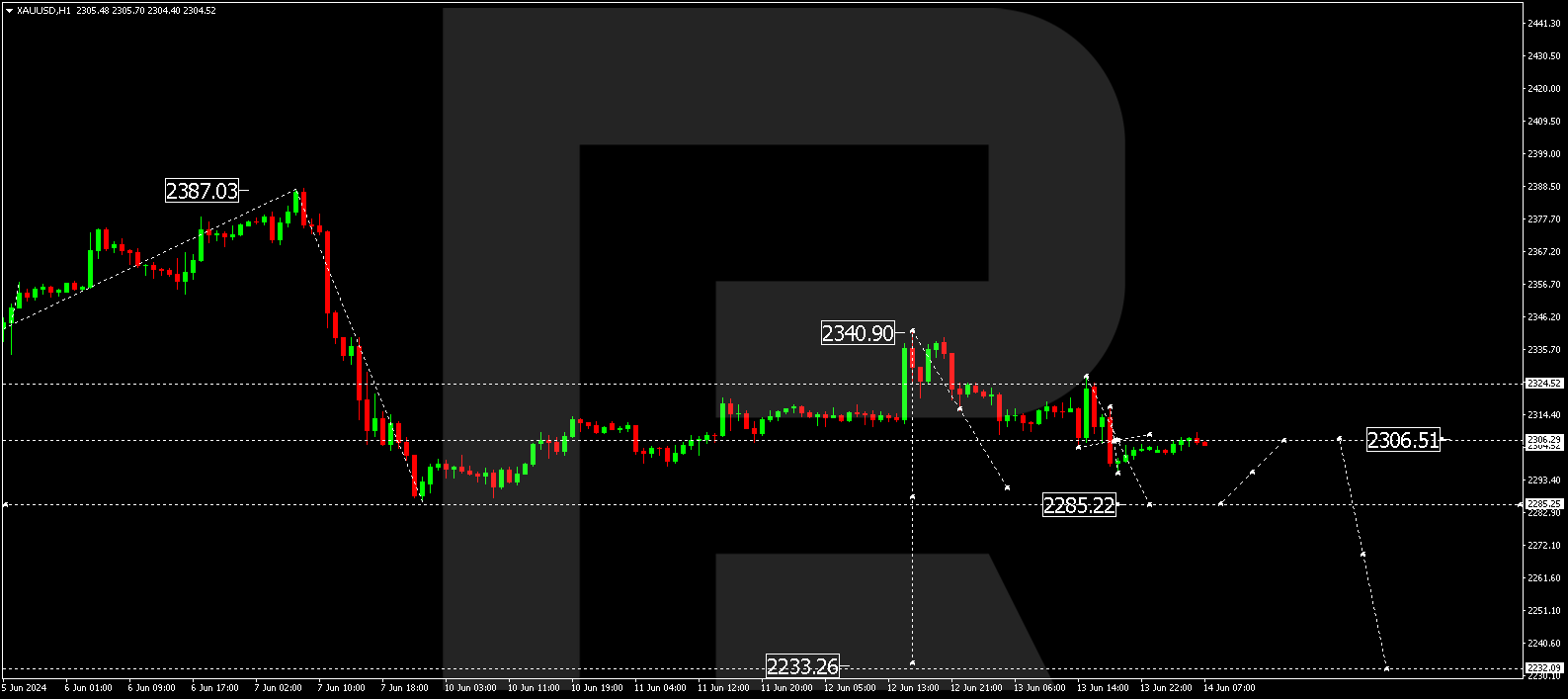

XAUUSD, “Gold vs US Dollar”

After completing another ascending wave at 1960.60, Gold is consolidating below it. If later the price breaks this range to the downside, the market may start a new decline towards 1850.00; if to the upside – resume trading upwards with the target at 1980.98 or even 2020.70.

