Forex Technical Analysis & Forecast 14.12.2022

EURUSD, “Euro vs US Dollar”

The currency pair escaped the consolidation range upwards and exhausted the whole potential of the wave of growth at 1.0670. Today the market is forming an impulse of decline to 1.0594. After this level is reached, growth to 1.0633 will become possible. Then a decline to 1.0540 will follow.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair escaped the consolidation range upwards to 1.2444. The whole potential of the wave of growth has been exhausted. Today an impulse of decline is expected to develop to 1.2283, followed by growth to 1.2362 and falling to 1.2260.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of decline to 134.70. Today a link of decline to 133.60 is not excluded. Then growth to 135.77 and a decline to 131.30 might follow.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has escaped the consolidation range downwards. The goal of the wave at 0.9230 has been reached. Today the pair may grow to 0.9310 and fall to 0.9272, growing next thing to 0.9373.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair escaped the consolidation range upwards and completed a wave of growth to 0.6891. Today a structure of a declining impulse to 0.6813 is forming. Next, growth to 0.6853 and a decline to 0.6755 should follow.

BRENT

Crude oil is extending the structure of a wave of growth to 82.33. After this level is reached, a correction to 78.78 may follow. Then the pair should grow to 86.00, from where the trend may continue to 89.25. The goal is first.

XAUUSD, “Gold vs US Dollar”

Gold escaped the consolidation range upwards. The potential of a wave of growth to 1824.20 has been exhausted, and today the market is forming an impulse of decline to 1796.20. After this level is reached, a link of growth to 1820.20 might follow, and next – a decline to 1786.30.

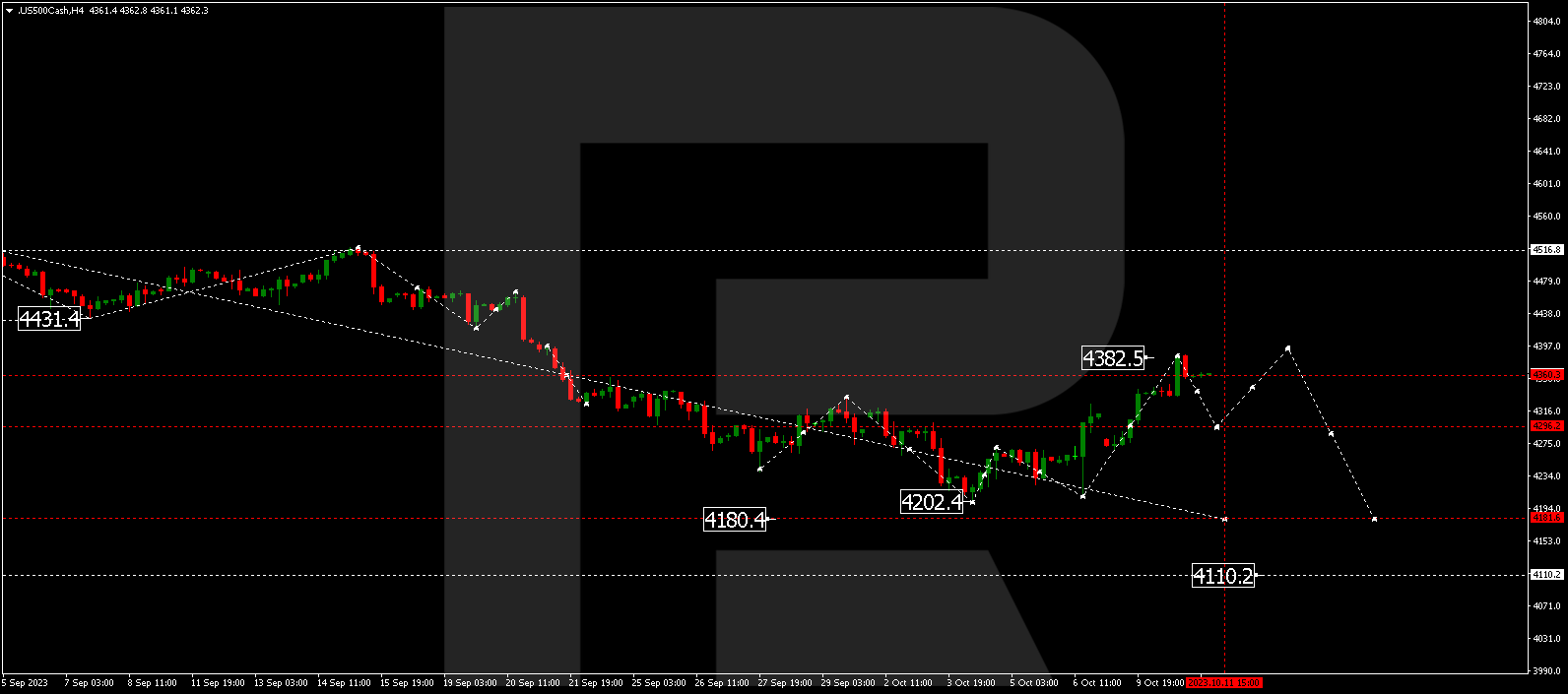

S&P 500

The stock index broke through 3997.5 upwards and completed a wave of growth at 4147.0. Today the market has performed an impulse of decline to 3997.5. A link of correction to 4073.0 is not excluded. Then the stock index might fall to 3889.6, from where the trend might continue to 3777.7.