EURUSD, “Euro vs US Dollar”

The currency pair has completed a structure of a declining wave to 1.0222. Today a link of correction to 1.0277 is not excluded (a test from below). Then falling to 1.0160 should follow. from where the wave might continue to 1.0111. The goal is local.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of decline to 1.1777 and a correction to 1.1863. Today another decline to 1.1777 is expected. And with a breakaway of this level downwards, the wave might continue to 1.1588. The goal is local. After this level is reached, correction to 1.1777 might develop.

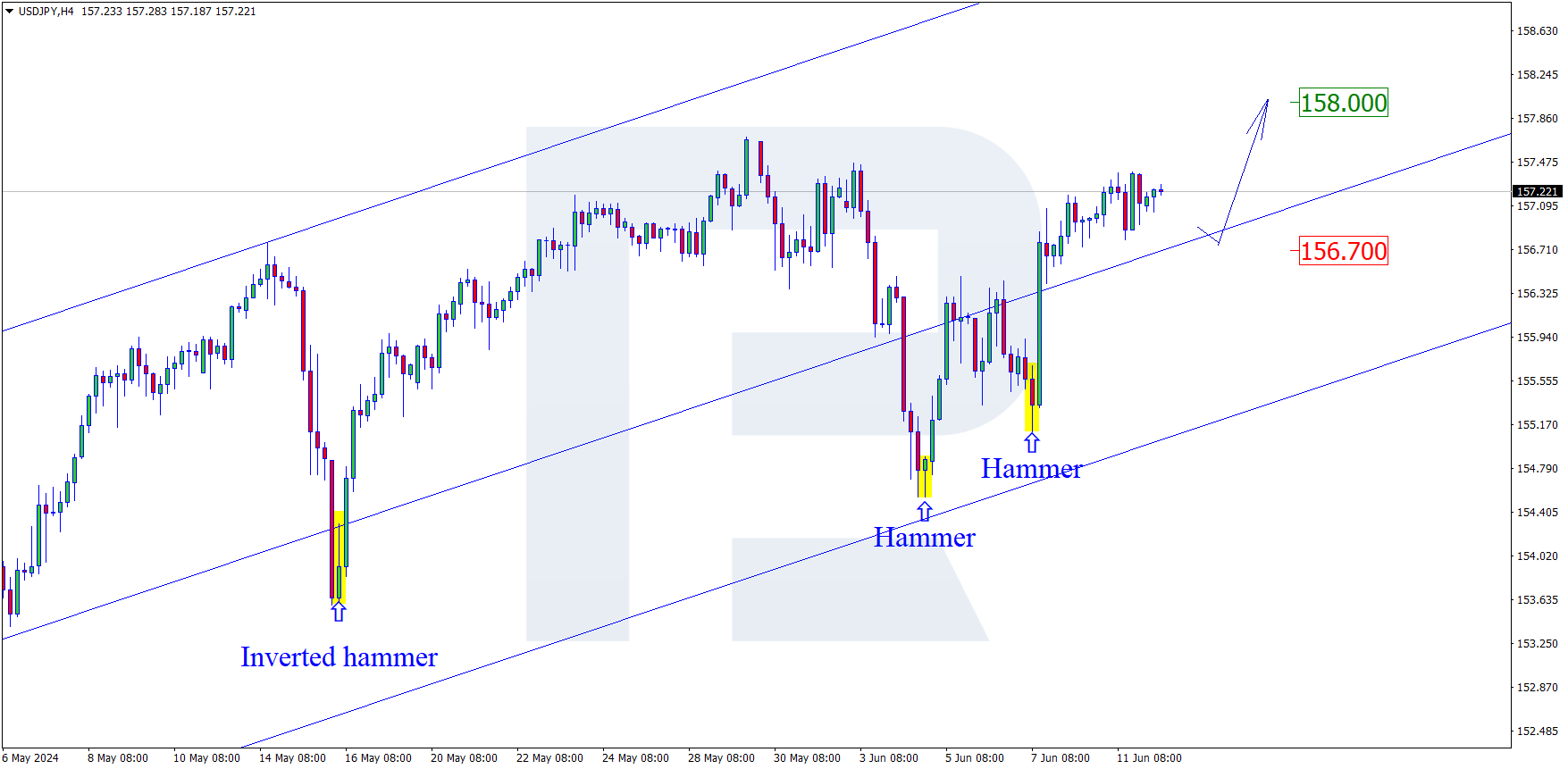

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has performed a wave of growth to 142.07. Today the market is forming a consolidation range around this level. Expansion of the range to 142.55 is not excluded, followed by falling to 139.94 and growth to 144.66.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a wave of growth to 0.9595. After this level is reached, a link of correction to 0.9555 is not excluded, followed by growth to 0.9606.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of decline to 0.6585. After this level is reached, a link of correction to 0.6690 is not excluded, followed by a decline to 0.6555.

