Forex Technical Analysis & Forecast 29.09.2020

EURUSD, “Euro vs US Dollar”

After finishing the ascending structure at 1.1640 and breaking it to the upside, EURUSD is expected to continue the correction towards 1.1690. Later, the market may break this level downwards and form a new descending structure with the target at 1.1600, at least.

GBPUSD, “Great Britain Pound vs US Dollar”

After completing the correctional structure at 1.2900, GBPUSD is consolidating around 1.2862. Possibly, today the pair may trade downwards to reach 1.2792 and then form one more ascending structure towards 1.2860, thus forming a new consolidation range between these two levels. If later the price breaks this range to the downside at 1.2790, the market may continue moving inside the downtrend with the target at 1.2700 or even 1.2600.

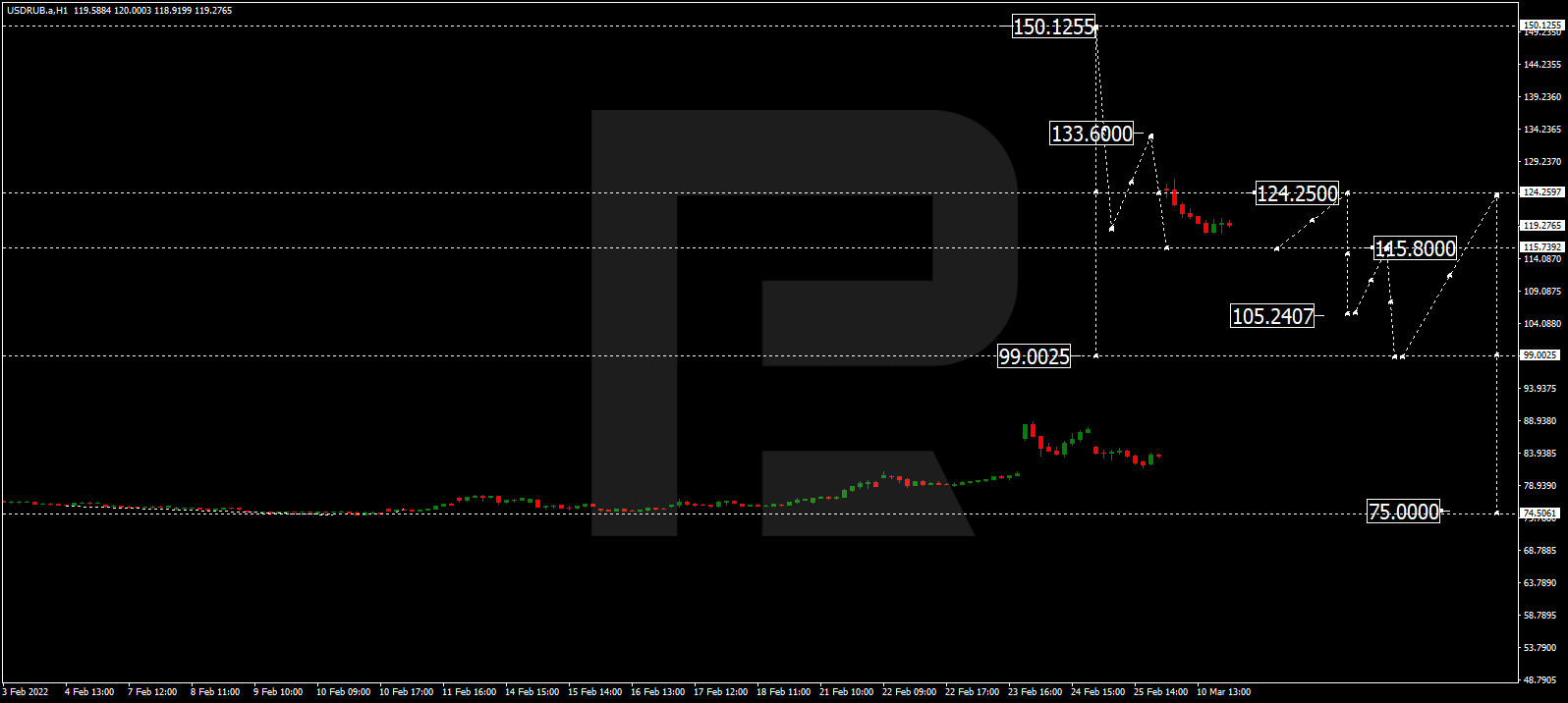

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is still moving upwards. Today, the pair may reach 79.34 and then form a new descending structure towards 77.97. After that, the instrument may start another growth with the target at 79.79. However, all these ascending structures should be considered as an alternative scenario only to continue correction. The main scenario implies that the price may start plummeting at any moment. The first downside target is at 76.60.

