GBPUSD forecast 2025, 2026: expert predictions, price outlook, and analysis

Disclaimer: the information in this article is based on the analysis of reputable financial resources and analytical data from RoboForex specialists. It reflects the conclusions of thorough research, but it should be taken into account that economic changes may significantly affect market conditions, which may lead to changes in forecasts. We recommend conducting your own research and consulting with professionals before making important financial decisions.

The article presents a forecast for GBPUSD for the years 2025 - 2026 and highlights the main factors influencing the direction of the pair’s movement. We will apply technical analysis, consider the opinions of leading experts, major banks, and financial institutions, and study forecasts based on artificial intelligence. The GBPUSD analysis will provide investors and traders with a comprehensive view of possible movements in the GBPUSD pair, giving them the necessary information to make well-informed decisions.

Table of contents:

- Key takeaways: GBPUSD price prediction

- GBPUSD fundamental analysis in 2025

- What influences the British pound (GBPUSD) price forecast in 2025?

- GBPUSD live price chart

- GBPUSD weekly technical analysis

- Long-term GBPUSD forecast for 2025

- Expert GBPUSD forecast 2025-2026

- GBPUSD forecast from AI 2025-2026

- Conclusion

- FAQ

Key takeaways: GBPUSD price prediction

At the moment, many experts believe that GBPUSD will continue to exhibit moderate volatility. The key drivers of exchange rate changes will remain the differences in monetary policy between the Bank of England and the U.S. Federal Reserve (Fed), as well as the economic consequences of global changes such as the energy transition and trade agreements.

Experts and analysts have differing opinions, but hopes for the strengthening of the pound remain. The forecast for 2025 looks quite optimistic, suggesting that the GBPUSD pair will make a reversal and continue developing an upward trend, with target growth levels of 1.3200-1.3400.

GBPUSD fundamental analysis in 2025

In 2025, the GBPUSD currency pair demonstrates volatility driven by various fundamental factors. At the beginning of the year, the British pound faced pressure due to the yield on 10-year UK government bonds rising to 4.79%, the highest level since 2008. This increase is linked to fiscal policy measures and expectations regarding the economic policy of the new U.S. president, Donald Trump, which, in turn, intensified inflation concerns and increased borrowing costs for the British government.

On the foreign exchange market, the pound hit its 2023 low against the U.S. dollar, which was due to rising bond yields and investor concerns about the fiscal stability of the UK.

Despite these negative factors, some analysts expect the pound to strengthen over the year. According to forecasts by Bank of America, the pound could reach 1.41 USD by the end of the year, driven by strong UK economic growth and government changes that contribute to improved economic prospects.

What influences the British pound (GBPUSD) price forecast in 2025?

- Interest rates and monetary policy: If the Bank of England continues to raise interest rates to combat inflation, the pound may strengthen against the dollar. At the same time, the Fed's policy of rate cuts and the economic policy of the Trump administration could reinforce this trend.

- Economic growth and inflation: The level of economic growth in the UK and the U.S. will significantly impact the GBPUSD exchange rate. A stronger economy usually supports the national currency.

- Political stability and geopolitics: A stable political environment in the UK and progress in post-Brexit trade negotiations could strengthen the pound. However, geopolitical conflicts or uncertainty could have the opposite effect.

- Global market conditions: The U.S. dollar is traditionally considered a "safe haven" during periods of global economic turmoil. This may limit GBPUSD growth if the global economy faces difficulties.

