EURUSD, “Euro vs US Dollar”

The currency pair has formed a consolidation range around 1.0646. At some point, the range got expanded upwards to 1.0693. Today the market has returned to 1.0646. The decline is expected to continue to 1.0616, i.e. the lower border of the range. Next, a correction to 1.0646 looks possible, followed by a decline to 1.0542.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has expanded the range to 1.2244. Today the market continues developing an impulse of decline to 1.2340, followed by growth to 1.2393 and a decline to 1.2236.

USDJPY, “US Dollar vs Japanese Yen”

Today the currency pair is forming an impulse of growth to 135.95. After this level is reached, an impulse of decline to 135.30 is not excluded, followed by growth to 137.30.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair expanded the consolidation range downwards to 0.9213. Today growth to 0.9275 looks possible. Next, a decline to 0.9252 and growth to 0.9373 look probable.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is forming a structure of an impulse of decline to 0.6820. Then growth to 0.6853 and a decline to 0.6762 should follow. The goal is local.

BRENT

Crude oil has completed a wave of growth to 83.13. Today a link of decline to 79.94 looks possible. Then growth to 84.62 might follow, and upon breaking through this level upwards, the quotes may proceed to 89.24.

XAUUSD, “Gold vs US Dollar”

Gold has corrected to 1814.00. Today the market is forming a structure of decline to 1784.66. And with a breakaway of this level downwards, a pathway for a wave of decline to 1755.00 will follow.

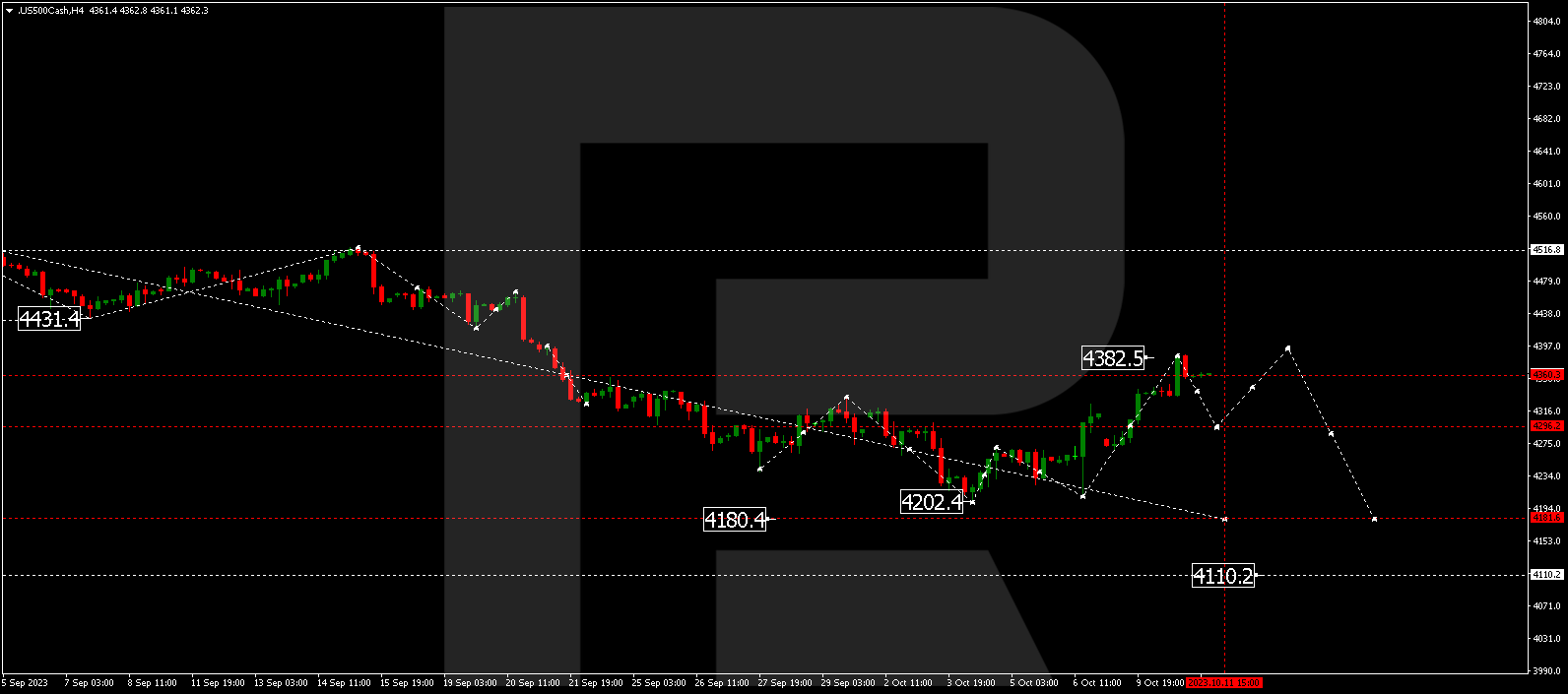

S&P 500

The stock index is forming a structure of decline to 3925.5. Then growth to 3991.7 and a decline to 3835.4 should follow, from where the trend may continue to 3626.0.