Forex Technical Analysis & Forecast 27.08.2020

EURUSD, “Euro vs US Dollar”

After finishing the descending wave at 1.1773 and rebounding from this level to the upside, EURUSD has returned to 1.1824; right now, it is consolidating around this level. If later the price breaks this range to the upside, the market may start a new correction towards 1.1880 and then resume trading within the downtrend with the target at 1.1750.

GBPUSD, “Great Britain Pound vs US Dollar”

After rebounding from 1.3116 and completing the ascending structure at 1.3193, GBPUSD is consolidating around the latter level. If later the price breaks the current range to the downside, the market may resume trading downwards to reach 1.3155; if to the upside – form one more ascending structure with the target at 1.3268.

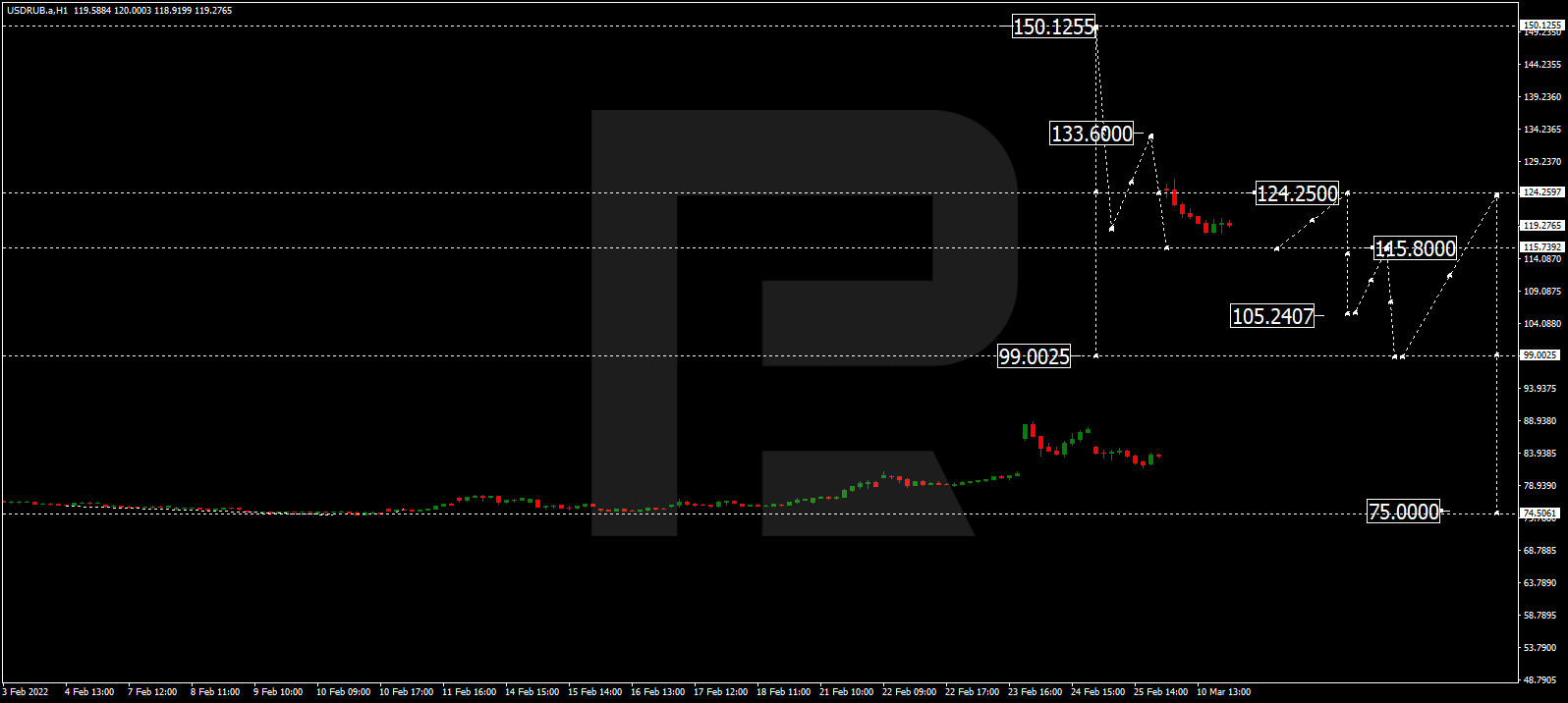

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is still trading upwards; it has already reached 75.90. Possibly, the pair may correct towards 75.08 or even 74.30. Later, the market may form one more ascending structure with the target at 76.40.

