Forex Technical Analysis & Forecast 20.10.2020

EURUSD, “Euro vs US Dollar”

After rebounding from 1.1703 and then breaking 1.1744 to the upside, EURUSD has reached the short-term correctional target at 1.1788 and may later continue moving according to an alternative scenario to finish the correction at 1.1800. Possibly, today the pair may fall to test 1.1744 from above and then grow towards 1.1757, thus forming a new consolidation range between these two levels. If later the price breaks this range to the downside, the market may complete the correction and start a new decline with the target at 1.1688; if to the upside – choose an alternative scenario to finish the correction at 1.1800 and then resume trading downwards to reach the above-mentioned target.

GBPUSD, “Great Britain Pound vs US Dollar”

After finishing the correctional structure at 1.3022 and then returning to 1.2934, GBPUSD is consolidating above the latter level. Possibly, the pair may form one more ascending structure to reach 1.2979 and then resume moving within the downtrend with the first target at 1.2844.

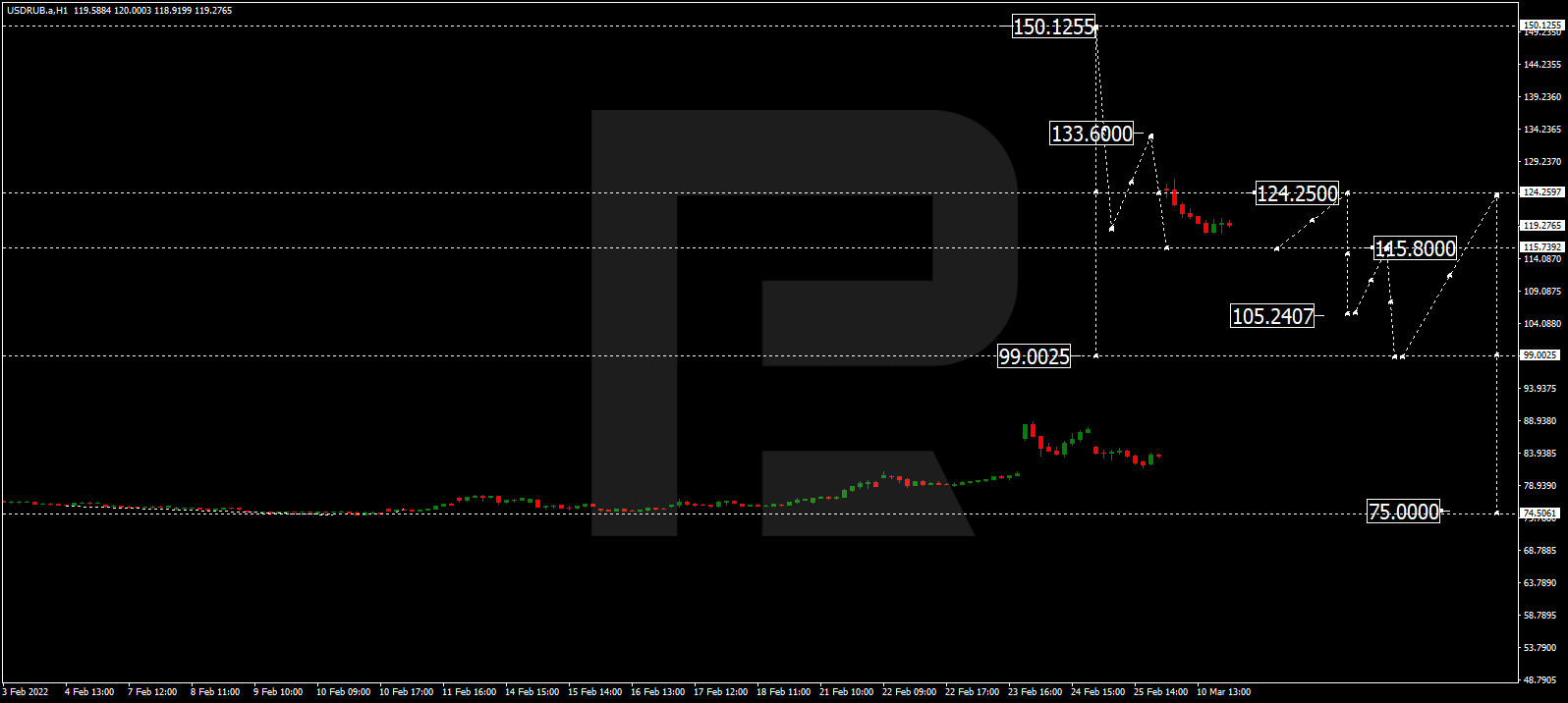

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is still falling to reach 77.30. Later, the market may start a new growth towards 77.80 and then fall to return to 77.30. If the price breaks this level, the instrument may continue trading downwards with the first target at 76.40.

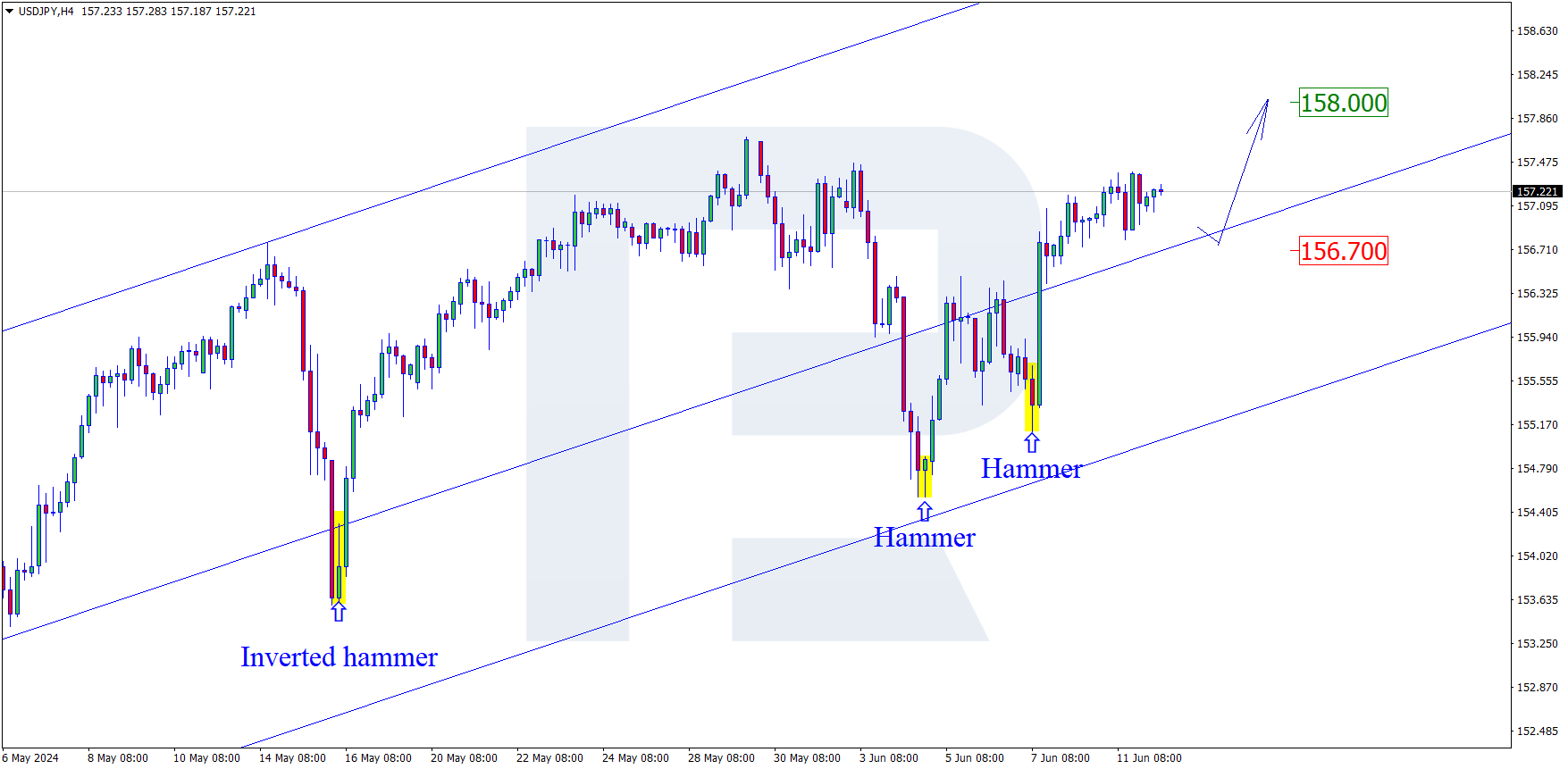

USDJPY, “US Dollar vs Japanese Yen”

