Forex Technical Analysis & Forecast 24.11.2020

EURUSD, “Euro vs US Dollar”

After completing the ascending wave at 1.1900 and then plummeting towards 1.1800, EURUSD has finished another ascending structure at 1.1847; right now, it is consolidating below the latter level. Possibly, the pair may start a new decline to reach 1.1788 or even continue the correction towards 1.1770. Later, the market may form one more ascending structure with the target at 1.2000.

GBPUSD, “Great Britain Pound vs US Dollar”

After reaching the target of the third ascending wave at 1.3396 and then falling towards the first correctional target at 1.3265, GBPUSD is expected to grow towards 1.3333 and may later start a new descending wave with the target at 1.3255. After that, the instrument may break the latter level and continue trading downwards to reach 1.3194.

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is consolidating above 75.65. Possibly, today the pair may form one more ascending structure towards 76.60 and then resume falling to reach 75.00. After that, the instrument may break the latter level to the downside and then continue moving downwards with the first target at 74.50.

USDJPY, “US Dollar vs Japanese Yen”

After forming the consolidation range above 103.70 and then breaking 104.00 to the upside, USDJPY has expanded the range up to 104.55. Today, the pair expand the range up to 104.70 and then start a new decline to return to 104.00. Later, the market may break the latter level to the downside and then continue trading downwards with the target at 103.30.

USDCHF, “US Dollar vs Swiss Franc”

After expanding the consolidation range down to 0.9077, USDCHF has completed the ascending structure at 0.9140. Possibly, today the pair may start a new decline to break 0.9100 and then continue falling with the target at 0.9066.

AUDUSD, “Australian Dollar vs US Dollar”

After expanding its consolidation range up to 0.7330 and then finishing the descending structure at 0.7264, AUDUSD is expected to start a new growth to reach 0.7322. After that, the instrument may resume falling with the target at 0.7244.

BRENT

After finishing the ascending wave at 45.55and forming an upside continuation pattern, Brent has updated the pattern’s high; right now, it is still moving upwards. Possibly, the asset may form one more ascending structure with the target at 48.50 and then start a new correction to return to 42.50.

XAUUSD, “Gold vs US Dollar”

After reaching its predicted downside target at 1850.00, Gold is still trading downwards. Possibly, the metal may reach 1823.80 and then start a new correction towards 1847.60. Later, the market may fall with the target at 1820.00 or even reach 1810.00.