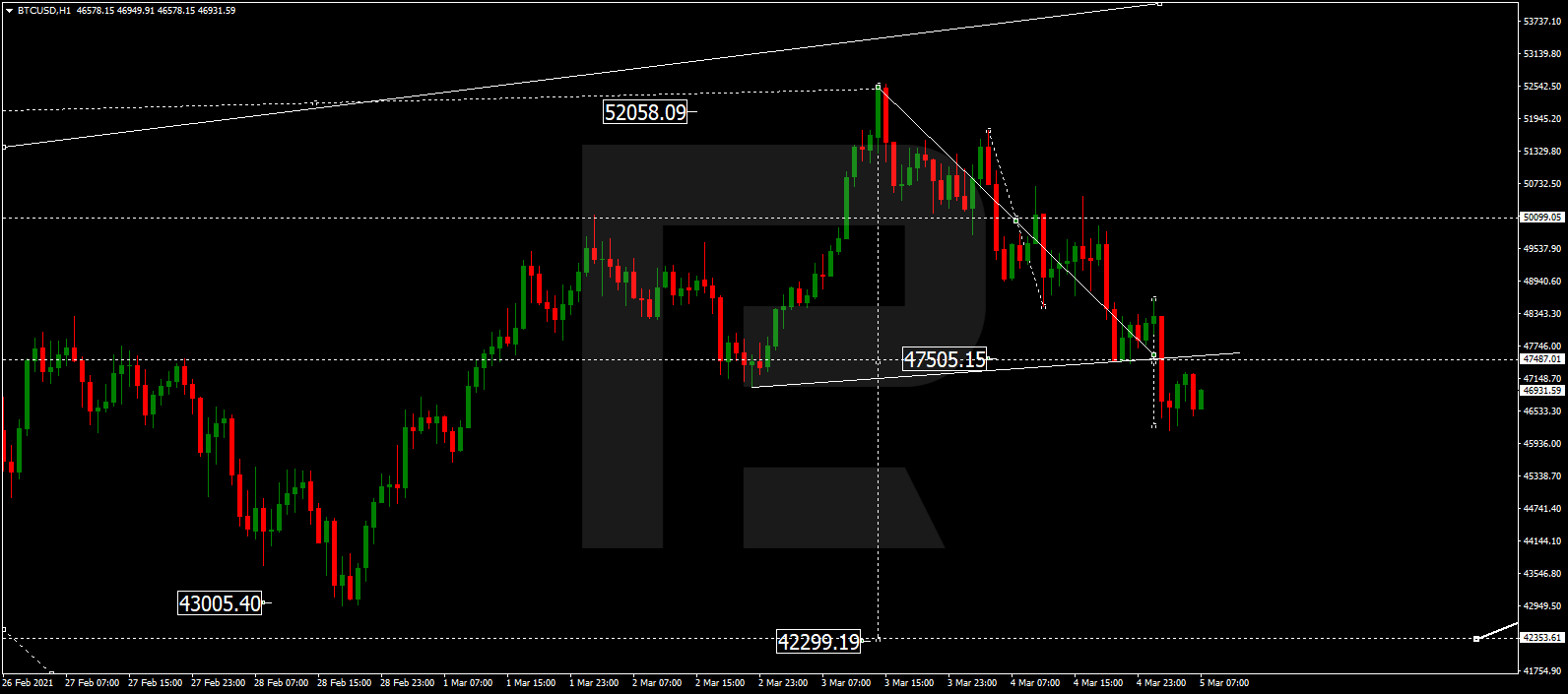

BTCUSD, “Bitcoin vs US Dollar”

After finishing the correction at 11830.00, BTCUSD is expected to fall and break 11400.00 to the downside. After that, the instrument may form a new descending structure towards 11000.00 or even 10500.00. However, if the price rebounds from 11500.00 and then breaks 11850.00, the market may continue trading upwards with the target at 12500.00.

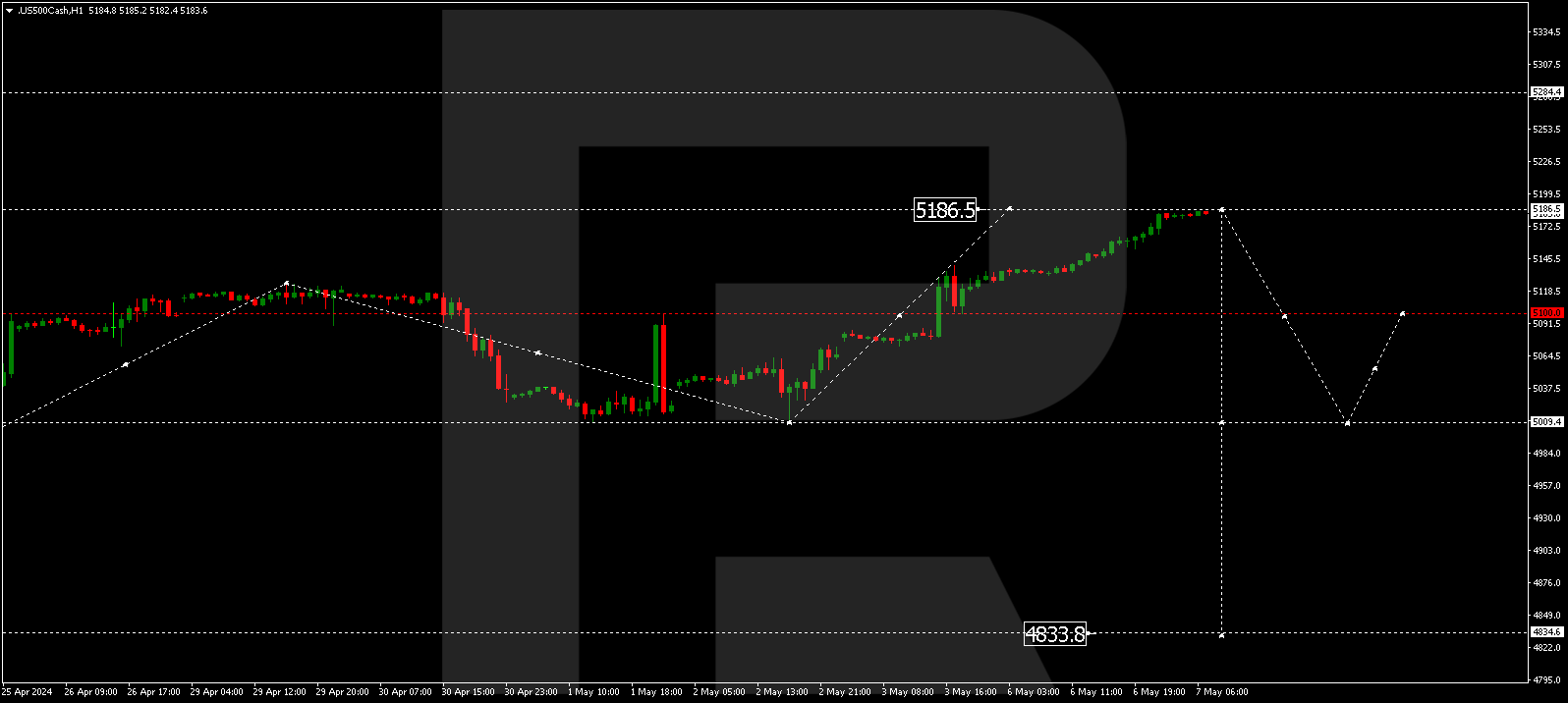

S&P 500

After returning to 3364.0, the S&P index is growing towards 3395.1. Possibly, the asset may try to reach 3400.0. Later, the market may start a new correction with the target at 3333.0.