After completing the correction at 105.55, USDJPY is expected to start a new decline to break 105.00 and then continue moving downwards with the short-term target at 104.40.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is moving downwards. Today, the pair may reach 0.9085 and then form one more ascending structure to break 0.9125. After that, the instrument may continue growing with the target at 0.9177.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is still moving downwards; it has already broken 0.7060. Possibly, the pair may fall with the target at 0.7000 and then start a new correction to reach 0.7100.

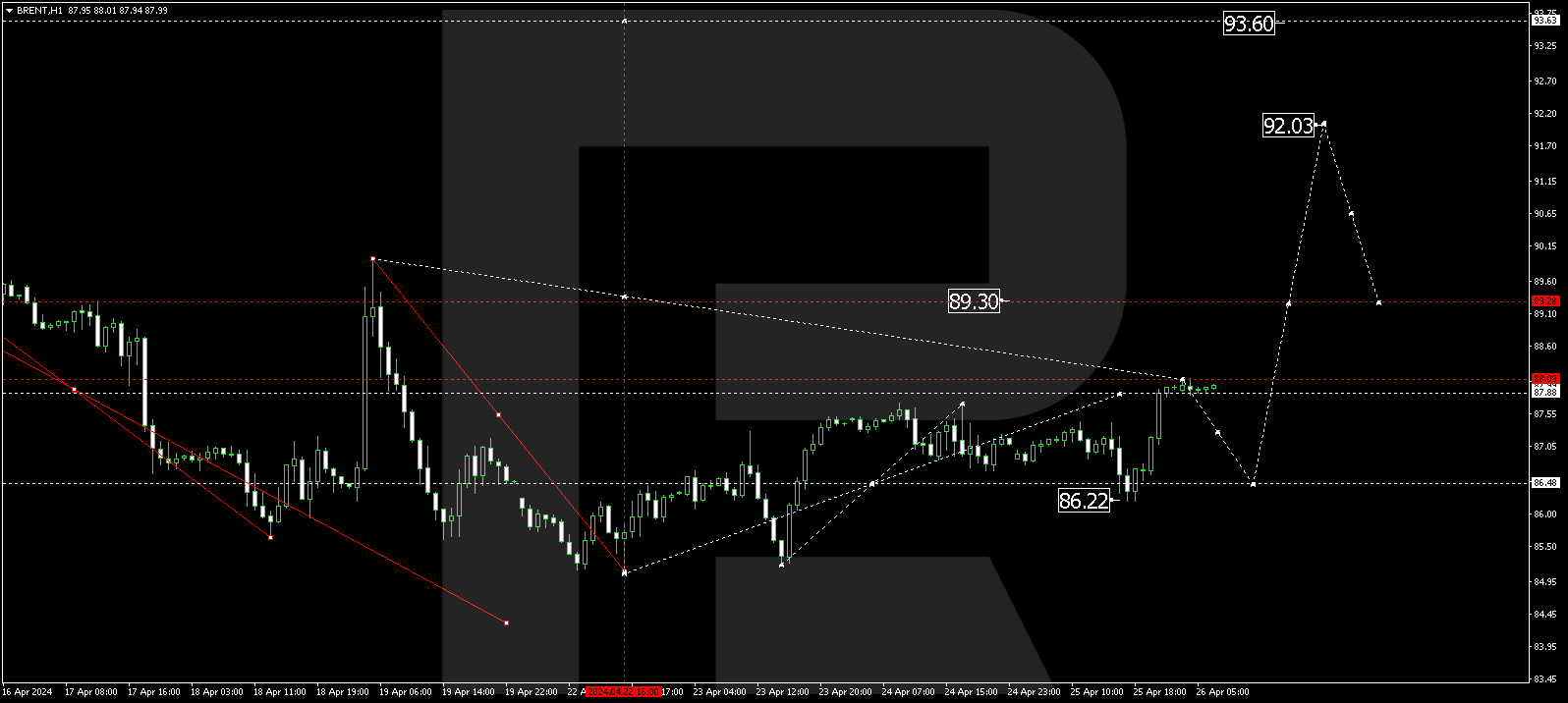

BRENT

