French election uncertainty supports the euro

The EURUSD rate continues to rise on Tuesday, 25 June 2024, reaching 1.0741. Investors are awaiting the results of the French legislative election.

The euro is rising despite worsening German business sentiment

According to the recent Ifo survey, the business climate in Germany unexpectedly deteriorated in June 2024. The business climate index decreased to 88.6 from 89.3 in May, below the forecasted 89.7. Worsening sentiments are caused by a decrease in expectations, with the expectations gauge dropping to 89.0 from the previous 90.4.

Inflation data released in major European countries this week may show opposite trends. The annual inflation rate in Spain is projected to decrease from 3.6% in May to 3.3% in June, while consumer prices in Italy might rise by 0.2% from the previous month.

Overall, investors are concerned about the upcoming French legislative election. Sumitomo Mitsui Banking Corporation’s analysts note that the political situation will have maximum impact on the EURUSD rate and in case instability persists, the euro may weaken further against the US dollar. However, the euro is rising for the second consecutive day despite political instability and mixed economic indicators, approaching the key resistance level of 1.0750.

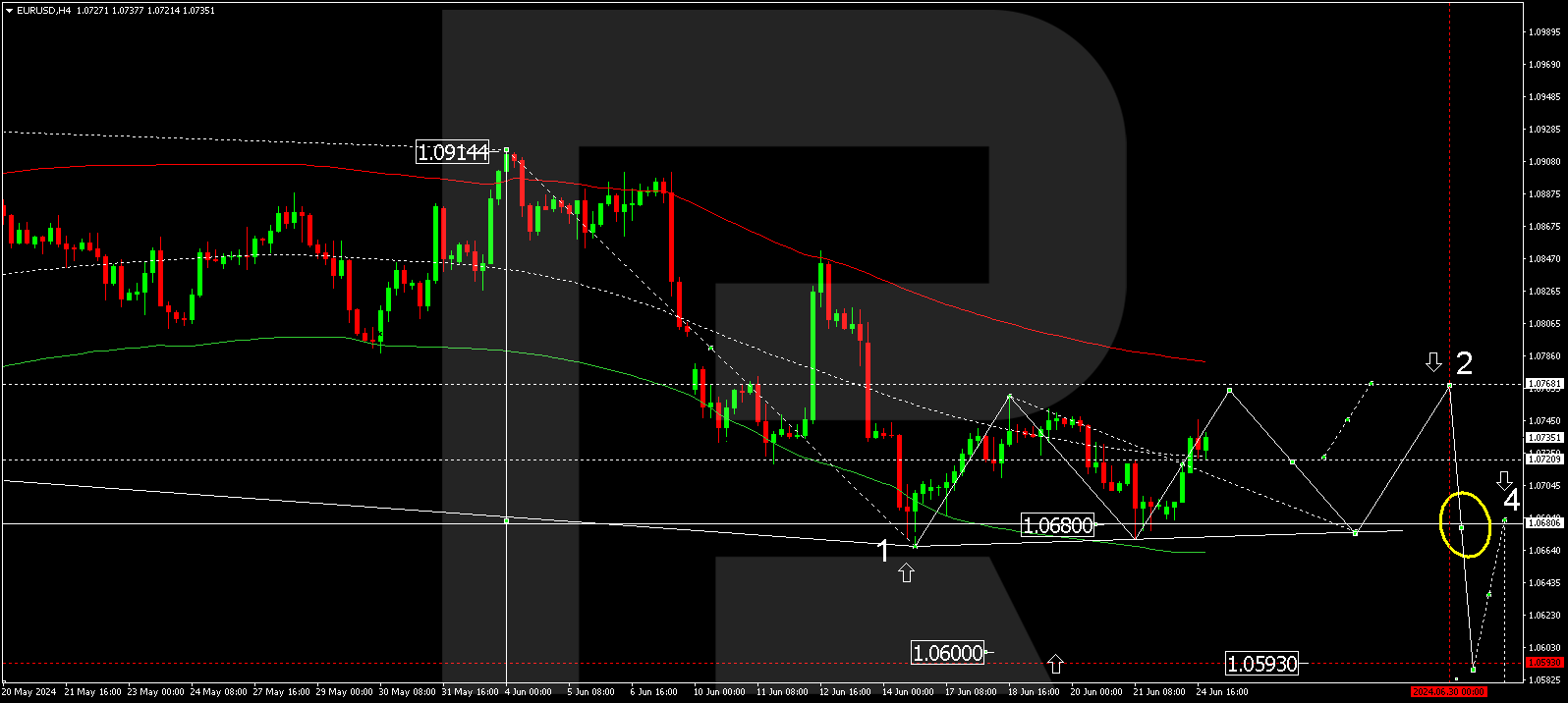

EURUSD technical analysis

A consolidation range has formed above the 1.0680 level on the EURUSD Н4 chart. With an upward breakout, a correction might continue to 1.0760. After reaching this level, the price is expected to decline to 1.0680. A new consolidation range is expected to form around this level, which is crucial for the EURUSD forecast for 25 June 2024. With a downward breakout of this range, a decline to 1.0610 is possible, followed by a rise to 1.0680 (testing from below). Once the price hits this level, a new decline wave might start, aiming for 1.0600 and potentially continuing to 1.0570, the estimated target. With an upward breakout of the range, another corrective structure could follow, targeting 1.0780. After the price reaches this level, a new decline wave might begin, aiming for 1.0590 as the local target.

EURUSD technical analysis 25.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. It is considered key for the EURUSD pair in the downtrend. The market returned to the Envelope’s centre and is consolidating above the 1.0720 level. The correction could practically continue to the Envelope’s upper boundary. After the price tests it from below, a decline wave could develop, targeting its lower boundary.

Summary

French election uncertainty supports the euro, with even a decline in German business sentiment unable to discourage bulls. The EURUSD technical analysis points to a potential decline wave towards the targets of 1.0600 and 1.0570 once the correction is complete.