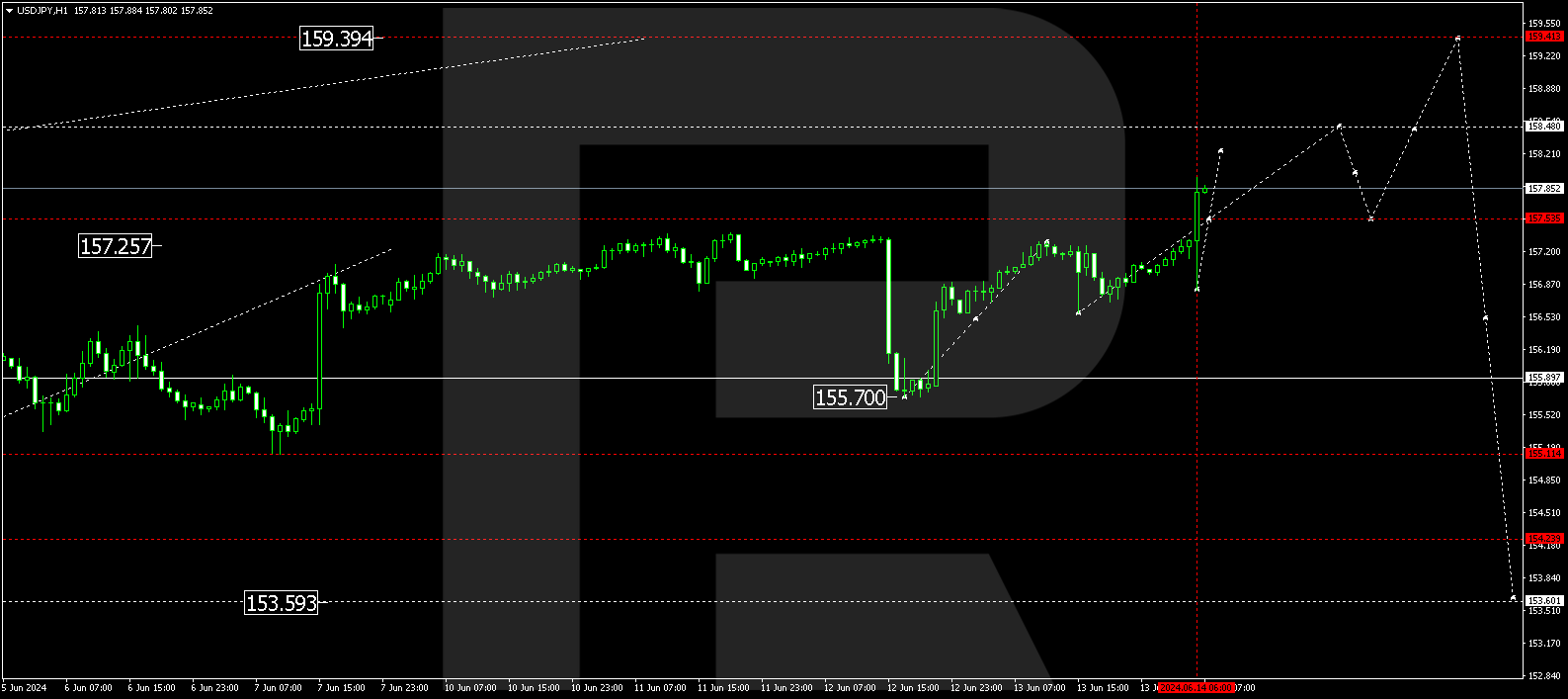

USDJPY, “US Dollar vs Japanese Yen”

After completing the descending wave at 106.12 and then forming a new consolidation range around this level, USDJPY has broken it to the downside. Today, the pair may continue trading downwards with the target at 105.68.

