The GBPUSD pair has risen confidently to 1.3294 as investors continue buying amid a favourable risk environment. Full details in today’s analysis for 14 May 2025.

GBPUSD forecast: key trading points

- GBPUSD resumes its upward movement and continues to appreciate

- UK inflation may exceed expectations, delaying potential Bank of England rate cuts

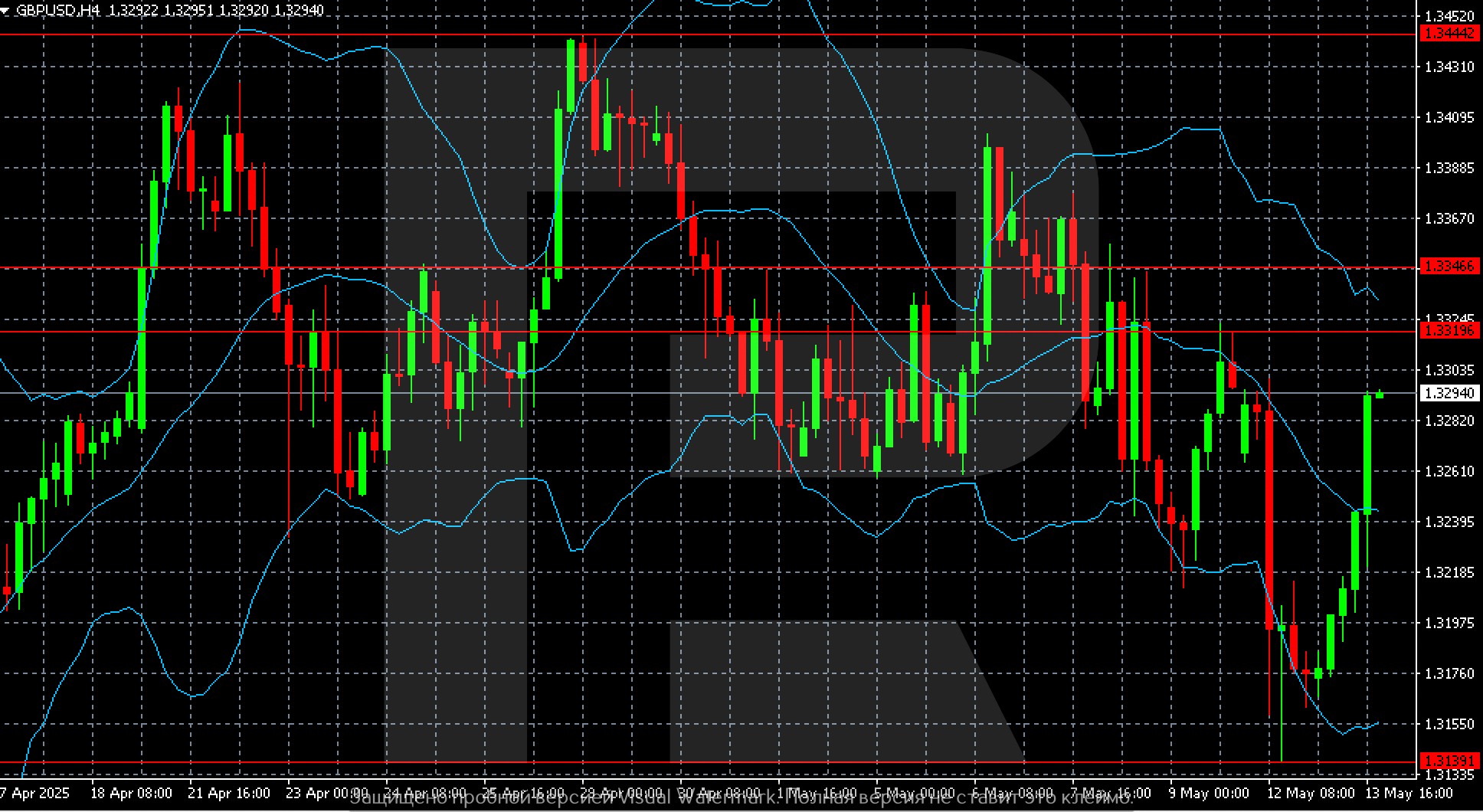

- GBPUSD forecast for 14 May 2025: 1.3319 and 1.3346

Fundamental analysis

GBPUSD strengthened to 1.3294 on Wednesday. Market sentiment improved following a temporary tariff-reduction agreement between the US and China, which encouraged demand for risk assets globally.

The pound is benefiting from this positive backdrop and from stabilising macroeconomic conditions. Inflation dynamics in the UK have improved, bolstered by stronger trade relations with the US and India.

However, Bank of England Chief Economist Huw Pill noted that inflation in the UK could be higher than the Bank’s forecasts, potentially requiring elevated interest rates to be maintained longer than markets anticipate. Last week, Pill voted against a 25-basis-point rate cut.

Currently, markets are pricing in a 48-basis-point rate reduction by year-end. No changes are expected at the BoE’s June meeting.

Outlook for GBPUSD remains favourable.

GBPUSD technical analysis

On the H4 chart, GBPUSD is showing a clear setup for a continued move to 1.3319. If that level is breached, the next upside target is 1.3346.

At the same time, it's worth noting that the sharp rebound could pave the way for a potential correction — a pullback of around 50% of the recent move is technically possible.

Summary

GBPUSD is gaining momentum, supported by revived risk appetite and improving fundamentals. The forecast for GBPUSD on 14 May 2025 points to further upside, with targets at 1.3319 and 1.3346.