Forex Technical Analysis & Forecast 30.11.2020

EURUSD, “Euro vs US Dollar”

The pair keeps developing a wave of growth to 1.1980. After it reaches this level, a correction to 1.1910 is not excluded. Then another wave of growth to 1.202, at least, is expected. Then a wave of decline to 1.1800 might start.

GBPUSD, “Great Britain Pound vs US Dollar”

The pair keeps developing a consolidation range around 1.3350. At the moment, the market has broken the level top-down and extended the range to 1.3285. Today, the market is growing again to 1.3350. Upon reaching this level, the pair might correct to 1.3311, then grow to 1.3373 and extend the range to 1.3400.

USDRUB, “US Dollar vs Russian Ruble”

The currency pair keeps forming a consolidation range around 75.60, lacking any pronounced trend. The main scenario is a decline to 75.00 and even 74.62 in the future. The goal is first. After this level is reached, a new wave of growth to 77.70 might start.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair keeps developing a wave of decline towards 103.40. Upon reaching this level, it might grow to 104.00, then go down to 103.00 and even extend the wave to 102.50. The goal is main.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair keeps developing a wave of decline to 0.9011. After this level is reached, a wave of growth towards 0.9074 might start, aiming at 0.9100 in the future.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of growth to 0.7377. It created a consolidation range around this level and broke it upwards, extending the wave. Today, it might reach 0.7410. Upon reaching this level, the pair might correct to 0.7377, then extend the range to 0.7420.

BRENT

Oil demonstrated the first declining impulse to 47.33 and corrected to 48.25. Today, it might go back down to 47.33. A breakaway of this level will open a pathway to 46.45. The goal is local.

XAUUSD, “Gold vs US Dollar”

Gold remains under pressure: at the moment, the market has broken away 1782.85, opening a pathway to 1765.75. Then the metal might grow to 1807.50, then decline to 1750.50, completing the wave of decline there. Then a wave of growth to 1850.50 is to start.

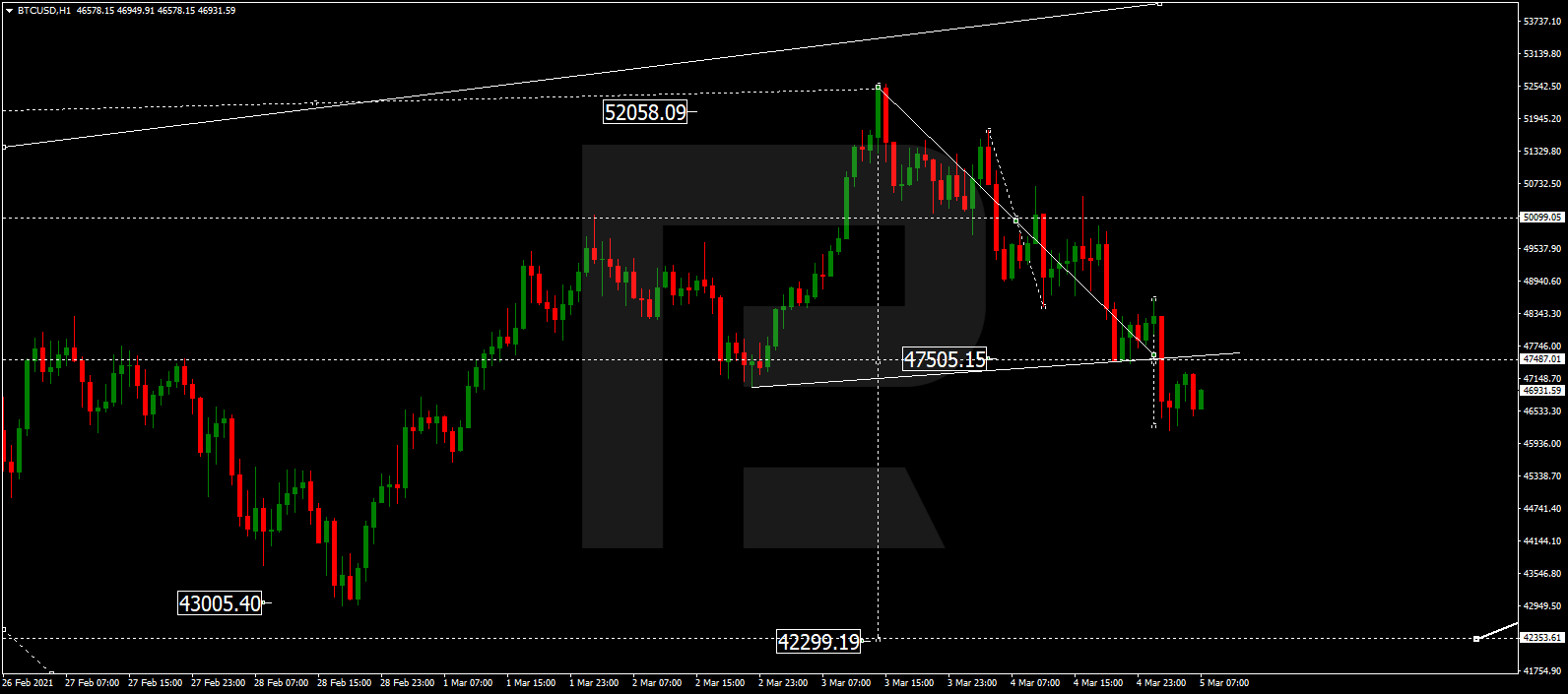

BTCUSD, “Bitcoin vs US Dollar”

