EURUSD, “Euro vs US Dollar”

The currency pair has completed a structure of a correctional wave to 1.0325. Today the quotes may escape the correctional channel and continue falling to 1.0224. Then the pair should grow to 1.0270 and fall to 1.0222, from where the wave may continue to 1.0222. The goal is local.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of correction to 1.1900. Today another decline to 1.1777 is expected. With a breakaway of this level downwards, the wave is likely to continue to 1.1588. The goal is local. After this level is reached, correction to 1.1777 might develop.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of decline to 140.90. Today the market is correcting to 141.63. When the correction is over, the wave of decline should continue to 139.94.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a structure of decline to 0.9492. After this correctional wave is over, a new wave of growth to 0.9630 might start.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is forming a consolidation range around 0.6625. Extension of the range to 0.6666 is not excluded (a test from below). Then a decline to 0.6577 should follow.

BRENT

Crude oil has completed a structure of decline to 89.20. Today another structure of decline to 81.15 is likely to develop. After this level is reached, a link of growth to 89.50 is expected.

XAUUSD, “Gold vs US Dollar”

Gold is forming a consolidation range around 1737.77. An escape downwards to 1728.28 is expected. After this level is reached, a wave of growth to 1748.48 should start, followed by a decline to 1710.55.

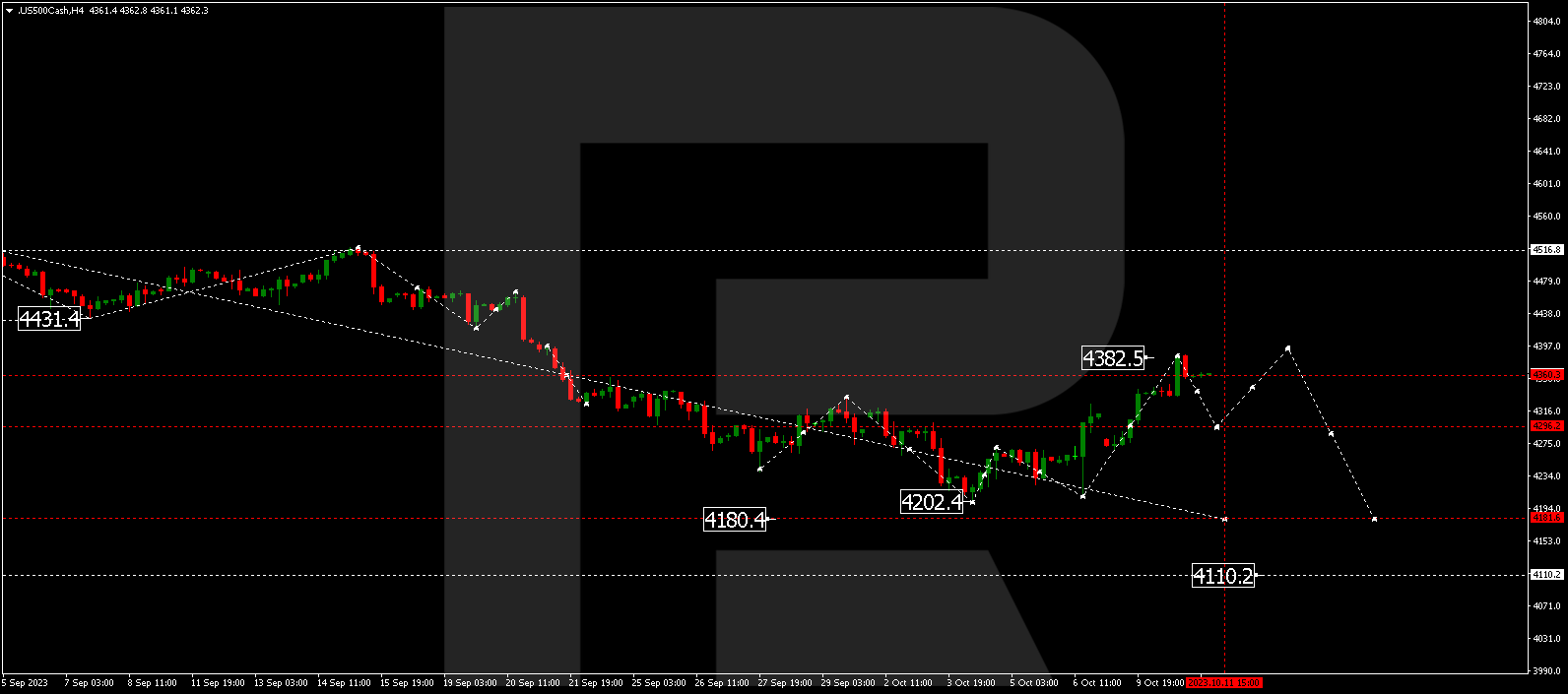

S&P 500

The stock index continues forming a structure of growth to 4011.1 After it is reached, a new wave of decline should develop to 3849.5, from where it may extend to 3777.7.