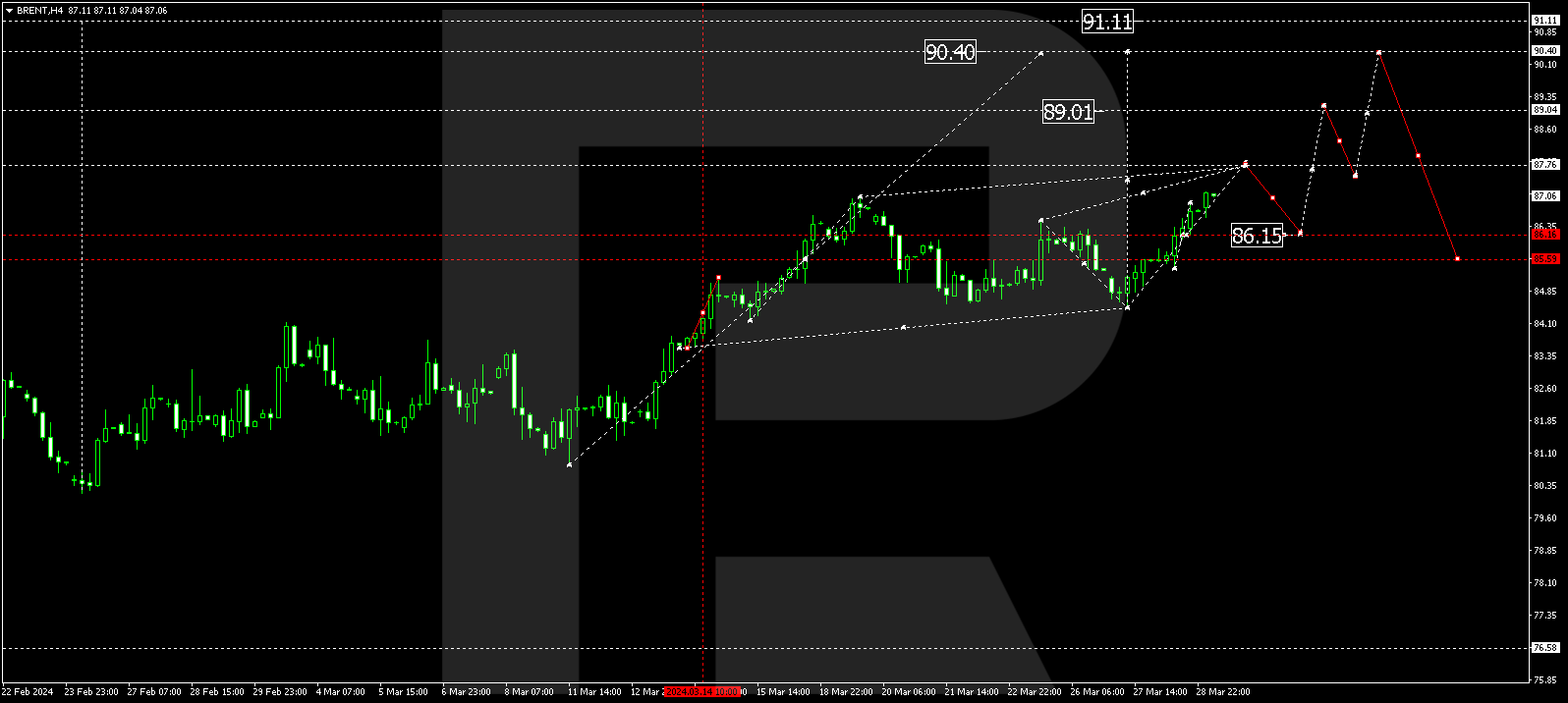

BRENT

Crude oil has extended the structure of decline to 82.42. Today the market is forming a link of growth to 89.42, and after this level is reached, another link of decline to 81.00 is not excluded, followed by growth to 89.44.