GBPUSD live price chart

GBPUSD weekly technical analysis

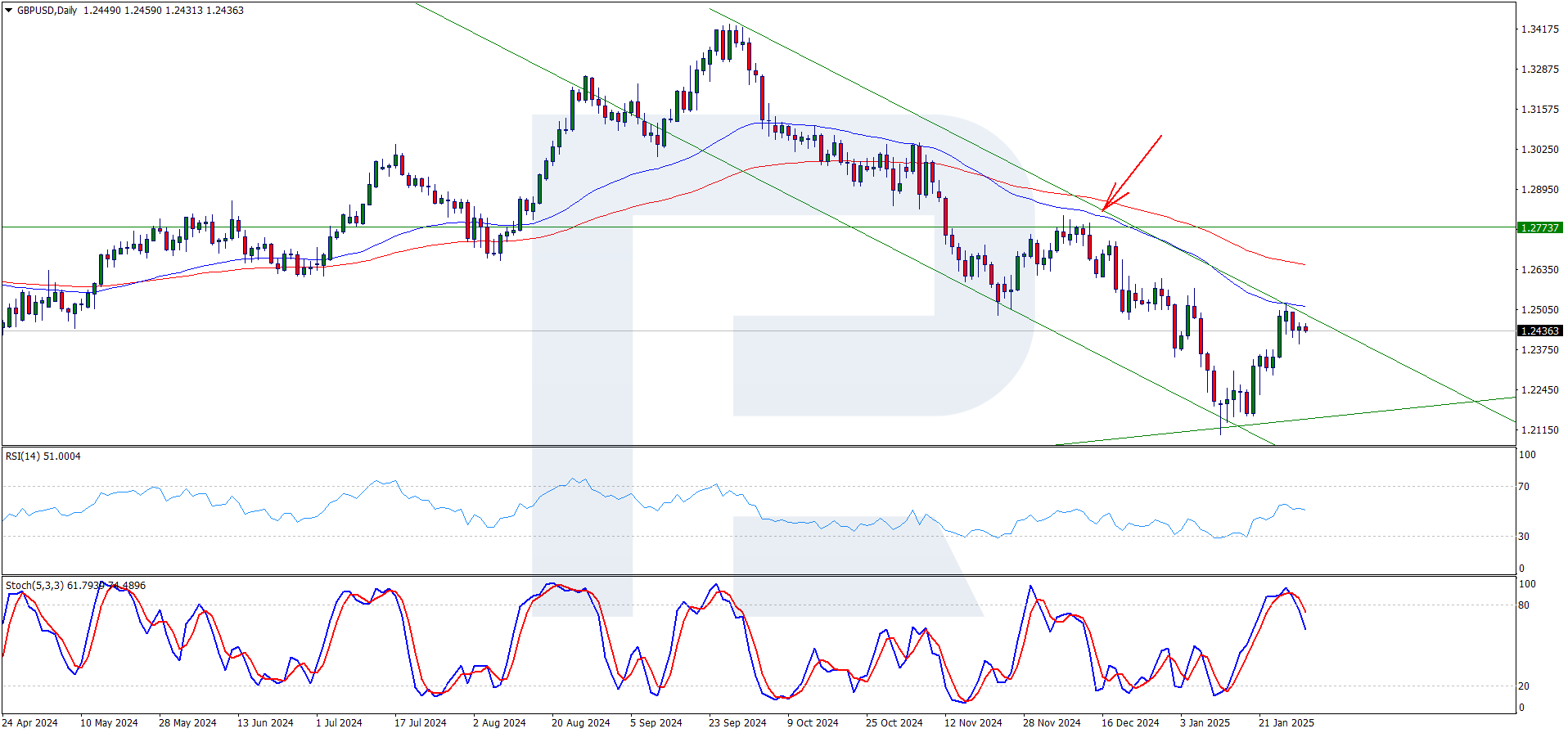

GBPUSD charts over the past weeks show:

Resistance: At the 1.2700 level, the pound faces increased selling pressure.

Resistance level 1.2700

Indicators: The 100 MA and 50 MA moving averages indicate a sideways trend, the Relative Strength Index (RSI) is in the overbought zone, and the Stochastic Oscillator is also in the overbought zone.

Technical analysis suggests that the GBPUSD exchange rate may undergo a correction and remain within the 1.2100-1.2500 range over the next month until clearer macroeconomic signals emerge from the U.S. and the UK.