Brent is still consolidating around 42.70 without any particular direction. Possibly, today the asset may fall to reach 42.07 and then form one more ascending structure towards 43.95. The main scenario implies that the asset may break this range to the upside and then continue trading upwards with the first target at 44.22.

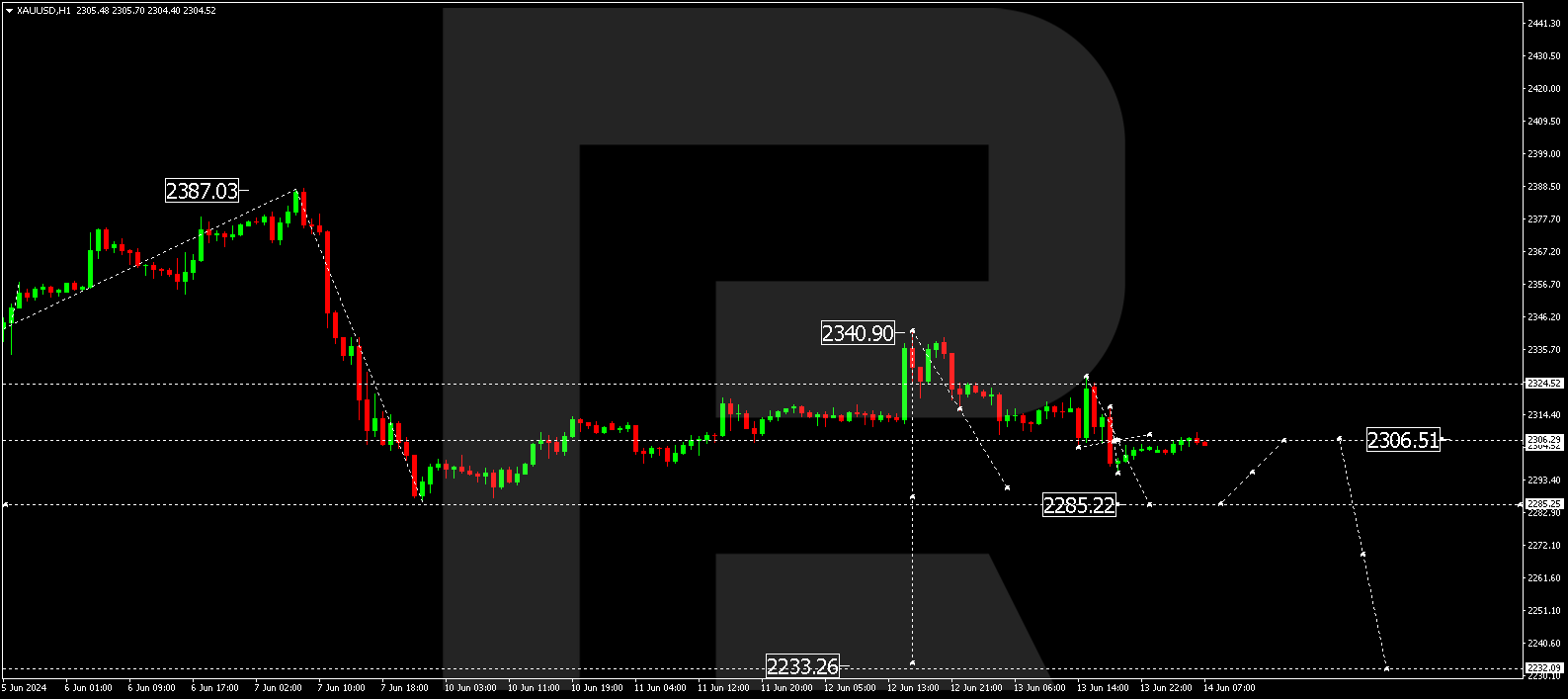

XAUUSD, “Gold vs US Dollar”

After expanding the range up to 1917.77, Gold has returned to 1900.00. According to the main scenario, the price is expected to expand this range down to 1888.70 and then grow to return to 1900.00. After that, the instrument may start a new decline with the first target at 1877.40.