USDCHF, “US Dollar vs Swiss Franc”

After rebounding from 0.9112 to the downside, USDCHF continues trading downwards to reach 0.9056. After that, the instrument may form one more ascending structure to return to 0.9112.

AUDUSD, “Australian Dollar vs US Dollar”

After forming a new consolidation range around 0.7197 and breaking it to the upside, AUDUSD has reached the short-term target at 0.7250. Possibly, today the pair may correct to return to 0.7197. Later, the market may resume trading upwards with the target at 0.7256.

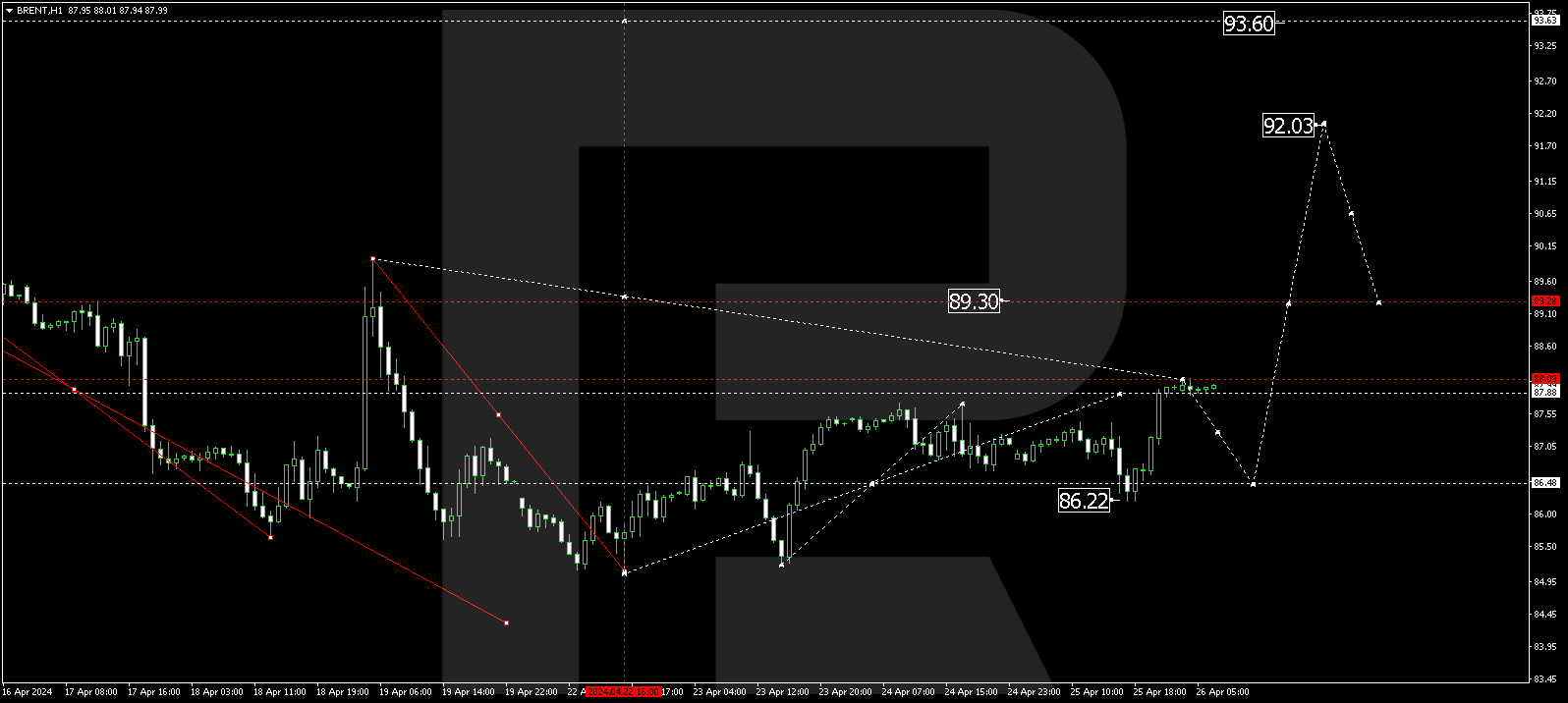

BRENT

Brent is consolidating above 46.00. If later the price breaks the current range to the downside, the market may start a new correction to reach 45.00 and then resume growing towards 48.00; if to the upside – form one more ascending structure with the target at 47.30 or even 47.90.