Long-term GBPUSD forecast for 2025

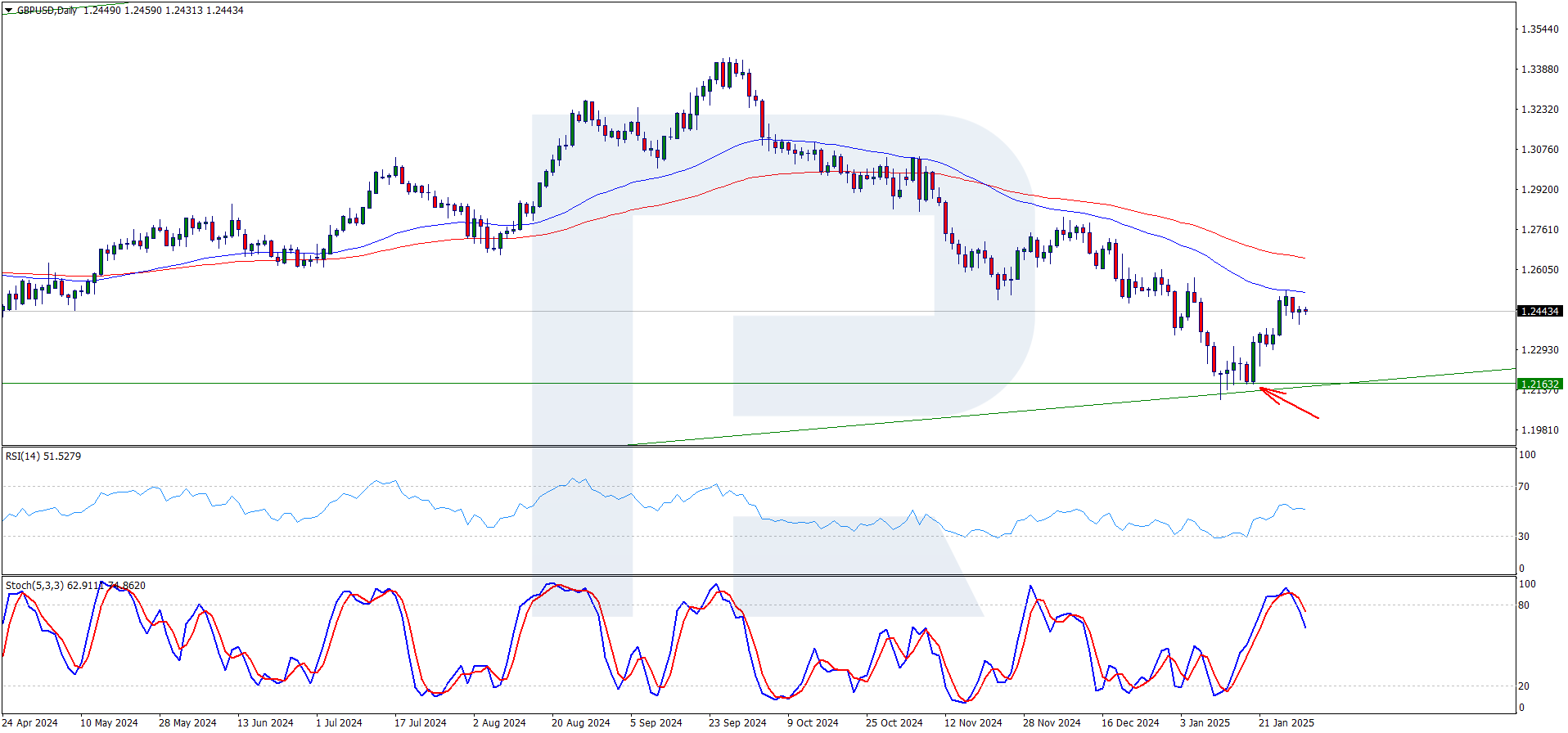

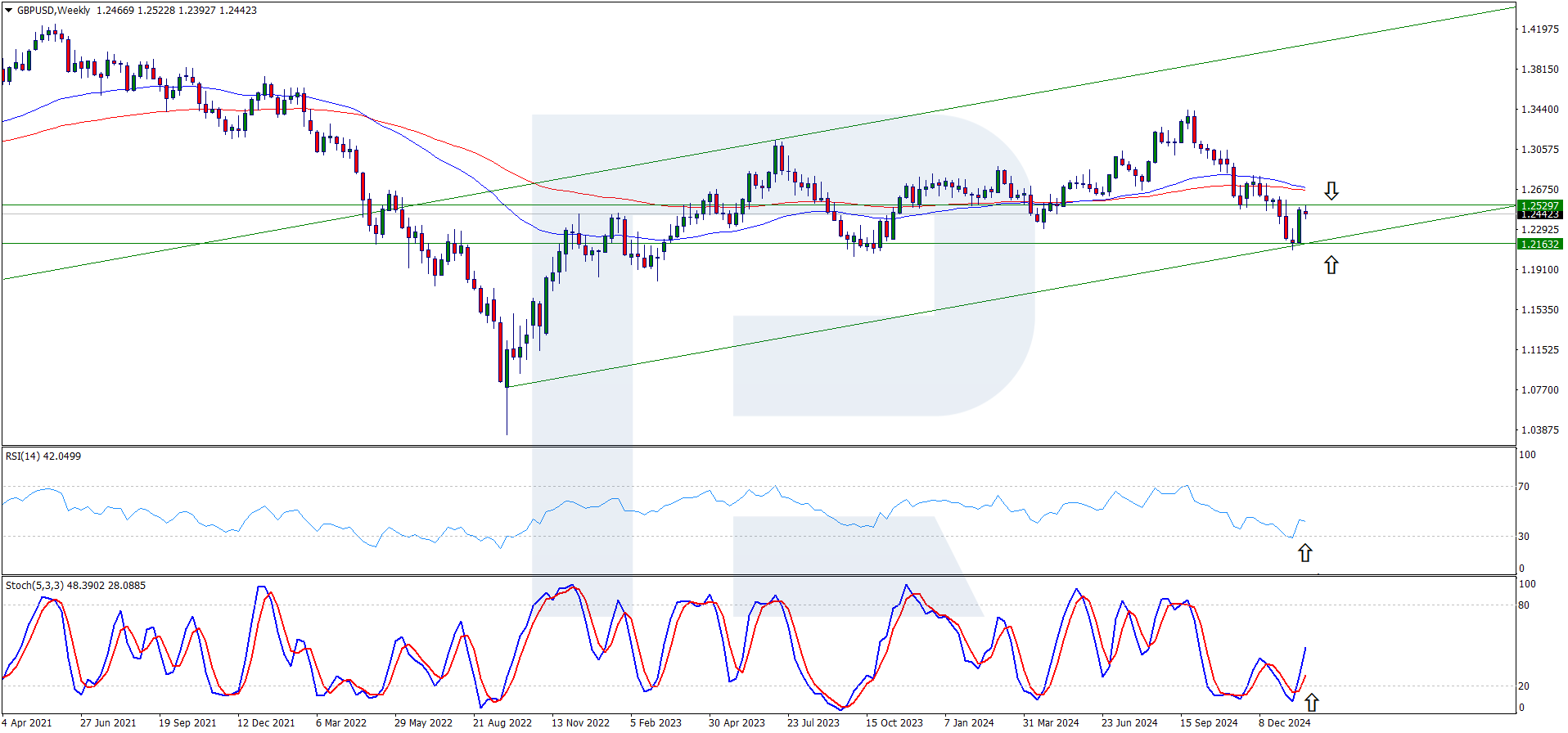

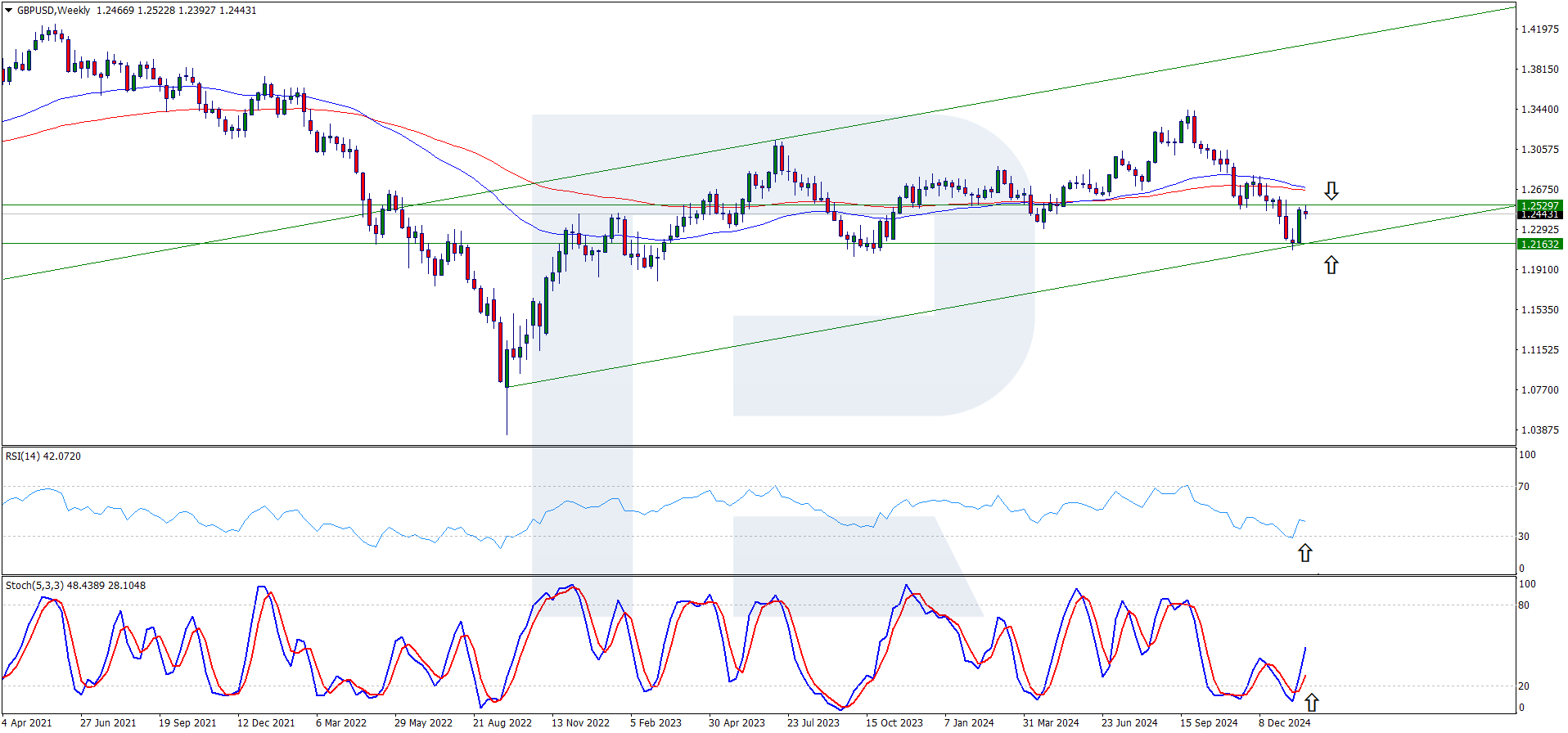

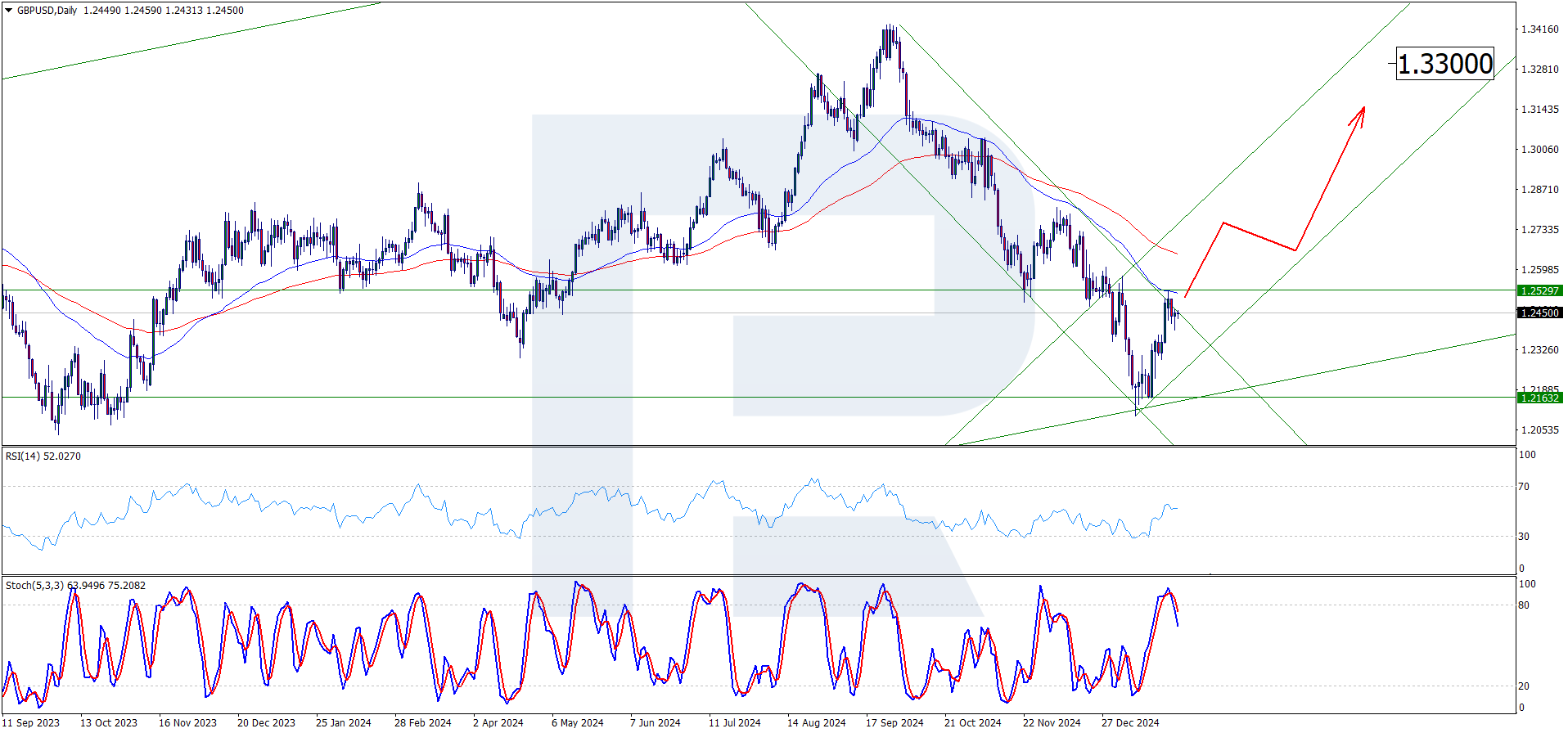

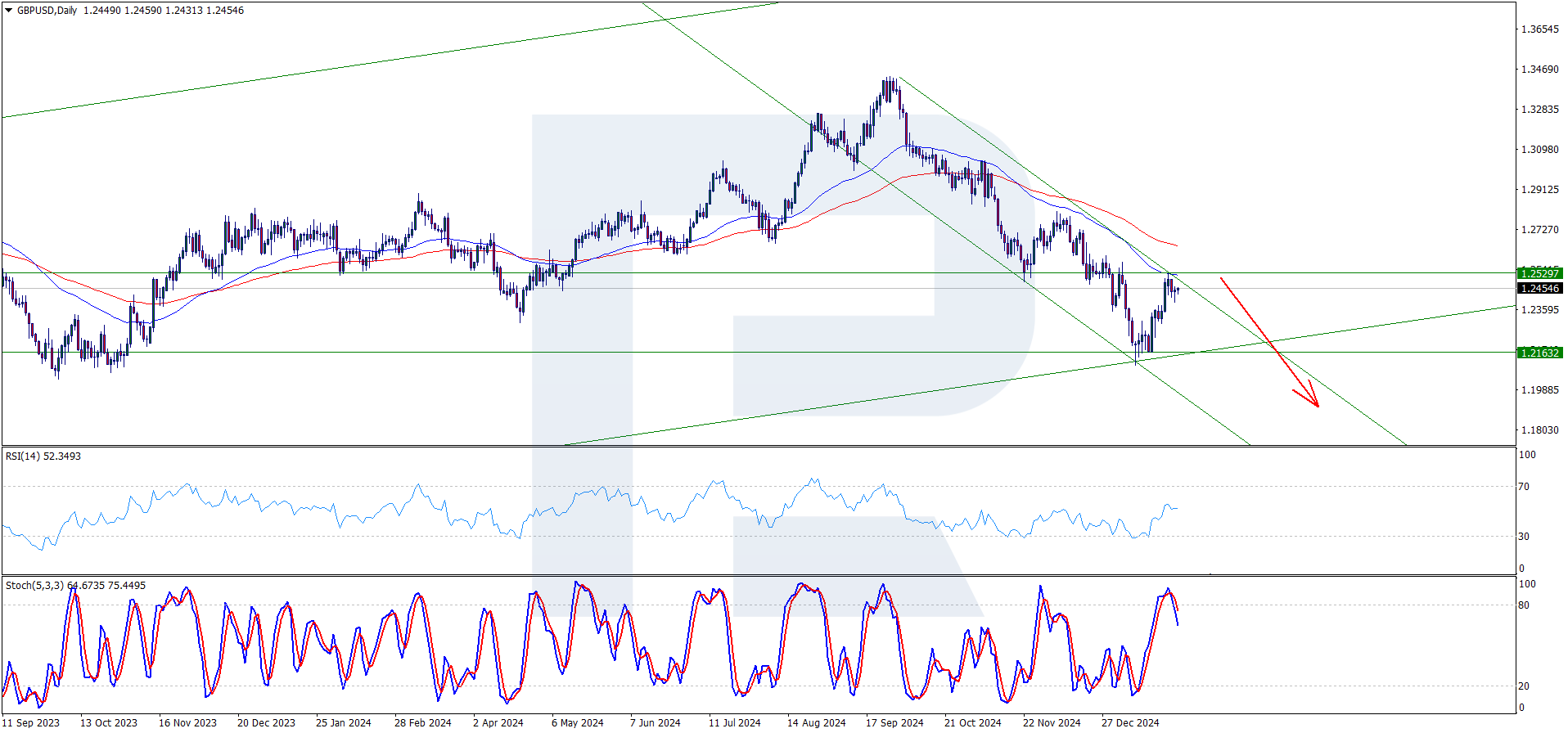

As of the time of writing (January 2025), the GBPUSD exchange rate stands at approximately 1.2400. After the decline that began in September 2024, the pound is attempting to form a correction wave. The key factors influencing the current exchange