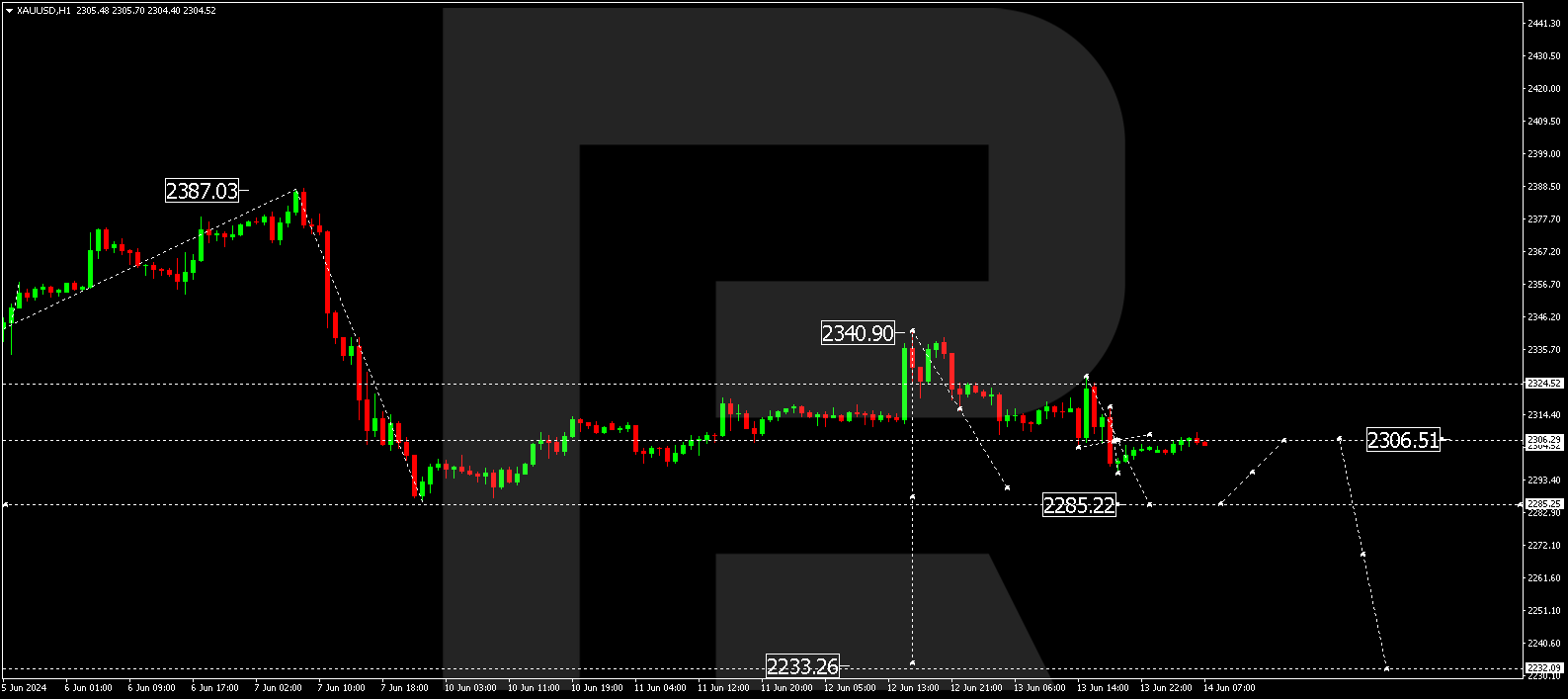

XAUUSD, “Gold vs US Dollar”

Gold has completed a structure of a wave of decline to 1732.48. Today a link of correction to 1748.22 is not excluded, followed by a decline to 1728.30, from where the wave might continue to 1710.50.

