GBPUSD forecast: USD remains under pressure

The GBPUSD rate has risen for the fourth consecutive trading session, remaining below the resistance level at 1.3340. Read more in our analysis for today - 23 September 2024.

GBPUSD forecast: key trading points

- UK Retail Sales rose by 1% in August 2024, beating economists' forecasts

- GfK's UK Consumer Confidence Index fell sharply to -20, the lowest in 6 months

- GfK's Major Purchase Index fell to -23, indicating a decline in UK consumer confidence

- GBPUSD forecast for 23 September 2024: 1.3404 and 1.3555

Fundamental analysis

The GBPUSD rate strengthened slightly on Monday after last week's volatile fluctuations. On Wednesday, the US Federal Reserve lowered the interest rate by 50 basis points, the first cut in the last four years. The Fed justified its decision with confidence in the return of inflation to the 2% target and growing risks in the labour market. However, the head of the Fed, Jerome Powell, emphasised that the regulator will not hurry with further easing of monetary policy. Today, investors are focused on the US manufacturing and services business activity index.

Meanwhile, UK retail sales rose 1.0% in August 2024 from the previous month, significantly beating analysts' expectations of 0.4%. Food shops recorded a 1.8% increase, while non-food shops recorded a 0.6% rise. Online sales remained unchanged. On a year-on-year basis, retail sales rose by 2.5%, the highest since February 2022. In today's GBPUSD forecast, such data may support further growth.

A negative factor for the pound was a sharp drop in the UK's GfK Consumer Confidence Index. It dropped to -20 points in September 2024, reaching the lowest level in the last six months. The Major Purchase Index, which reflects consumer confidence, fell by 10 points to -23. These indicators are important signals of economic dynamics and suggest unfavourable prospects despite the stabilisation of inflation.

GBPUSD technical analysis

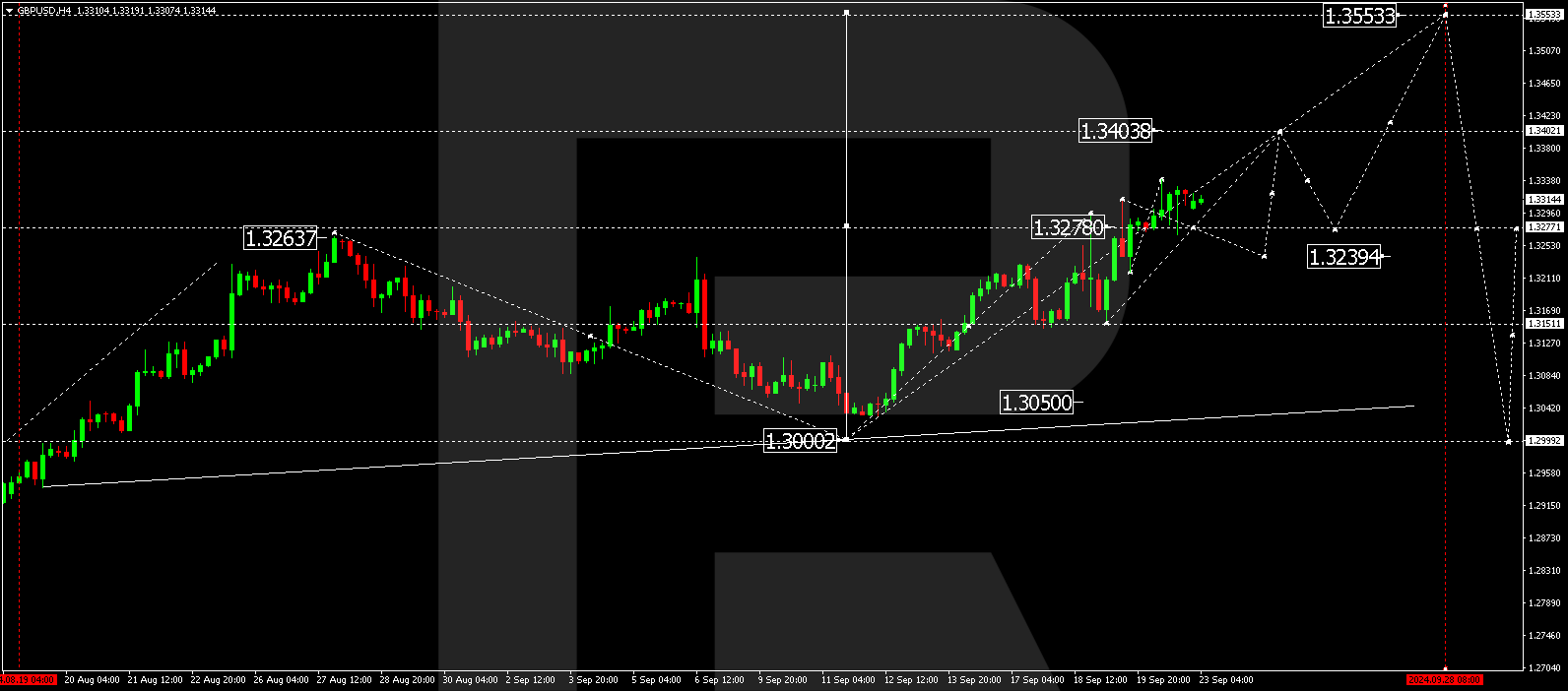

On the H4 chart of GBPUSD, the market has formed a consolidation range around 1.3278. Currently, the range is extended downwards to the level of 1.3222 and upwards to the level of 1.3333. Today, 23 September 2024, we expect an upward exit from this range. The 1.3333 level has been breached and can be considered a signal for continuing the wave to 1.3404. The target is local. After reaching this level, we will consider the probability of a correction to 1.3278 (test from above). In the future, a growth wave towards 1.3555 will not be excluded.

Summary

Despite the positive UK retail sales data, falling consumer sentiment indicates potential risks for the UK economy, which may limit further GBPUSD growth. Technical indicators for today's GBPUSD outlook suggest considering the probability of GBPUSD rising towards 1.3404 and 1.3555.