EURUSD, “Euro vs US Dollar”

The currency pair has completed a link of decline to 1.0660. Today the market might develop a link of correction to 1.0733. Then the quotes might decline to 1.0635 and extend the wave to 1.0595.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a structure of decline to 1.1989. Today a correction to 1.2084 looks possible. Then a decline to 1.1950 should follow, from where the wave might extend to 1.1903.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a structure of growth to 134.35. Today a correction to 133.33 might happen. Then a link of growth should develop to 135.14.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a correction to 0.9200. After the correction is over, a wave of growth to 0.9322 should start, from where the wave might extend to 0.9393.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a structure of decline to 0.6865. Today the market may correct to 0.6960. Then the quotes should decline to 0.6838 and continue the wave to 0.6813.

BRENT

Crude oil has completed a structure of growth to 85.60. Today the market is forming a consolidation range around this level. Then a new structure of growth should develop to 86.45. Next, we expect a correction to at least 85.60 and growth to 87.55. The goal is first.

XAUUSD, “Gold vs US Dollar”

Gold has completed an impulse of decline to 1830.60. Today a correction to 1845.66 is not excluded. After this level is reached, a decline to 1825.00 will become possible, from where the wave might extend to 1820.00.

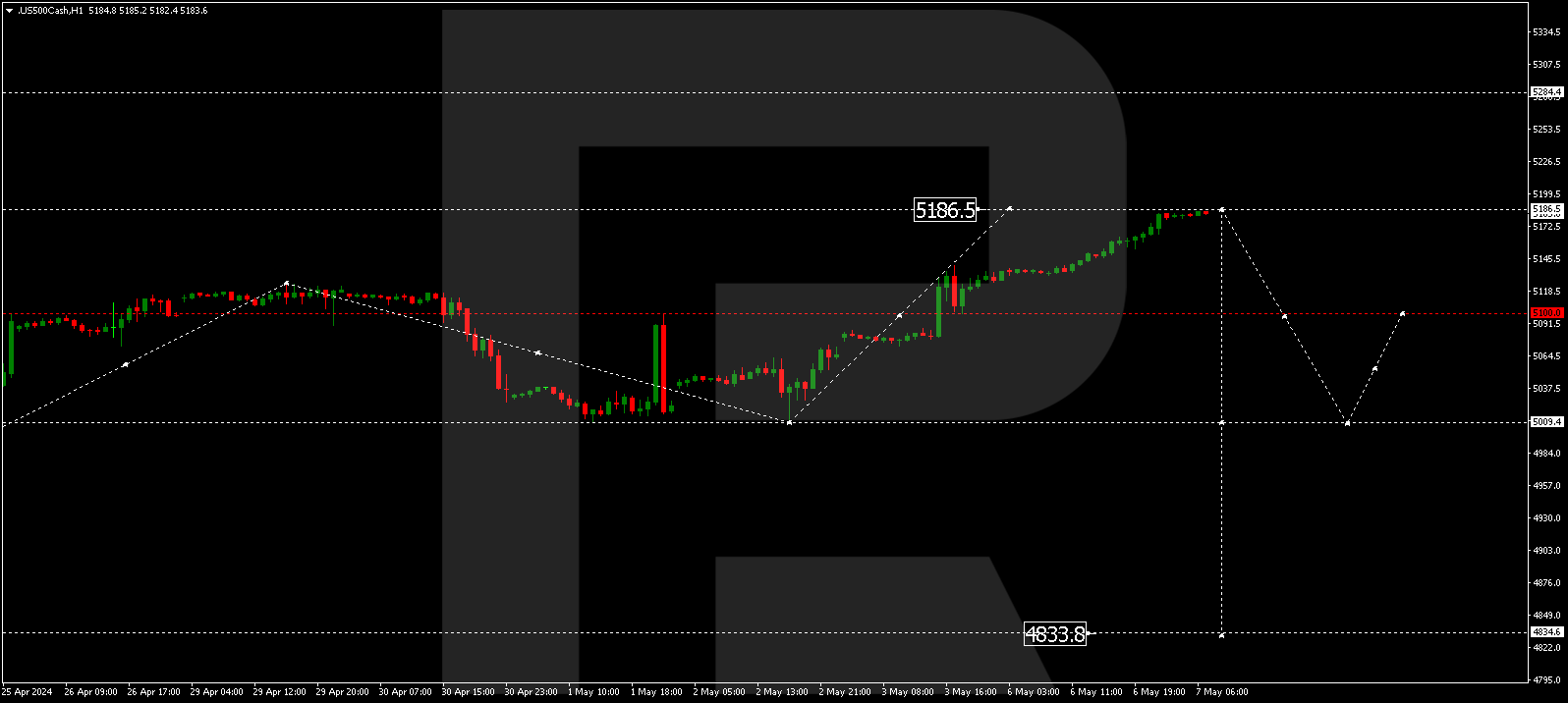

S&P 500

The stock index has completed a link of growth to 4142.0. Today the market is forming a consolidation range around this level. With an escape upwards, a link of growth to 4188.0 is not excluded, followed by a decline to 4088.0. And with a breakaway of this level as well, a pathway down to 3973.0 should open.