EURUSD, “Euro vs US Dollar”

EURUSD is forming a wide consolidation range around 1.0970. Possibly, today the pair may start a new decline towards 1.0966 and then grow to reach 1.1001. After that, the instrument may resume trading downwards with the target at 1.0937.

GBPUSD, “Great Britain Pound vs US Dollar”

After completing the descending wave at 1.3066, GBPUSD is expected to correct towards 1.3113. Later, the market may form a new descending structure with the target at 1.3060 or even extend this decline down to 1.2960.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed the descending impulse at 123.13 along with the correction towards 124.29. Today, the pair may form the second descending impulse to break 122.60 and then continue falling with the short-term target at 120.99.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is correcting towards 0.9318. After that, the instrument may form one more ascending structure with the first target at 0.9417.

AUDUSD, “Australian Dollar vs US Dollar”

After reaching the short-term downside target at 0.7466 and finishing the correction towards 0.7494, AUDUSD is expected to resume trading downwards with the first target at 0.7450.

BRENT

Having completed the correctional stricture at 108.82, Brent is expected to start another growth to break 118.88. After that, the instrument may continue trading upwards with the short-term target at 129.29.

XAUUSD, “Gold vs US Dollar”

Gold has finished another correctional structure at 1922.30. Possibly, today the metal may form one more ascending wave with the first target at 1981.89.

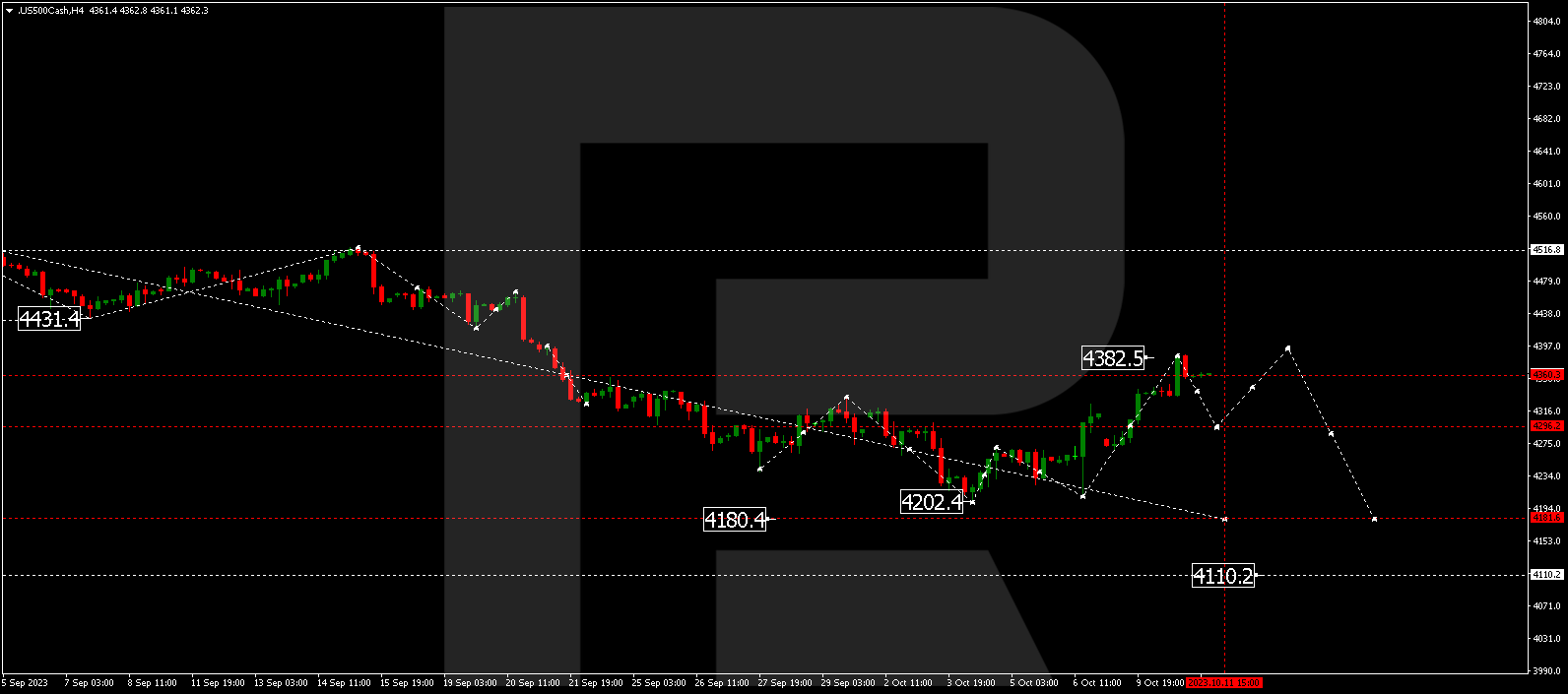

S&P 500

After rebounding from 4516.0, the S&P index continues growing towards 4593.7. Later, the market may start a new decline to break 4365.5 and then continue falling with the target at 4070.0.