rate include the Bank of England’s interest rate decisions and UK macroeconomic data, which indicate inflation stabilization.

When forecasting for 2025, it is also essential to consider the potential changes in U.S. and UK interest rates. If economic conditions favor the pound, there is a strong likelihood of a trend reversal that is clearly visible on the daily timeframe. Meanwhile, on the weekly chart, price movement appears as a correction wave within an overall uptrend. Based on this, a preliminary conclusion can be drawn: if a reversal is confirmed, GBPUSD may continue its upward trend toward the 1.3300 - 1.3400 range.

However, it is crucial to consider the other side of the coin. If the UK's economic indicators deteriorate, the British pound may weaken further against the U.S. dollar. In this scenario, GBPUSD could continue declining to its 2022 levels, reaching the 1.1000 area.

Expert GBPUSD forecast 2025-2026

J.P. Morgan

According to Meera Chandan, co-head of Global FX Strategy at J.P. Morgan, the GBPUSD pair could face the following developments in 2025-2026:

Despite the fact that the British pound was the best-performing currency against the U.S. dollar in 2024, a repeat of this strong outperformance seems unlikely in the coming year. Instead, GBP/USD is expected to fall to 1.2100 in the first quarter of 2025, followed by a recovery to 1.3200 by December.

"Overall, the risks to the pound from weaker UK growth and a more dovish Bank of England policy are likely to be offset by relative insulation from tariff risks and still-high yields in 2025. This means the pound will likely struggle but ultimately provide lower returns than in recent years," Chandan added.

RBC

According to an RBC Capital Markets report from December 17, 2024, the Bank of England is expected to begin gradually cutting interest rates in 2025. However, if the UK’s economic situation worsens, there is a high probability of a weaker pound.