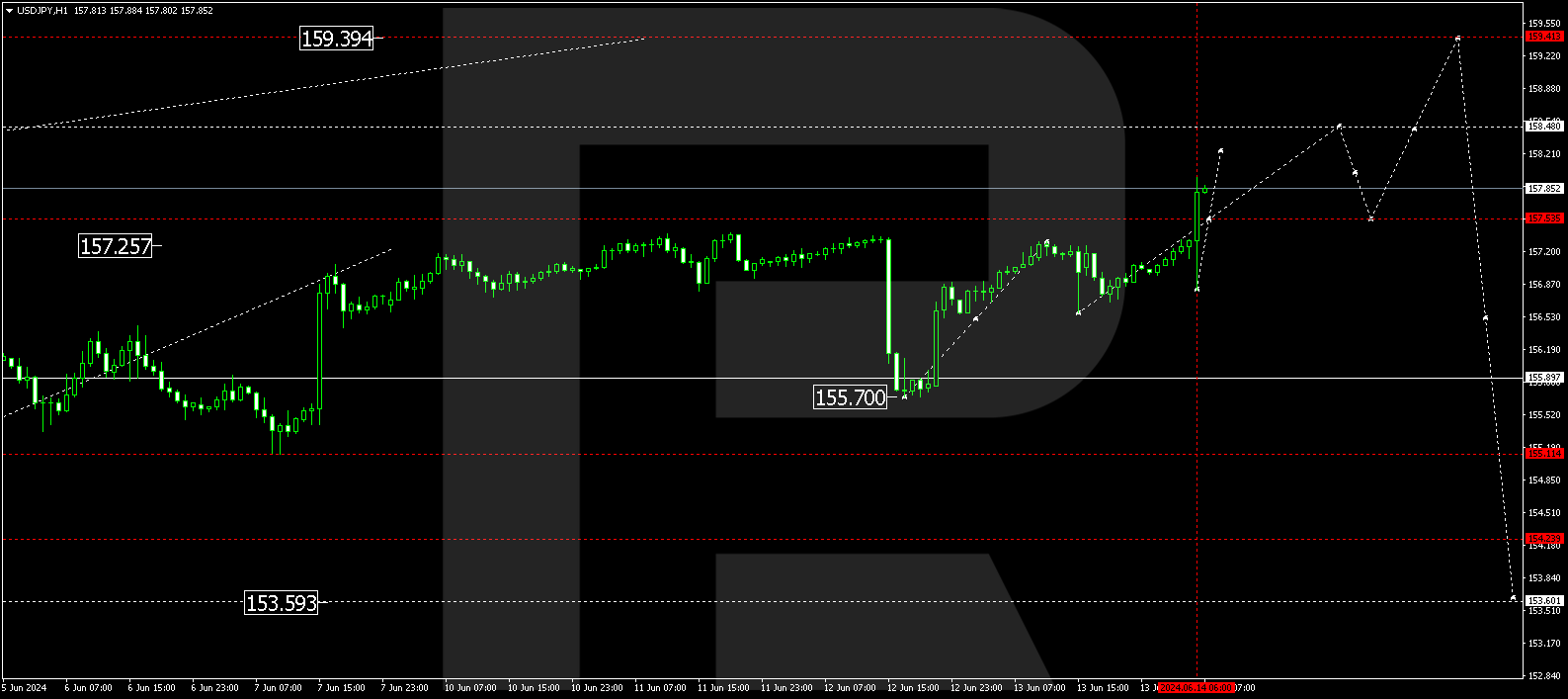

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is consolidating around 105.30. Possibly, the pair may fall towards 105/00 and then form one more ascending structure to reach 106.00 to finish the correction. Later, the market may start a new decline with the first target at 105.00.