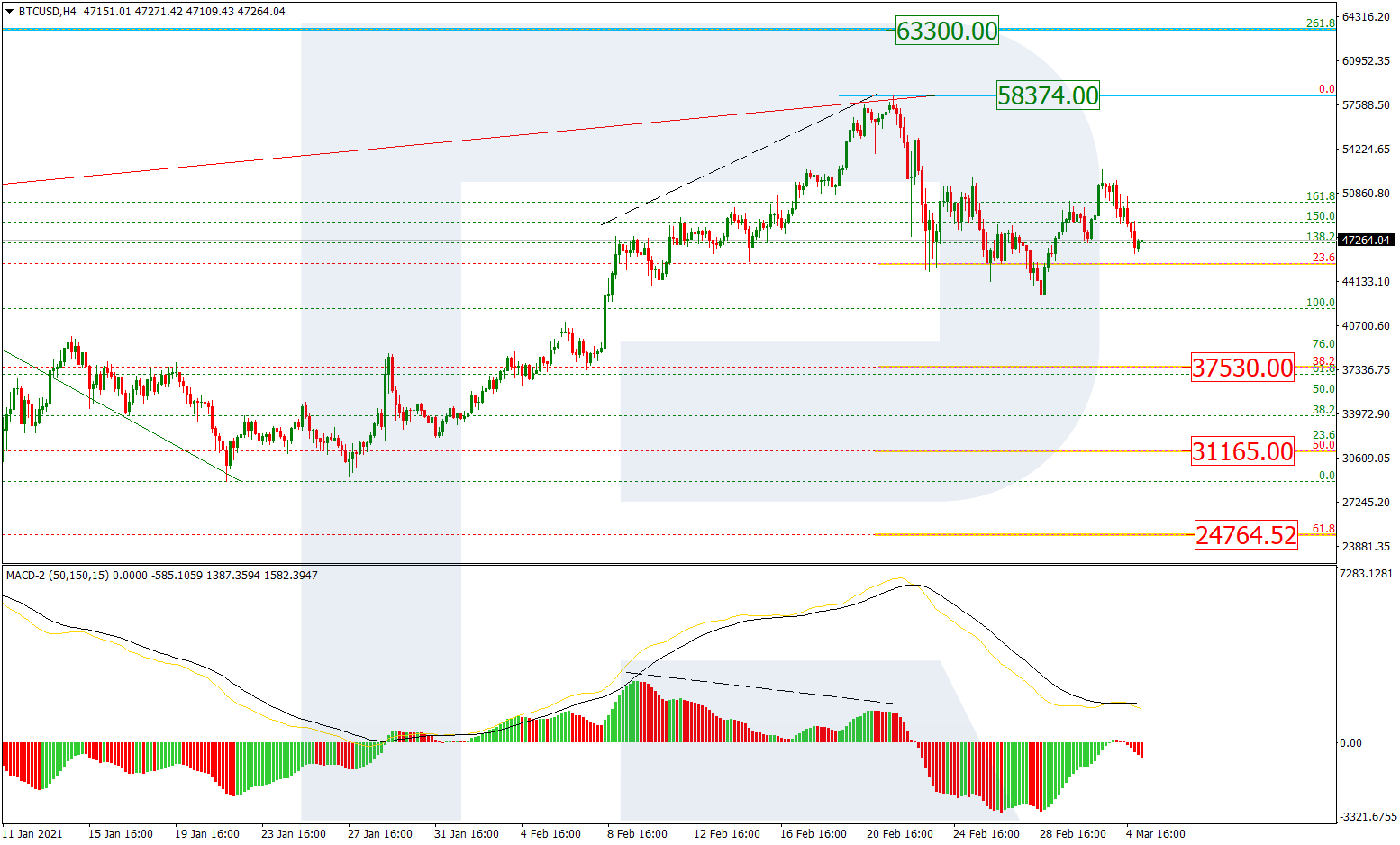

BTCUSD, “Bitcoin vs US Dollar”

After breaking the consolidation range to the upside, BTCUSD has reached 11800.00. Today, the asset may fall towards 11500.00 and then start another growth to reach 11810.00. Later, the market may correct with the target at 10900.00.

