The GBPUSD rate is aggressively declining today after rising on Friday on weak US data. Find out more in our analysis dated 5 August 2024.

GBPUSD trading key points

- The US economy added only 114,000 jobs, significantly below the projected 175,000

- Analysts believe the strengthening of the GBPUSD pair may be temporary

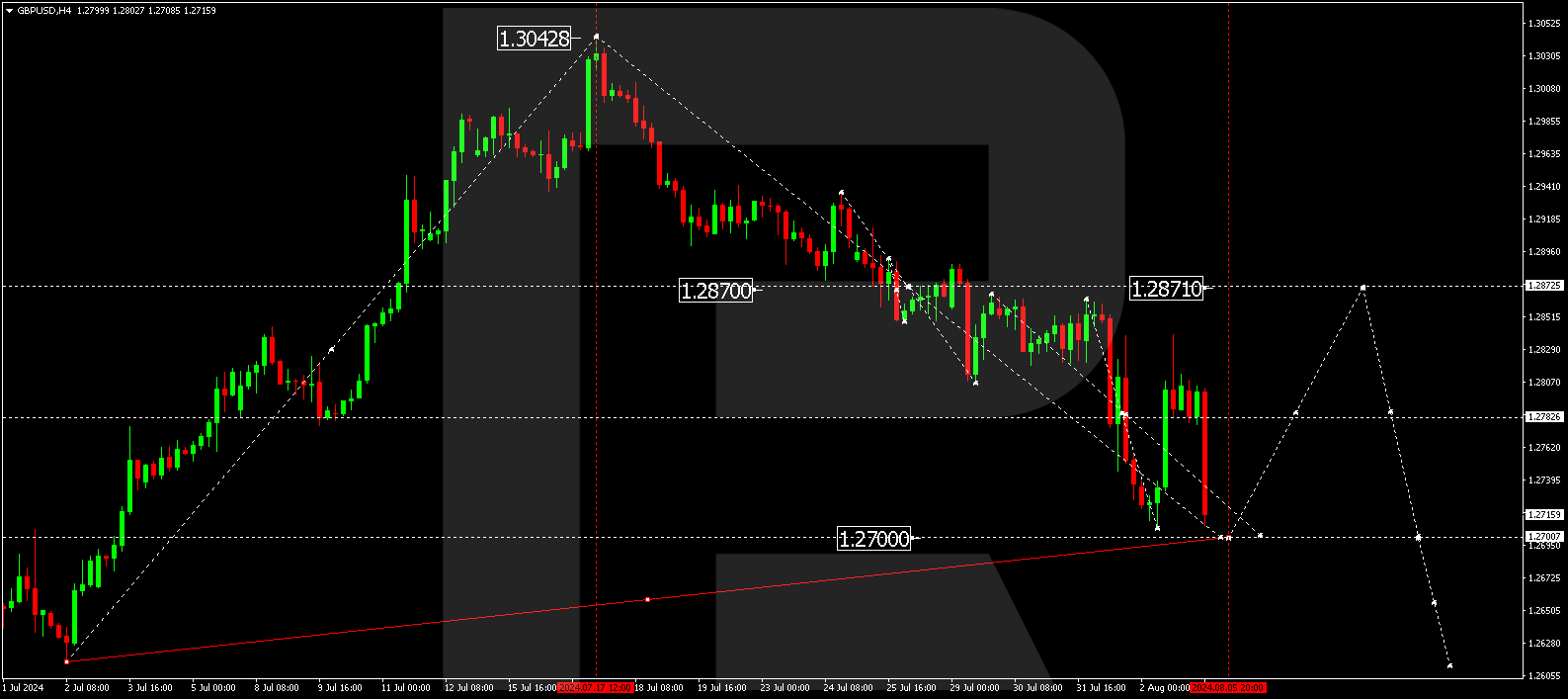

- GBPUSD forecast for 5 August 2024: 1.2700 and 1.2870

Fundamental analysis

The GBPUSD currency pair rose by over 0.5% on Friday due to a weak US employment report. This report heightened concerns about a potential recession and increased expectations for a more significant Federal Reserve interest rate cut.

Friday’s data revealed that the US economy added just 114,000 jobs in July, falling short of the projected 175,000. The unemployment rate unexpectedly rose to 4.3%, reaching the highest level since 2021, while wage growth slowed more than anticipated.

According to analysts, if investors focus solely on Friday’s US employment data, this may distort the GBPUSD forecast for today. An average reading over the past three months could provide a more accurate picture.

Overall, traders believe that the strengthening of the pound sterling may be temporary. If the released data indicate easing inflation and declining employment in the UK, the Bank of England might ease its monetary policy, which could exert significant pressure on the GBPUSD rate.

GBPUSD technical analysis

Analysis for 5 August 2024 shows that the GBPUSD pair remains in a downtrend, aiming for 1.2700 as the first target. The price is expected to reach this target level today. Subsequently, it could correct towards 1.2870 (testing from below). Once the correction is complete, a new decline wave might begin, targeting 1.2600.

Summary

Despite Friday’s strengthening, the pound sterling may weaken due to worsening UK economic indicators and the potential easing of the Bank of England’s monetary policy. Technical indicators suggest that the GBPUSD rate could decline to 1.2700 before correcting towards 1.2870.