USDCHF, “US Dollar vs Swiss Franc”

After finishing the descending structure at 0.9255 and breaking it to the downside, USDCHF is expected to continue the correction towards 0.9216. After that, the instrument may resume moving upwards with the target at 0.9340, at least.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is still consolidating around 0.7055; right now, it is moving not far from the upside border at 0.7085. Possibly, today the pair may correct upwards to reach 0.7125. After completing the correction, the instrument may resume trading downwards to break 0.7027 and then continue falling with the target at 0.6930.

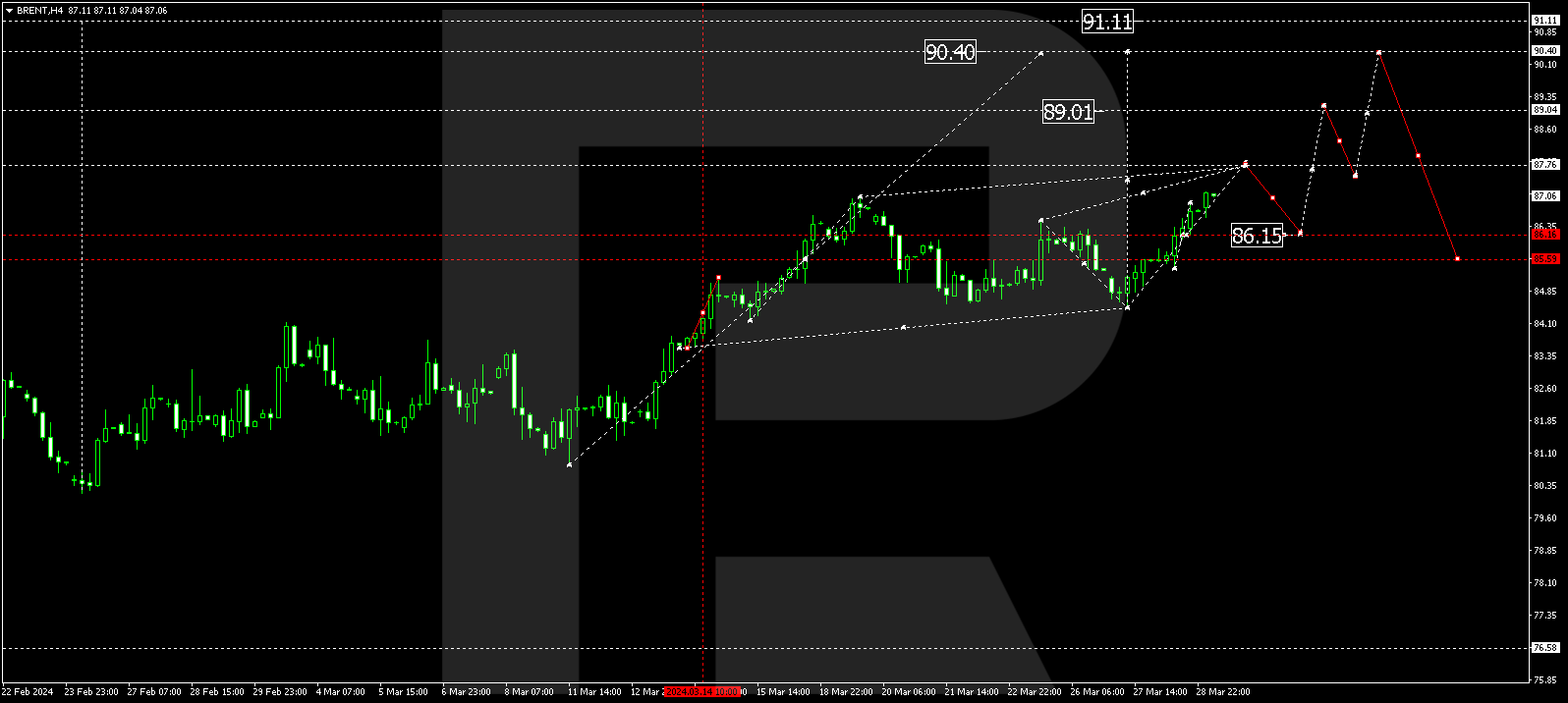

BRENT

After completing the ascending structure at 43.00, Brent is consolidating below this level. If later the price breaks this range to the upside at 43.00, the market may form one more ascending structure to break 44.60 and then continue moving within the uptrend; if to the downside at 42.30 – continue the correction with the target at 41.21.

