EURUSD, “Euro vs US Dollar”

The currency pair continues consolidating above 1.0600. Today it may grow to 1.0642. After this level is reached, a new structure of decline to 1.0550 might develop, followed by a correction to 1.0595 (a test from below). Then a decline to 1.0460 should follow. The goal is first.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair continues developing a consolidation range around 1.2044. Today a link of growth to 1.2100 is not excluded. After this level is reached, the pair may go down to 1.1940, correct to 1.2140, and fall to 1.1850. The goal is first.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has corrected to 133.13. Today a decline to 130.66 is expected. With a breakaway of this level, a pathway down to 128.28 will open. The goal is first.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair performed a link if growth to 0.9333. At the moment, the market is forming a consolidation range around this level. An escape upwards and continuation of the trend to 0.9366 are expected. The goal is first.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is forming a consolidation range around 0.6696. A link of growth to 0.6730 is not excluded today. After this level is reached, the wave of decline might continue to 0.6626, from where the trend might extend to 0.6500.

BRENT

Crude oil is continuing the wave of growth to 85.55. After this level is reached, a link of correction to 82.55 is not excluded. And after that a link of growth to 86.40 might follow, from where the trend should continue to 89.00. The goal is local.

XAUUSD, “Gold vs US Dollar”

Gold has completed a wave of growth to 1803.10. Today the market may form one more link of growth to 1804.40, followed by a decline to 1780.74 and possible trend continuation to 1770.00.

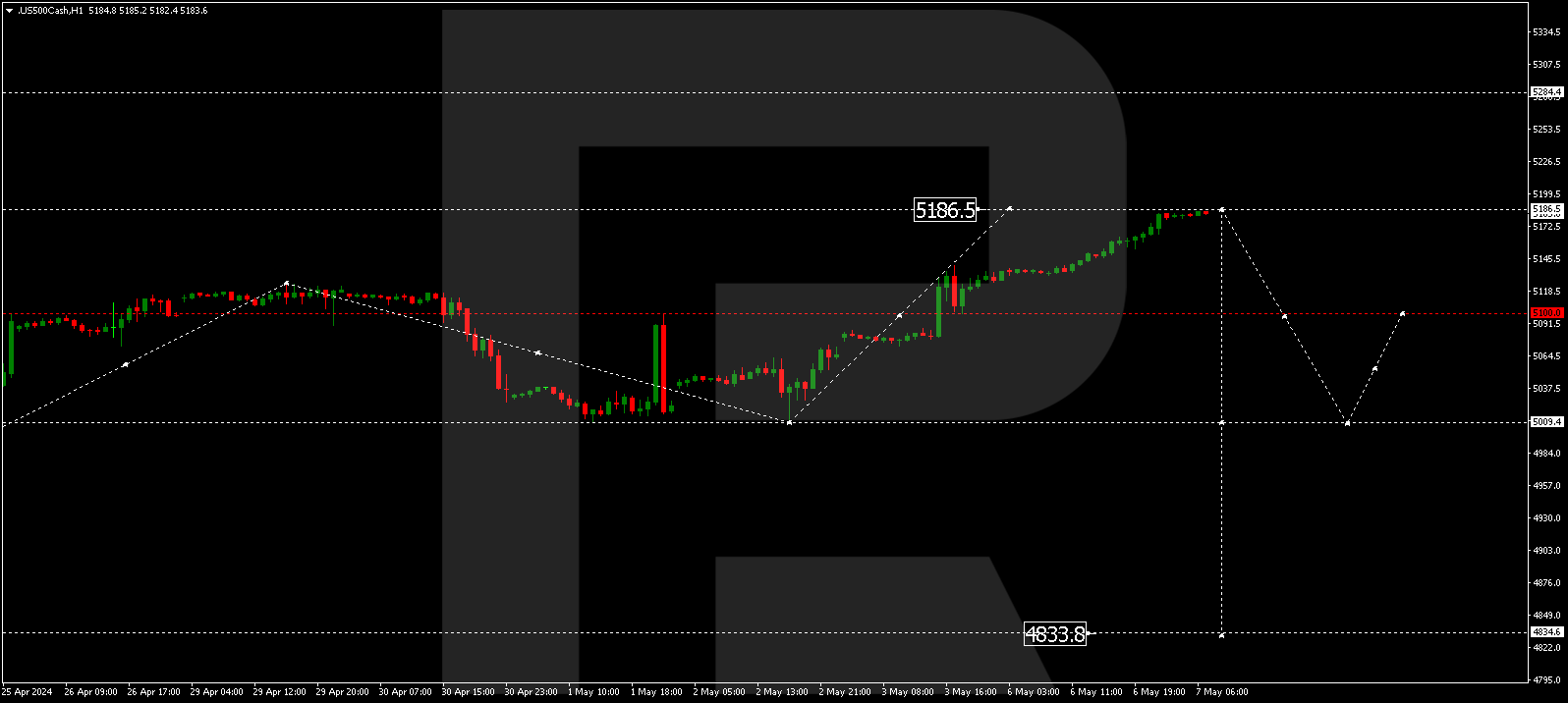

S&P 500

The stock index is forming a consolidation range above 3830.0. Today the market might extend it upwards to 3894.0. Then a decline to 3732.0 is expected. The goal is local.