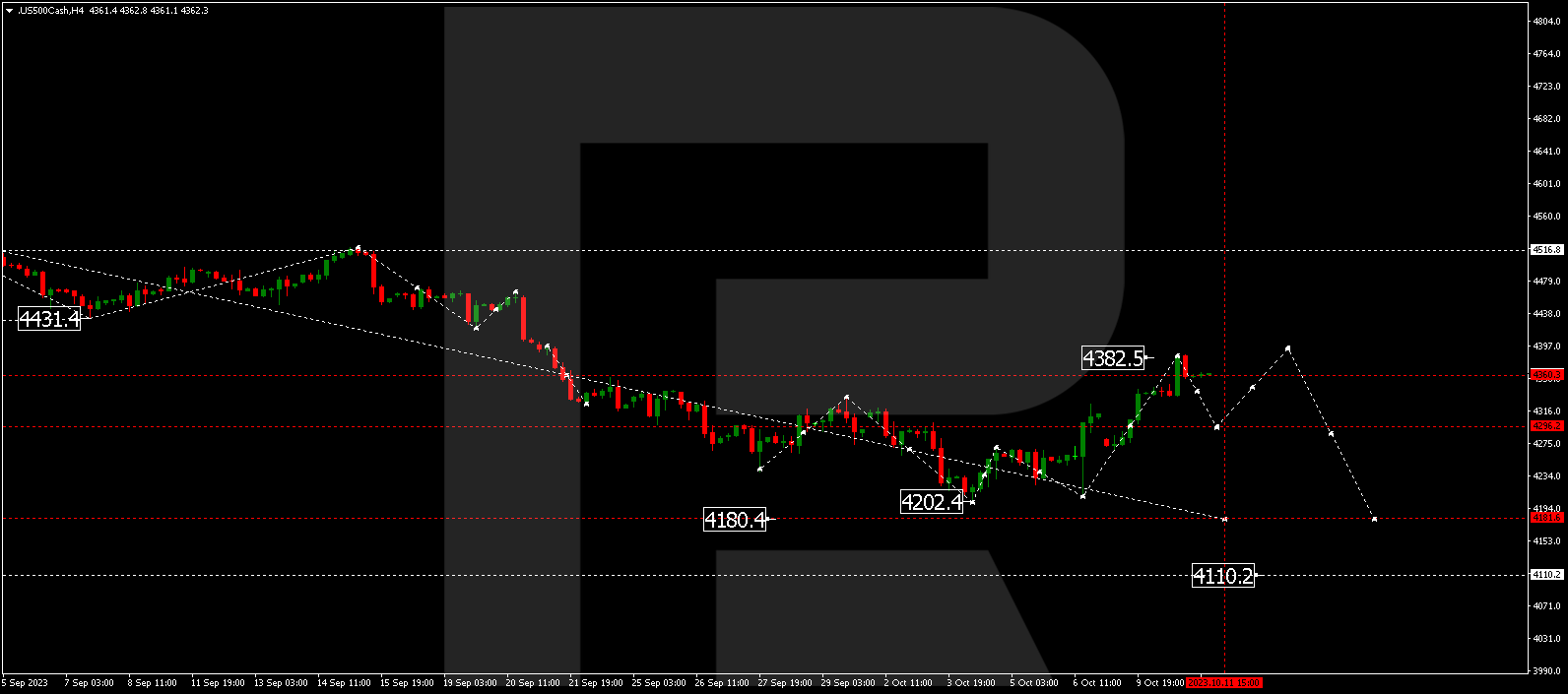

S&P 500

The stock index continues forming a consolidation range around 3959.9. Today a wave of decline may continue to 3873.7. The goal is first. Then a correction to 3959.0 and a decline to 3777.7 should follow.