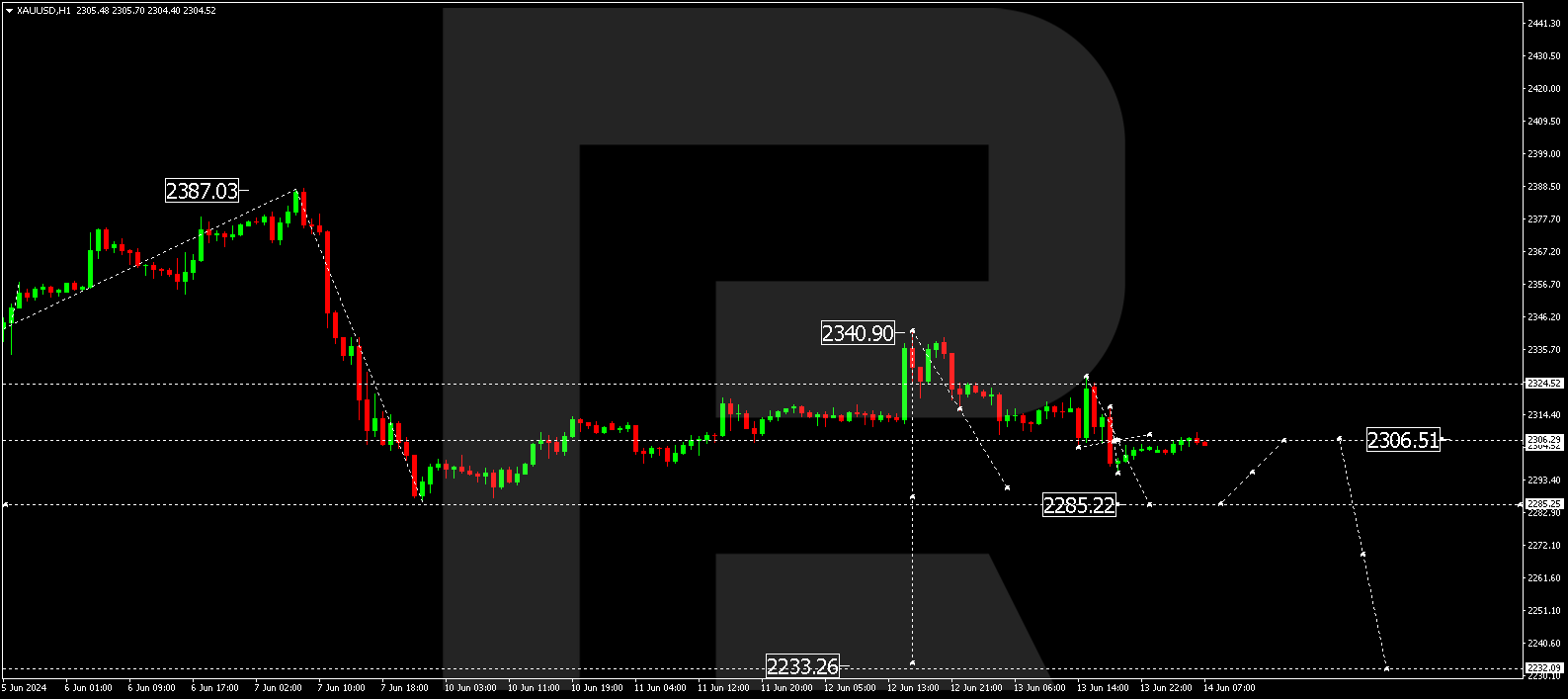

XAUUSD, “Gold vs US Dollar”

After reaching 1909.00 and then rebounding from this level, Gold has reached the upside border of the range; right now, it is still consolidating and moving downwards to reach 1927.00. If later the price breaks the current range to the downside, the market may resume trading downwards towards 1850.00; if to the upside – start another correction with the target at 2007.40.