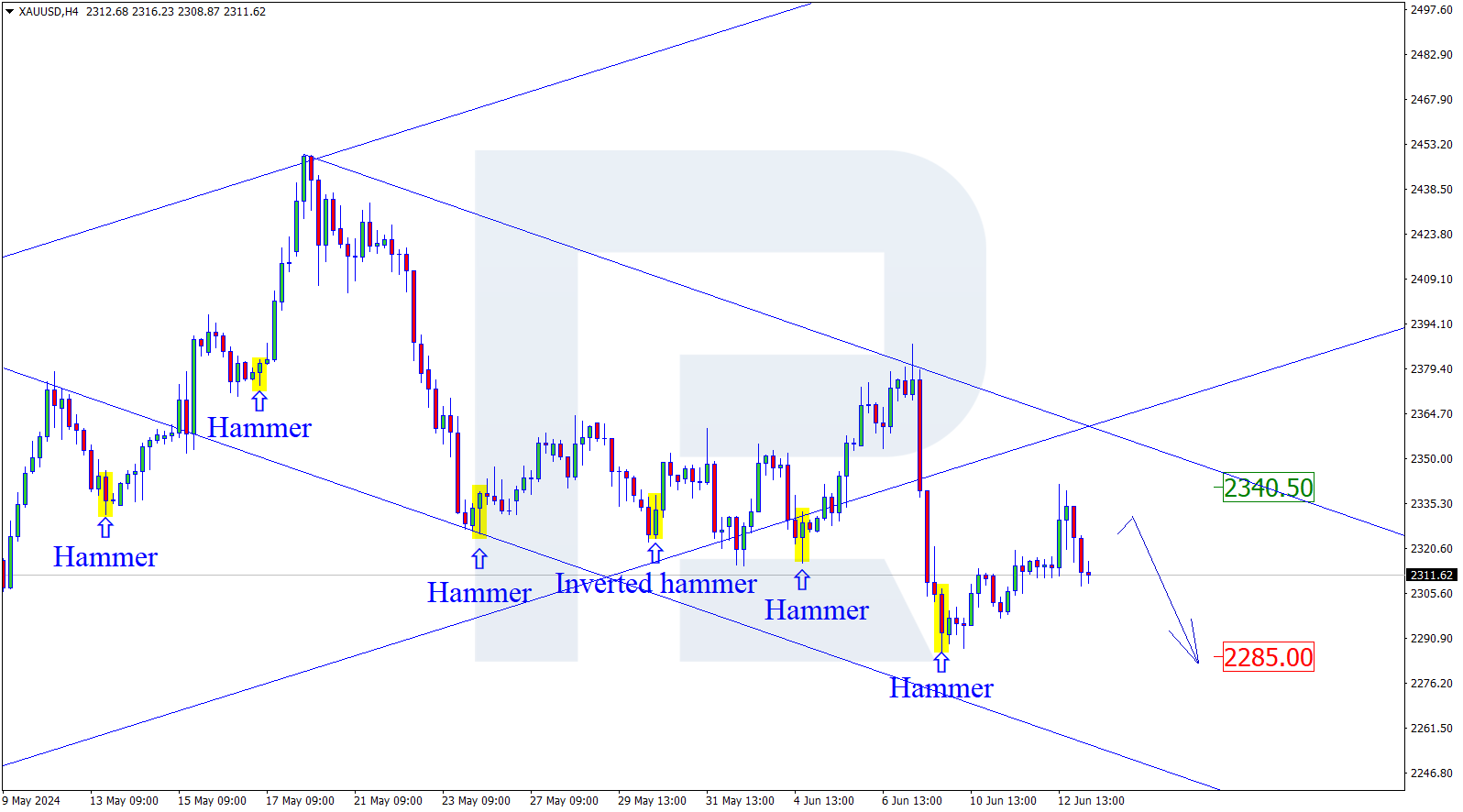

XAUUSD, “Gold vs US Dollar”

After finishing the ascending structure at 1885.45, Gold is expected to consolidate around this level. If later the price breaks this range to the upside, the market may form one more ascending structure with the target at 1906.63 or even 1921.12.

