Forex Technical Analysis & Forecast 31.05.2019 (EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD, USDRUB, GOLD, BRENT)

EURUSD, “Euro vs US Dollar”

After updating the low and almost reaching 1.1117, EURUSD has started consolidating around 1.1127. If later the price breaks this range to the upside, the instrument may be corrected to reach 1.1165; if to the downside – resume trading inside the downtrend with the target at 1.1050.

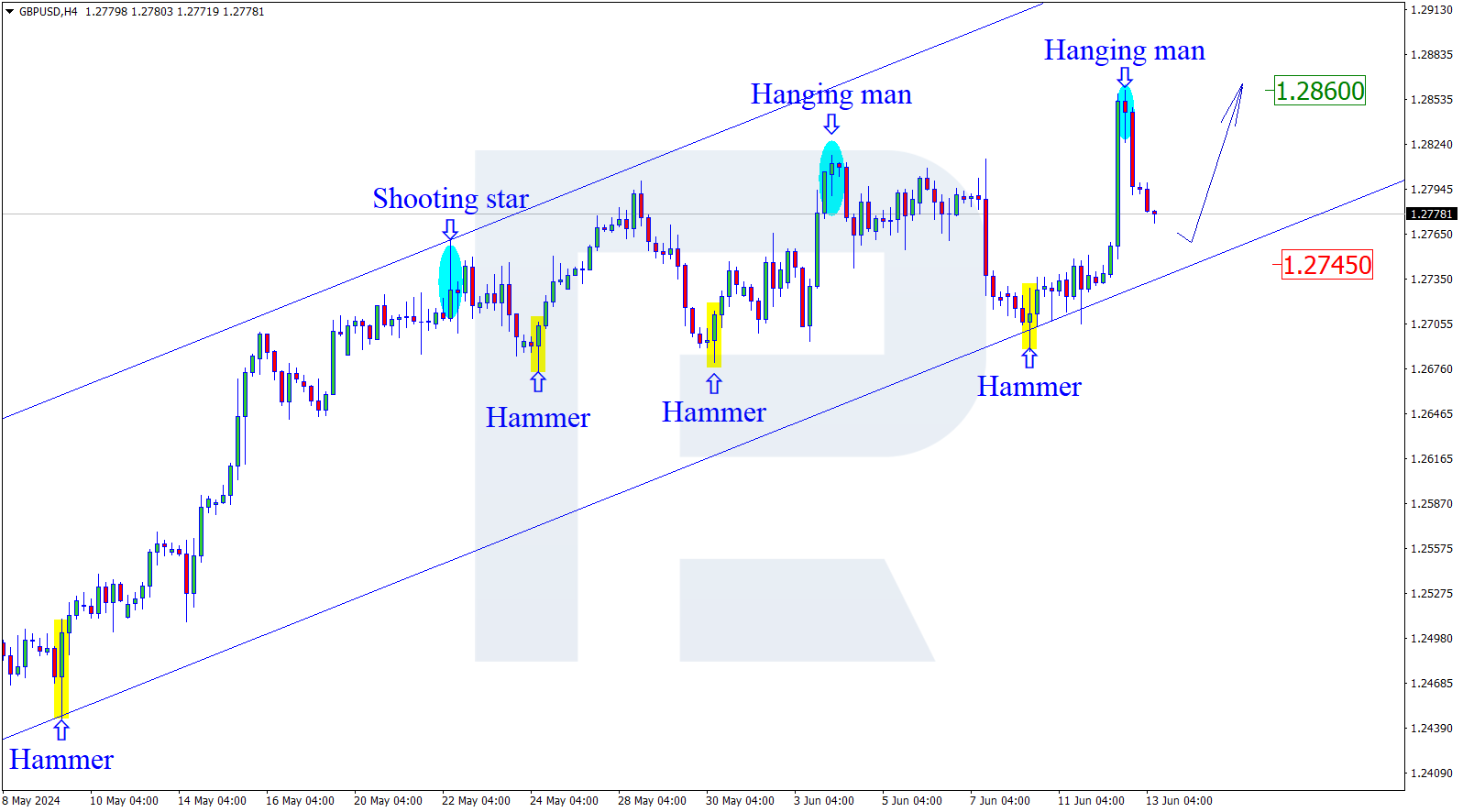

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has reached another downside target. Today, the pair may be corrected to reach 1.2666 and then resume trading inside the downtrend with the short-term target at 1.2533.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is consolidating around 1.0073; it has broken this level downwards and reached its short-term target. Possibly, today the pair may return to 1.0073 and then start a new decline towards 1.0048. Later, the market may form one more ascending structure to break 1.0097 and then continue trading inside the uptrend with the target at 1.0120.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed the correction at 109.91; right now, it is falling. Possibly, the pair may trade to break 109.12 and then reach the target at 108.62. After that, the instrument may test 109.25 from below and then resume trading inside the downtrend with the short-term target at 107.91.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is still consolidating around 0.6900. Today, the pair may grow towards 0.6954 and then fall to break 0.6900. Later, the market may continue trading inside the downtrend with the target at 0.6800.

USDRUB, “US Dollar vs Russian Ruble”

USDRUB has returned to 64.85; right now, it is forming another ascending structure towards 65.55. After that, the instrument may resume trading inside the downtrend with the first target at 64.40.

XAUUSD, “Gold vs US Dollar”

Gold has reached 1290.40 during the correction. Possibly, today the pair may consolidate near the highs. If later the price breaks this range to the downside, the instrument may resume trading inside the downtrend with the target at 1280.25.

BRENT

After failing to fix above 68.80, Brent has broken it downwards and almost reached the short-term target at 66.00. Possibly, today the pair may consolidate near the lows. Later, the market may form one more ascending structure towards 69.90 and then start a new decline to complete the correction at 64.40. After that, the instrument may continue trading inside the uptrend with the target at 77.20.