Forex Technical Analysis & Forecast 16.03.2022

EURUSD, “Euro vs US Dollar”

EURUSD is consolidating around 1.0970. Possibly, today the pair may expand the range up to 1.0997 and then fall towards 1.0940. If later the price breaks this range to the downside, the market may form a new descending structure to reach 1.0880; if to the upside – resume trading upwards with the target at 1.1040.

GBPUSD, “Great Britain Pound vs US Dollar”

After finishing the ascending wave at 1.3087 along with the correction towards 1.3030, GBPUSD is expected to form one more ascending wave to break 1.3082 and may later continue trading upwards with the short-term target at 1.3140.

USDJPY, “US Dollar vs Japanese Yen”

After finishing the descending impulse at 117.69 along with the correction towards 118.40, USDJPY is forming a new descending structure to break 117.60 and may later continue trading downwards with the first target at 116.81.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is forming a new consolidation range around 0.9395. Possibly, the pair may fall to break 0.9370 and then continue trading downwards with the first target at 0.9323.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is consolidating around 0.7205. If later the price breaks this range to the upside, the market may correct towards 0.7257 and then form a new descending structure with the target at 0.7149; if to the downside – resume falling to reach the above-mentioned target and then start another growth towards 0.7257.

BRENT

Brent continues the correction towards 98.58. Possibly, today the asset may form one more ascending structure with the first target at 120.50. After that, the instrument may start a new correction towards 111.80.

XAUUSD, “Gold vs US Dollar”

Gold has finished the correction at 1907.60. Today, the metal may start a new growth with the target at 1959.40 and then resume falling to reach 1850.00.

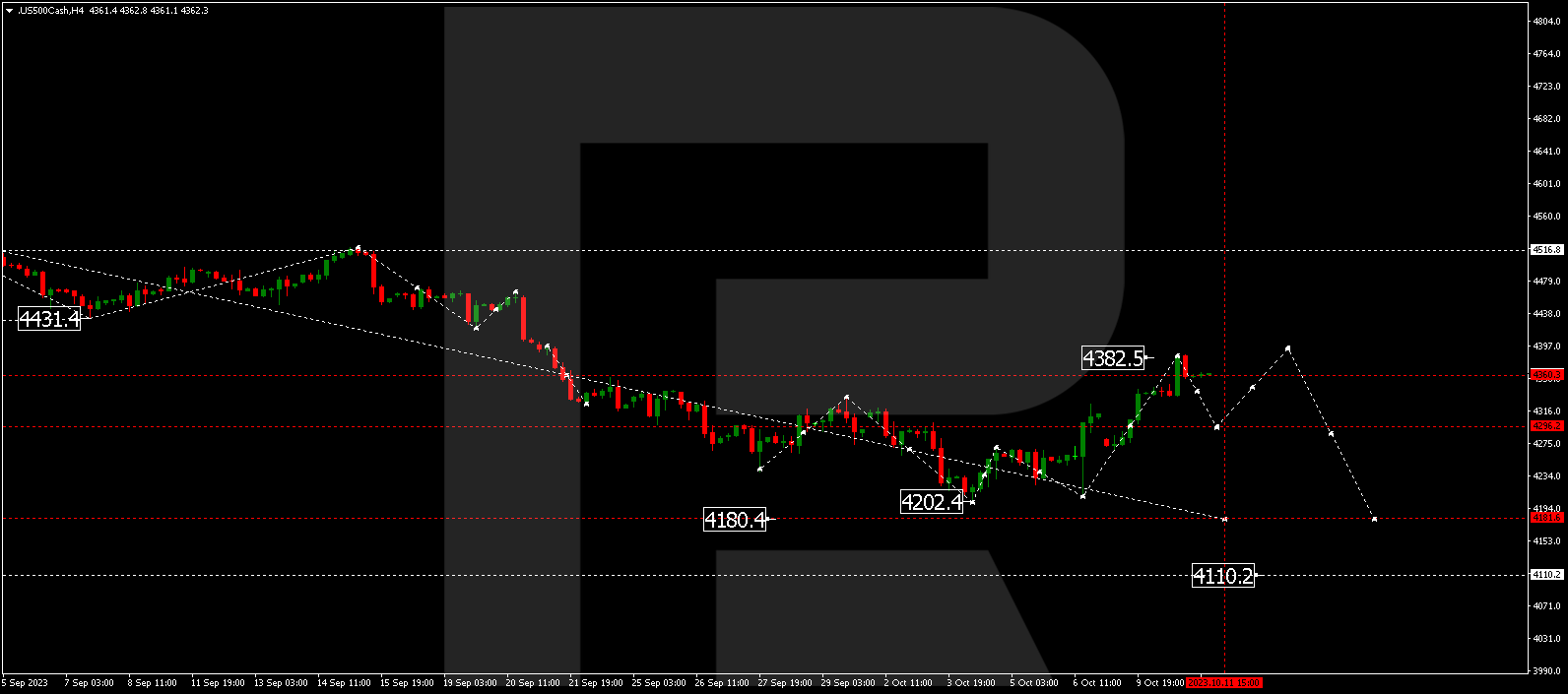

S&P 500

The S&P index is still consolidating above 4200.0. Possibly, the asset may form one more ascending structure towards 4333.3 and then resume falling to reach 4075.5. Later, the market may start a new growth to return to 4333.3 or even extend this correction up to 4444.4.