The market has broken 17,400 upwards, reaching a local goal of 18,450 today. A correction to 17,400 might develop (testing the level from above), followed by another wave of growth to 18,850. There, the flag of correction is to end. Then another wave of decline to 16,500 might follow.

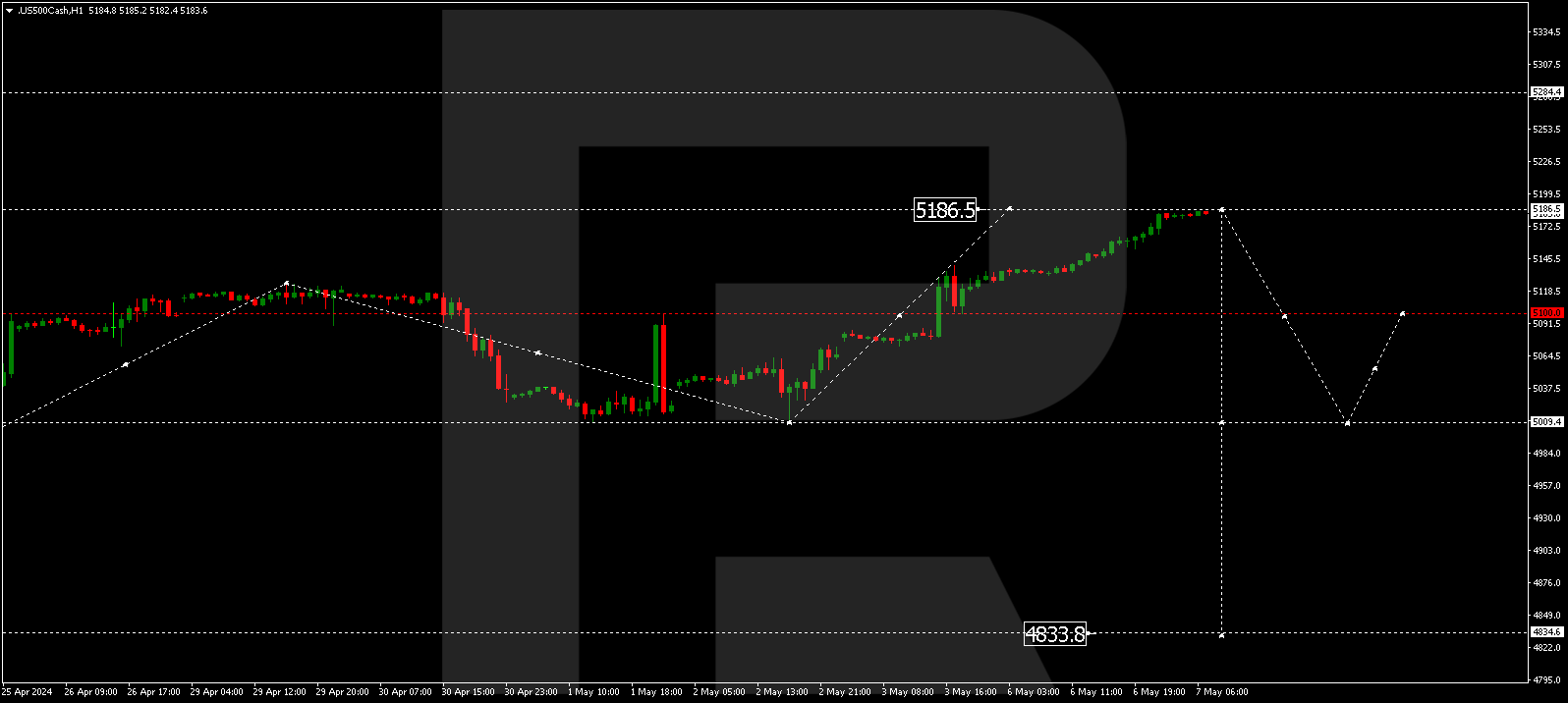

S&P 500

The stock index keeps forming a consolidation range around 3629.5. Today, it might extend downwards to 3602.2. After this level is reached, another structure of growth to 3662.2 might develop. The goal is main. Then a wave of decline to 3500.0 might begin.