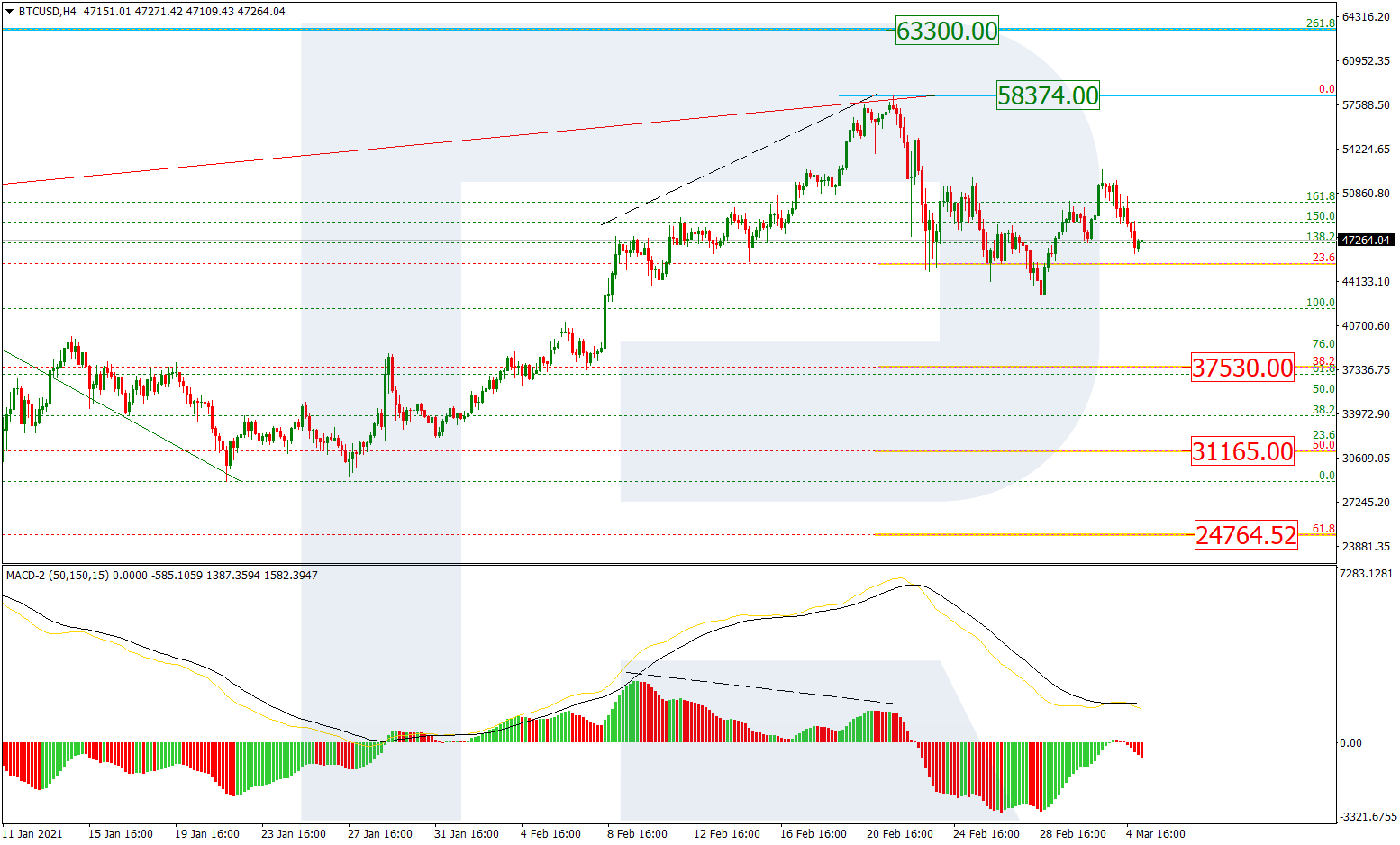

BTCUSD, “Bitcoin vs US Dollar”

After failing to fix above 10700.00 and continue the correction, BTCUSD is falling to break 10550.00. After that, the instrument may continue trading within the downtrend with the target at 10000.00 or even 9600.00.