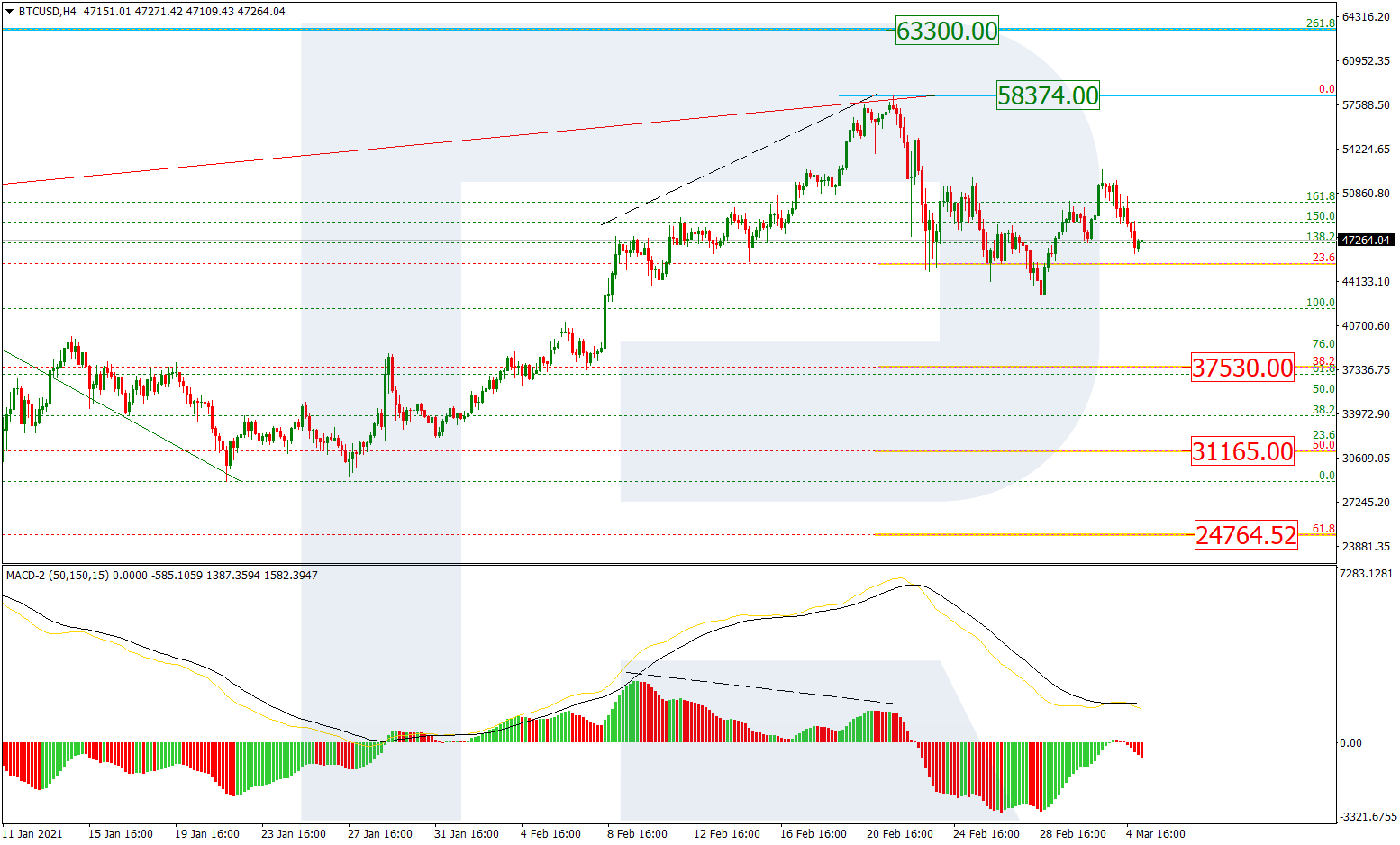

BTCUSD, “Bitcoin vs US Dollar”

After testing 11500.00 from below, BTCUSD is moving downwards. Possibly, the pair may reach 11000.00 and then form one more ascending structure to return to 11500.00. After that, the instrument may resume trading downwards with the target at 10500.00.