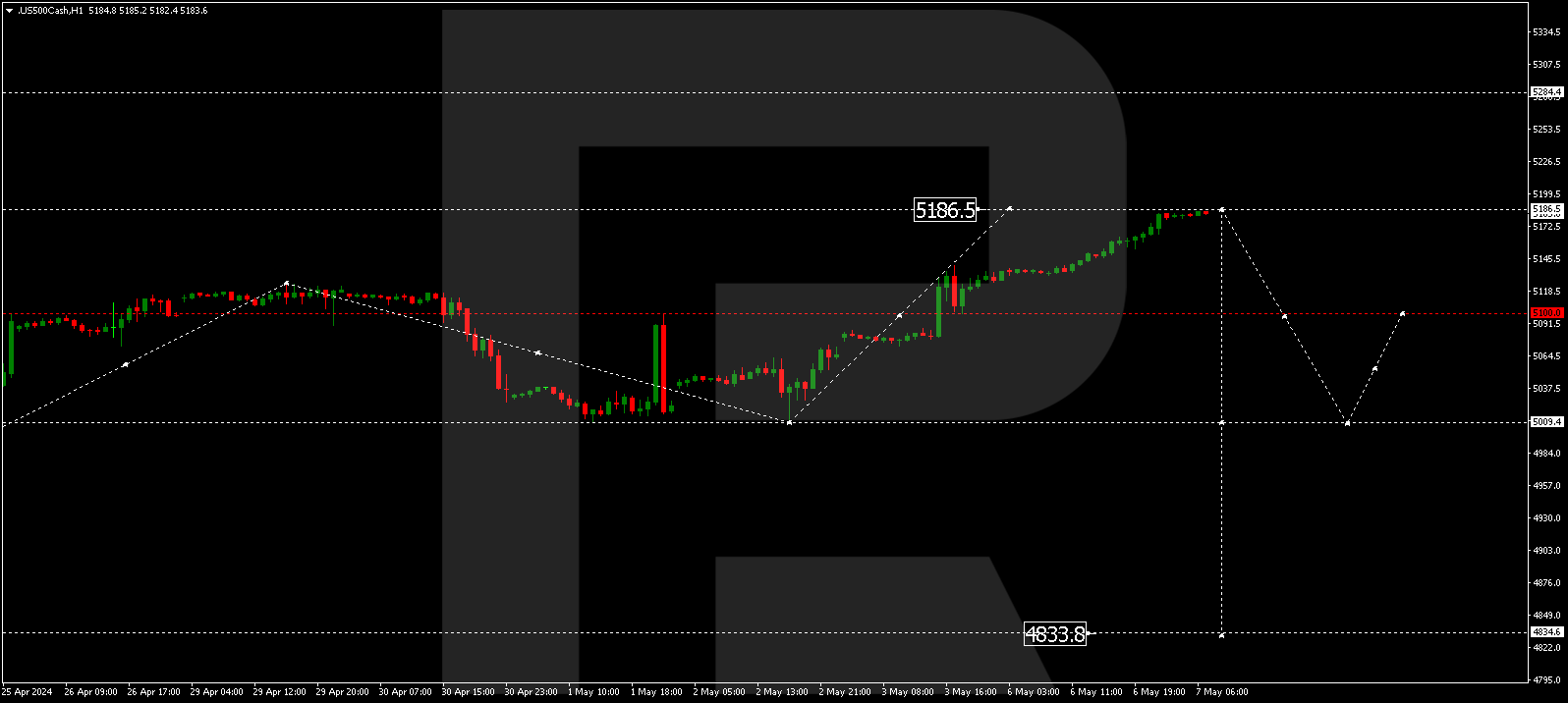

S&P 500

After finishing the descending structure with the first target at 3433.0, the S&P index is consolidating near the lows. If later the price breaks this range to the upside, the market may start a new correction with the target at 3484.4 and then resume falling towards 3300.0.