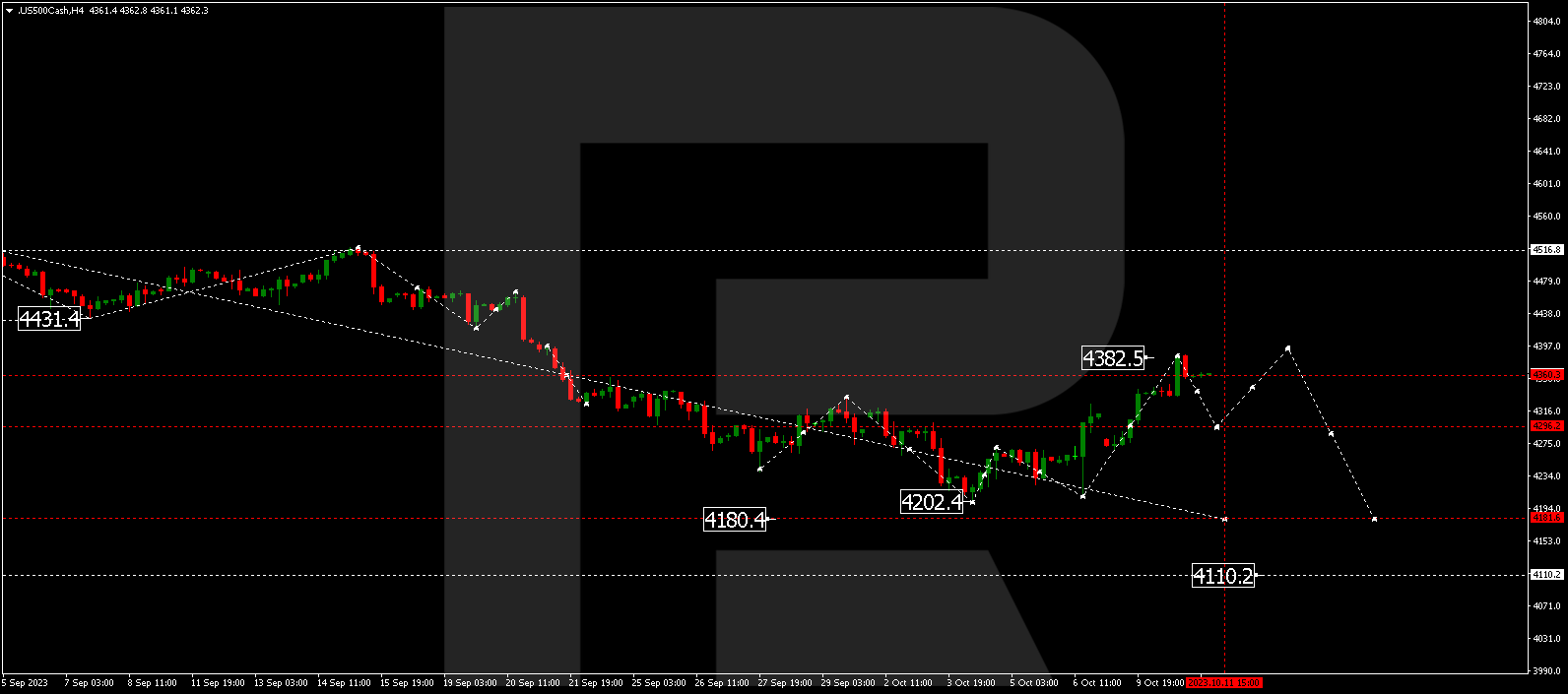

S&P 500

After completing the ascending structure at 3330.3, еhe S&P index is still moving upwards. Possibly, the asset may continue the correction towards 3385.3 and then fall to return to 3330.3. If later this level is broken to the downside, the instrument may continue trading downwards with the target at 3202.8.