RBC also highlights that the British pound remains overvalued based on the Real Effective Exchange Rate (REER), making it vulnerable to further depreciation.

Thus, RBC Capital Markets and other analysts suggest a possible decline in the pound against the U.S. dollar in 2025-2026, though exact exchange rate levels remain uncertain and will depend on the economic developments in the UK and globally.

Morgan Stanley

According to Morgan Stanley forecasts, the GBP/USD exchange rate is expected to undergo the following changes in 2025 and 2026:

- By the end of 2025, the pound is expected to strengthen to 1.34 against the U.S. dollar. This is attributed to the expected weakening of the dollar as the Federal Reserve lowers interest rates

- By the end of 2026, the GBPUSD rate is forecasted to decline to 1.20 due to a stronger U.S. dollar and potential economic shifts in the UK

Goldman Sachs

Goldman Sachs analysts believe that GBPUSD will remain within the 1.28–1.32 range until the end of 2026. However, a sharper rise is possible if the UK’s macroeconomic conditions improve.

In November 2024, Goldman Sachs noted that the global economy remains influenced by a strong U.S. dollar. The dollar is expected to maintain its strength in 2025, which could limit GBP/USD growth.

In June 2024, Goldman Sachs raised its UK economic growth forecasts for 2025 and 2026 by 0.1 percentage points, respectively. While specific figures were not provided, this improvement in economic prospects could positively impact the British pound's exchange rate.

GBPUSD forecast from AI 2025-2026

Panda Forecast

In the near future, investors may expect GBP to benefit from economic optimism, while USD could face challenges due to market uncertainty and external geopolitical factors. As a result, GBP may strengthen against a weaker USD, though fluctuations are likely as geopolitical and economic dynamics evolve.

- Forecast for 2025: According to Panda Forecast AI, GBPUSD may reach 1.1400 by mid-2025 and end the year at 1.2400. The growth will be primarily driven by sustained economic development in the UK and easing inflationary pressures

- Forecast for 2026: According to Panda Forecast AI, GBPUSD may rise to 1.3800 by mid-2026 and end the year at 1.3900

Long Forecast

The Long Forecast predicts that in the near future, the British pound may lose ground against the U.S. dollar. The GBPUSD exchange rate in 2025-2026 will depend on economic and geopolitical factors.

- Forecast for 2025: According to Long Forecast AI, GBPUSD could reach 1.2200 by mid-2025 and end the year at 1.2000

- Forecast for 2026: GBPUSD could reach 1.2000 by mid-2026 and end the year at 1.1800

Wallet Investor

According to Wallet Investor AI forecast, the British pound may experience a decline against the U.S. dollar in 2025-2026. While the drop may not be critical, GBPUSD is likely to remain in the 1.1900-1.2200 range.

- Forecast for 2025: GBPUSD may reach 1.2200 by mid-2025 and end the year at 1.1900

- Forecast for 2026: GBPUSD may reach 1.1900 by mid-2026 and end the year at 1.1700

Each AI model presents a different outlook, with Panda Forecast predicting significant growth, while Long Forecast and Wallet Investor anticipate moderate declines. The actual GBPUSD trend will depend on macroeconomic indicators, interest rate policies, and geopolitical events.

Conclusion

The GBPUSD forecast for 2025-2026 appears moderately optimistic, with expectations of growth if favorable economic conditions persist. Investors should consider key risks and factors affecting the pair’s dynamics, including monetary policy, inflation, and global economic trends.

Despite diverging opinions among various analyst agencies regarding GBPUSD’s trajectory in 2025-2026, the exchange rate is likely to fluctuate within the 1.10 - 1.37 range.

FAQ

The current USDJPY price you can find in the GBPUSD live price chart.

According to analysts, GBPUSD has optimistic prospects for 2025. After a correction, the pair may resume its upward movement toward 1.37 USD.

GBPUSD may decline in the first half of 2025, but the British pound could recover lost positions later, potentially continuing its upward trend. The actual GBPUSD exchange rate will depend on the economic conditions in the UK and the U.S..