GBPUSD continues to rise following a correction

Improving UK house price index and US manufacturing index figures support the British pound. Discover more in our analysis for 16 September 2024.

GBPUSD forecast: key trading points

- The Rightmove UK house price index (y/y): previously at -1.5%, currently at 0.8%

- NY Empire State Manufacturing Index (US): previously at -4.7 points, currently at -4.1

- GBPUSD forecast for 16 September 2024: 1.3177 and 1.3199

Fundamental analysis

A monthly change in the Rightmove UK year-over-year house price index was published on Monday, 16 September 2024. The indicator shows how much the average price of housing property for sale has changed. Figures above the forecast and previous data are a positive factor for the British pound. A weaker-than-expected reading reflects negative developments. The previous statistics came out below forecasts, while the current reading has now shifted to positive territory, reaching 0.8% and propelling the GBPUSD rate.

The NY Empire State Manufacturing Index measures the development of the manufacturing sector in New York State. It is calculated based on a survey of 200 largest manufacturing enterprises. A reading above zero points to increased manufacturing activity, while the one below zero indicates a decline. Stronger-than-expected data may provide significant support to the US dollar. The forecast for 16 September 2024 suggests that the reading will remain in negative territory at -4.1, which is still negative for the US dollar.

Fundamental analysis for 16 September 2024 does not provide arguments in favour of the US currency, so the pound sterling has every chance to continue its upward momentum after the correction.

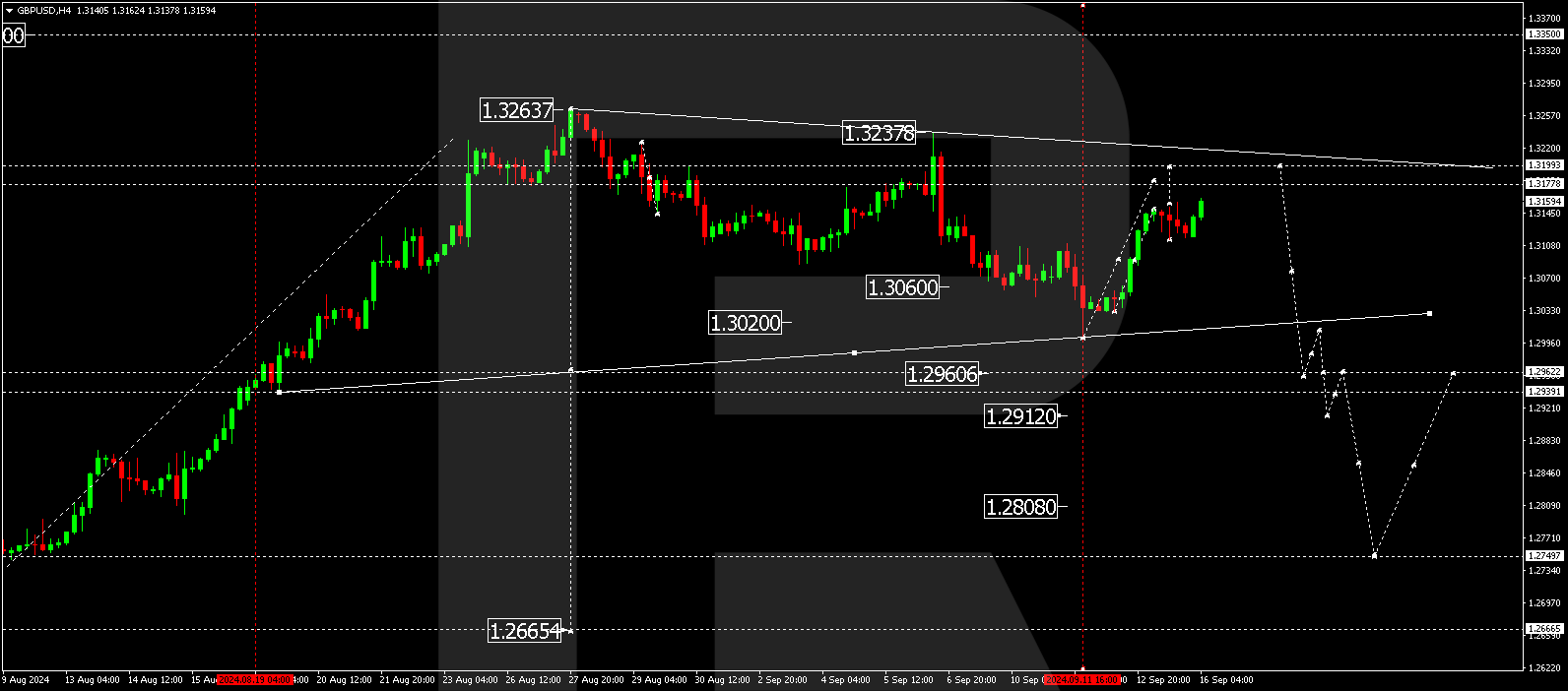

GBPUSD technical analysis

On the GBPUSD H4 chart, the market is forming a consolidation range around 1.3137. The range is extended down to 1.3114 and up to 1.3162. A downward wave could develop today, 16 September 2024, aiming for 1.3093. Subsequently, the price might rise to 1.3177 and potentially further to 1.3199. The probability of a triangle technical pattern is considered. After the price tests its upper boundary from below, a downward wave could start, aiming for the lower boundary of the triangle pattern at 1.3050.

Summary

The rise in the UK house price index and the GBPUSD technical analysis in today’s GBPUSD forecast suggest potential growth in the GBPUSD rate to the 1.3177 and 1.3199 levels.