GBPUSD has stabilised: traders await the Fed’s decision and signals from the Bank of England

The GBPUSD rate is correcting after rebounding from the 1.2615 support level. Find out more in our analysis for 16 December 2024.

GBPUSD forecast: key trading points

- The US dollar is losing ground ahead of the Federal Reserve’s decision, with the market estimating the likelihood of a 25-basis-point interest rate cut at 97.1%

- Weak economic data from the UK are fuelling expectations of an earlier Bank of England rate cut in 2025

- Bank of England Governor Andrew Bailey has signalled a cautious approach to easing, suggesting a gradual interest rate reduction next year

- GBPUSD forecast for 16 December 2024: 1.2570

Fundamental analysis

The GBPUSD rate is rising after tumbling for three consecutive trading sessions. The US dollar is losing ground ahead of the Federal Reserve’s decision. The regulator is expected to lower the interest rate by 25 basis points on Wednesday. However, traders will primarily focus on statements and forecasts by Federal Reserve Chair Jerome Powell.

The markets expect the US regulator to adopt a moderate pace of monetary policy easing in 2025. The likelihood of a quarter-percentage-point rate cut is currently estimated at 97.1%. However, traders are revising their expectations, suggesting that the Fed will refrain from further cuts in January.

Meanwhile, weak economic data from the UK are fuelling expectations of an earlier Bank of England rate cut in the coming year, which, according to today’s GBPUSD forecast, could strengthen the US dollar’s position. The market does not expect the regulator to change the rate at the upcoming meeting. Bank of England Governor Andrew Bailey has advocated a cautious approach to monetary policy easing, signalling gradual interest rate cuts in 2025.

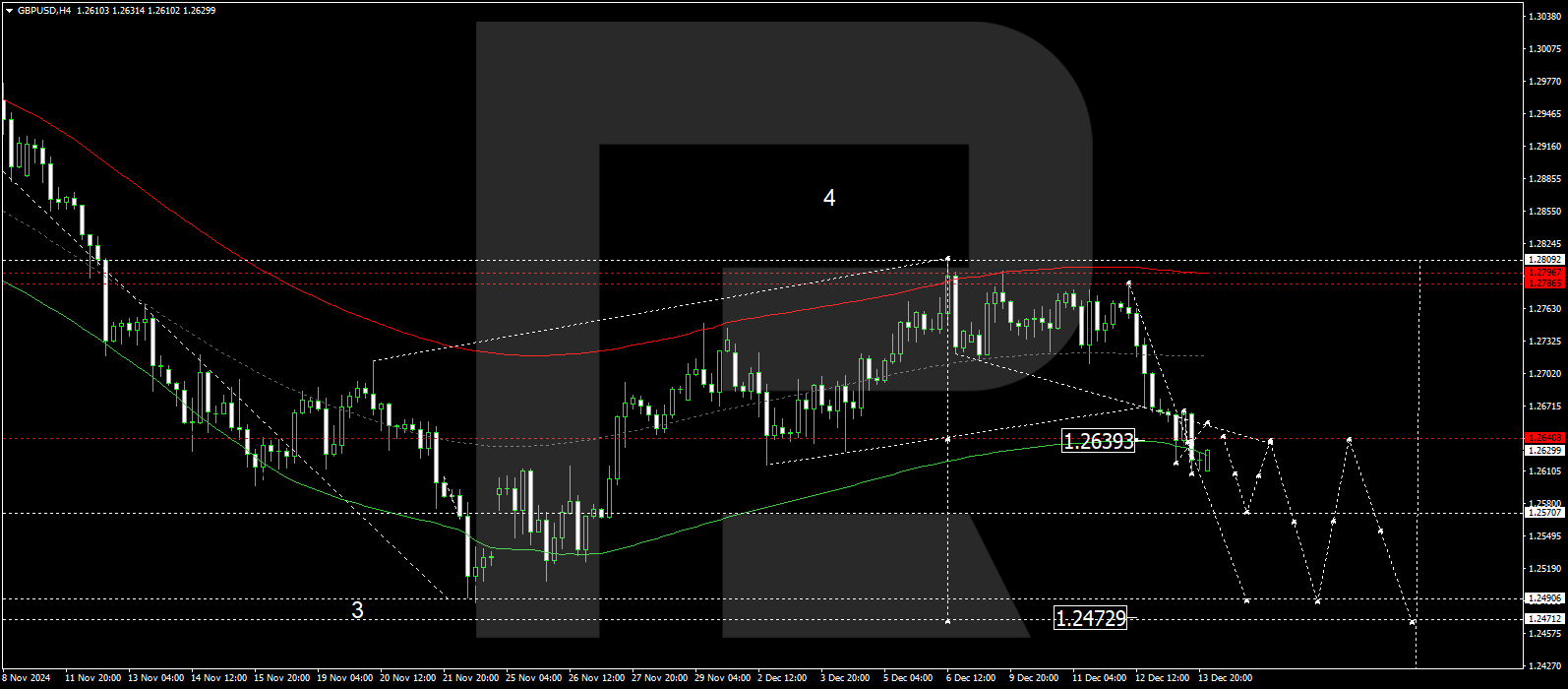

GBPUSD technical analysis

The GBPUSD H4 chart shows that the market has completed a downward wave, reaching 1.2608. A consolidation range could form above it today, 16 December 2024. If the price breaks below the range, the wave may continue towards 1.2570 and potentially further towards 1.2490. An upward breakout could lead to a correction towards 1.2656. Subsequently, the price is expected to fall to 1.2570.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2640, technically support this scenario for the GBPUSD rate. The market has declined to the lower boundary of a price envelope at 1.2607. A new consolidation range is expected to develop above this level. With a breakout below the range, the downward wave could continue to the local target of 1.2490.

Summary

The GBPUSD rate has stabilised due to holding the crucial support level at 1.2615. Traders expect a Fed interest rate cut this week, while the Bank of England will ease monetary policy cautiously, with rate cuts likely only in early 2025. Technical indicators for today’s GBPUS forecast suggest that the downward wave could continue towards the 1.2570 level.