EURUSD, “Euro vs US Dollar”

EURUSD is out of a downward consolidation range. Today we expect a test from the bottom at 0.9797. Further down to 0.9720 with the prospect of trend continuation to 0.9710.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has broken down to 1.1260. We consider the possibility of a continuation of the decline wave to 1.1080. After the performance of this level, the correction to 1.1260 is not excluded. Further, the decline to the level of 1.0902.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues to develop a rising wave to the level of 150.15. After its breakdown, a correction to 149.15 is not ruled out, and a breakdown of this level will open the potential for a further correction to 147.90.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues to develop a rising wave towards 1.0099. After it works out, consider the probability of correction to 0.9911. Next, growth to the level of 1.0350.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is out of a downward consolidation range. We expect a breakout of 0.6215. After that, the growth link to 0.6276 is not excluded. Further, the decline to the level of 0.6171.

BRENT

Brent continues to develop a rising wave towards 93.40. After it is reached, a correction to 91.75 is not ruled out. We expect a rise to 94.55 with the prospect of trend continuation to 100.00.

XAUUSD, “Gold vs US Dollar”

Gold has worked its way down to 1623.00. Today, an upside link to 1646.16 is not ruled out, followed by a decline to 1635.00. At these levels, we expect the formation of a new consolidation range.

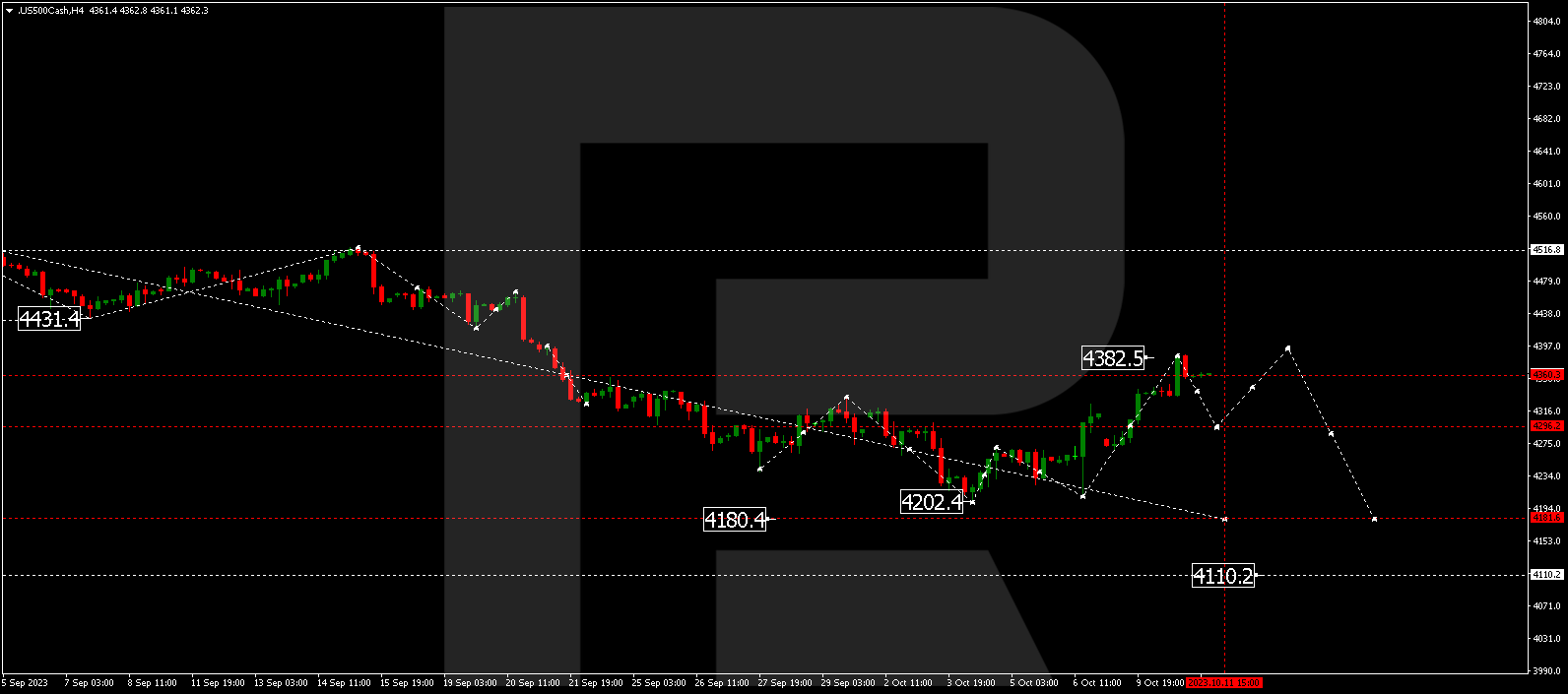

S&P 500

The S&P index worked its way up to 3760.0 and a correction to 3678.0. An upward link to 3861.0 is not ruled out today. Further down to 3678.0. An exit from this range down would open up the potential for a downside wave to 3500.0.