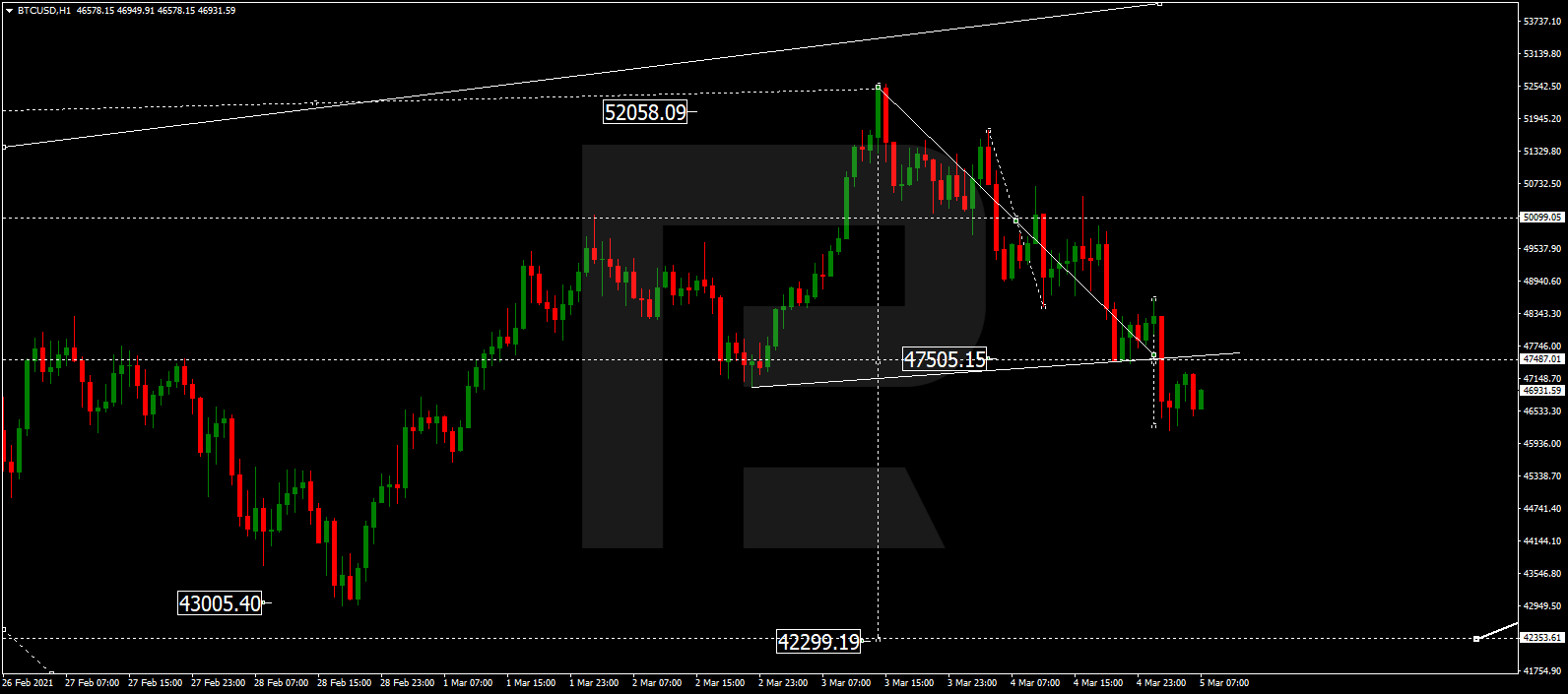

BTCUSD, “Bitcoin vs US Dollar”

BTCUSD is still consolidating above 18140.00. Possibly, the asset may break this level to the downside and then continue falling with the target at 17500.00. After that, the instrument may form one more ascending structure to reach 18200.00.

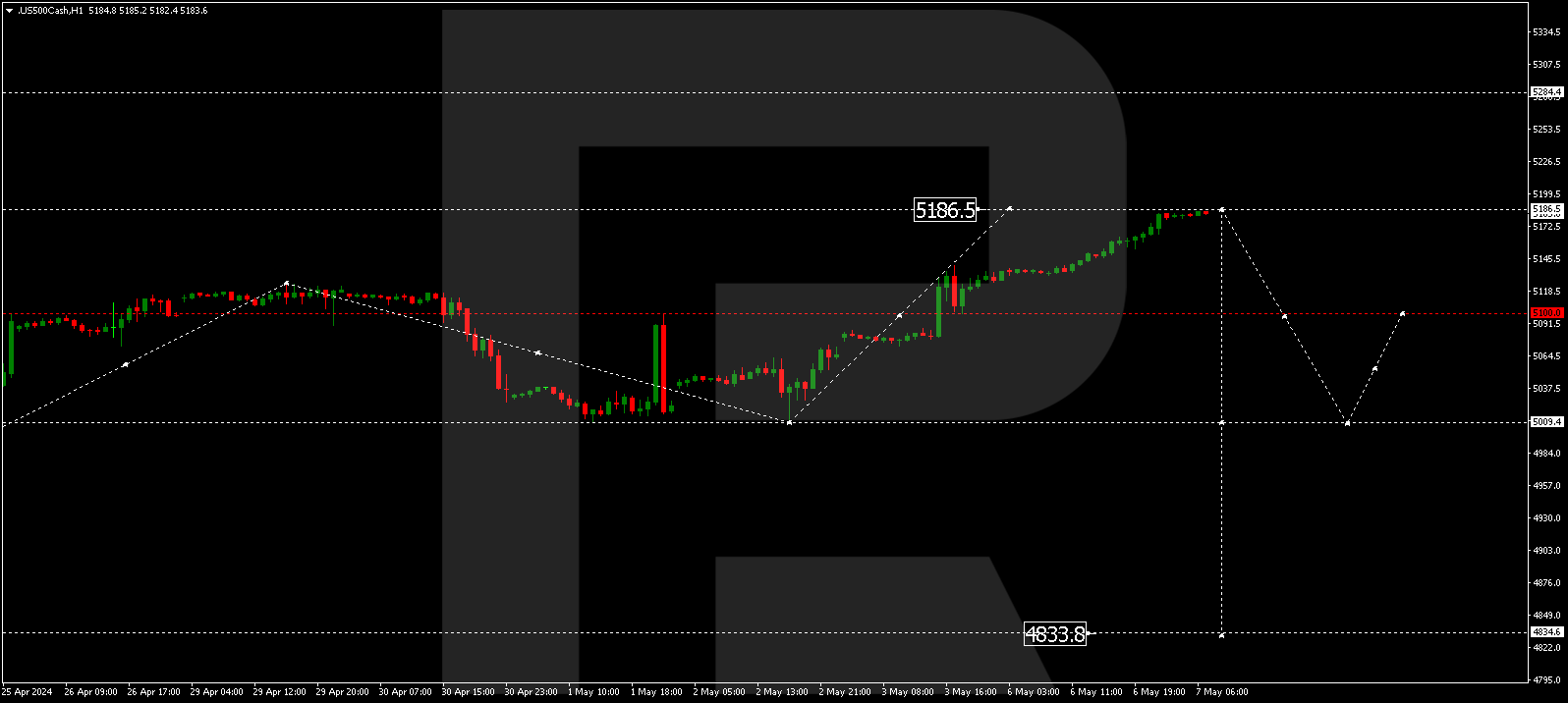

S&P 500

After forming the consolidation range below 3585.9, the S&P index has broken this level to the upside. Possibly, today the asset may grow to reach 3619.1 and then start a new correction to return to 3586.0. Later, the market may resume trading upwards with the target at 3651.1.