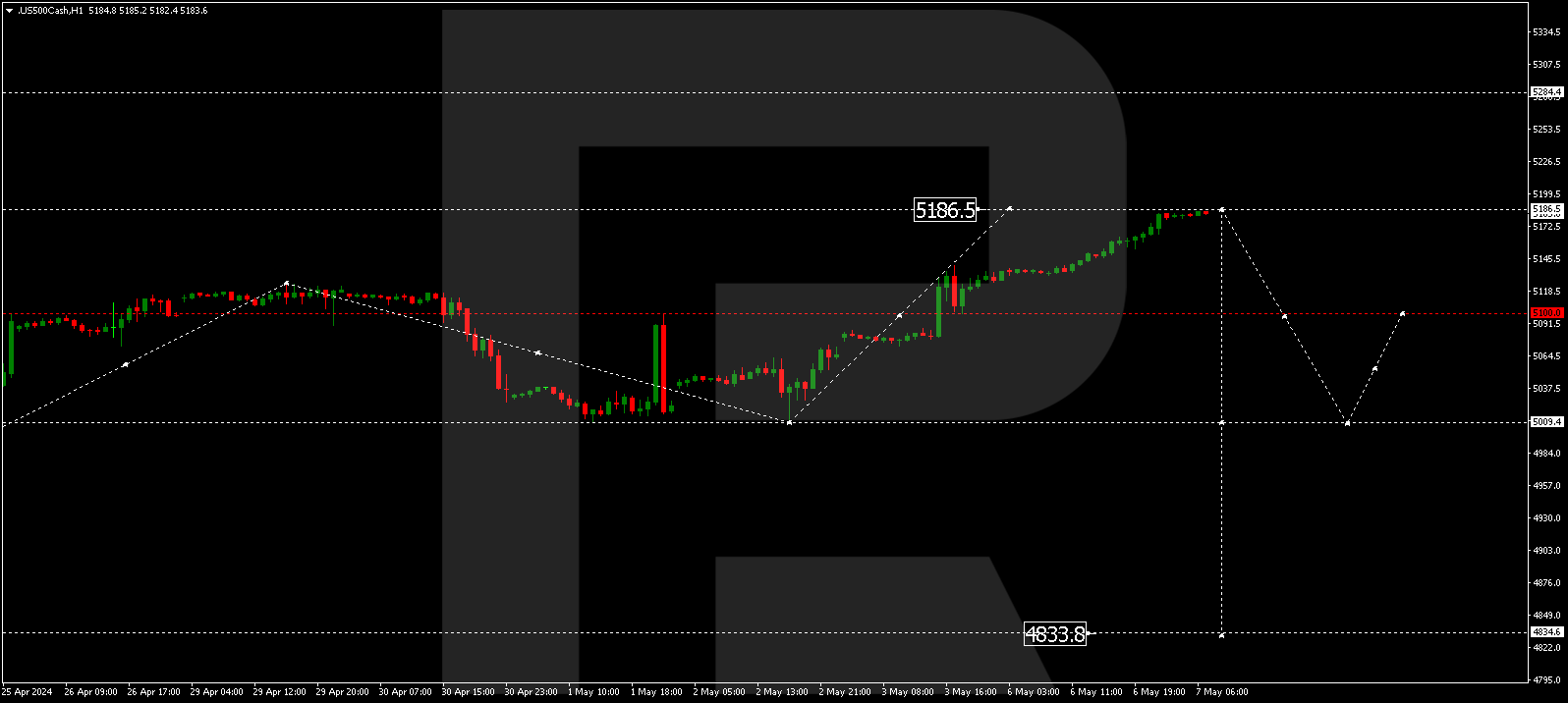

S&P 500

After breaking 3465.1 to the upside, the S&P index is growing towards 3488.9 and may later fall to return to 3465.1. After that, the instrument may form one more ascending structure to reach 3506.5 and then continue the uptrend towards 3520.0. All these ascending structures should be considered as an alternative scenario only. In fact, the asset may start plummeting towards 3222.2 at any moment.