The GBPUSD pair has climbed to 1.3290, up 6% against the US dollar since the start of the year. Discover more in our analysis for 16 April 2025.

GBPUSD forecast: key trading points

- The GBPUSD pair is rising steadily with the potential to reach new highs

- The UK is less vulnerable to US tariffs than other regions, but risks may weigh on the pound too

- GBPUSD forecast for 16 April 2025: 1.3290

Fundamental analysis

The GBPUSD rate has surged to 1.3290. Although overall market volatility is easing, this has had a neutral effect on the pound.

Recent labour data from the UK showed signs of weakness ahead of an April hike in employer taxes. However, wage growth remains strong, complicating matters for the Bank of England. Markets are currently pricing in a 90% likelihood of a 25-basis-point rate cut in May, with two more cuts expected later in 2025.

If real wages continue to rise and consumer purchasing power strengthens, the BoE may become more cautious. For now, the central bank maintains a soft monetary policy stance for 2025, and no major signals suggest a reversal.

While the UK is less exposed to US tariffs than China or the EU, the growing risk of a global recession continues to weigh on investor sentiment.

The GBPUSD forecast is positive.

GBPUSD technical analysis

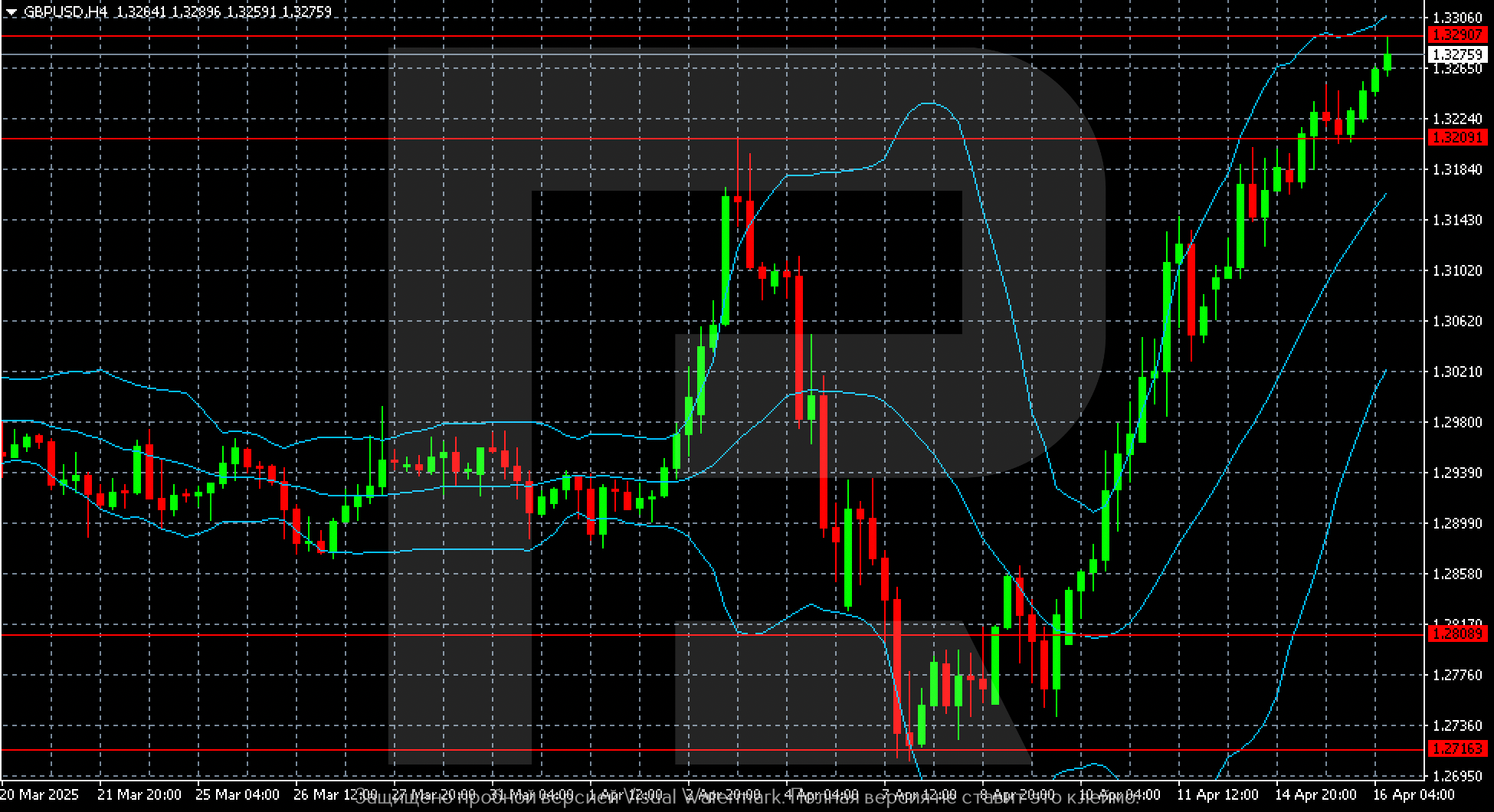

The GBPUSD H4 chart confirms the potential for the current bullish wave to extend towards 1.3290. After reaching this level, the price could consolidate within the 1.3209-1.3290 range.

Summary

The GBPUSD pair remains in a strong uptrend, gaining 6% since the start of the year. The GBPUSD outlook for today, 16 April 2025, suggests further bullish momentum, with the pair targeting 1.3290.