Ahead of the Federal Reserve’s interest rate decision, the pound continues to strengthen against the USD, with the GBPUSD rate possibly reaching 1.3570. Discover more in our analysis for 13 August 2025.

GBPUSD forecast: key trading points

- Average wage growth in the UK remains at a high level

- Anticipation of a Fed interest rate change is putting pressure on the USD

- GBPUSD forecast for 13 August 2025: 1.3570 and 1.3445

Fundamental analysis

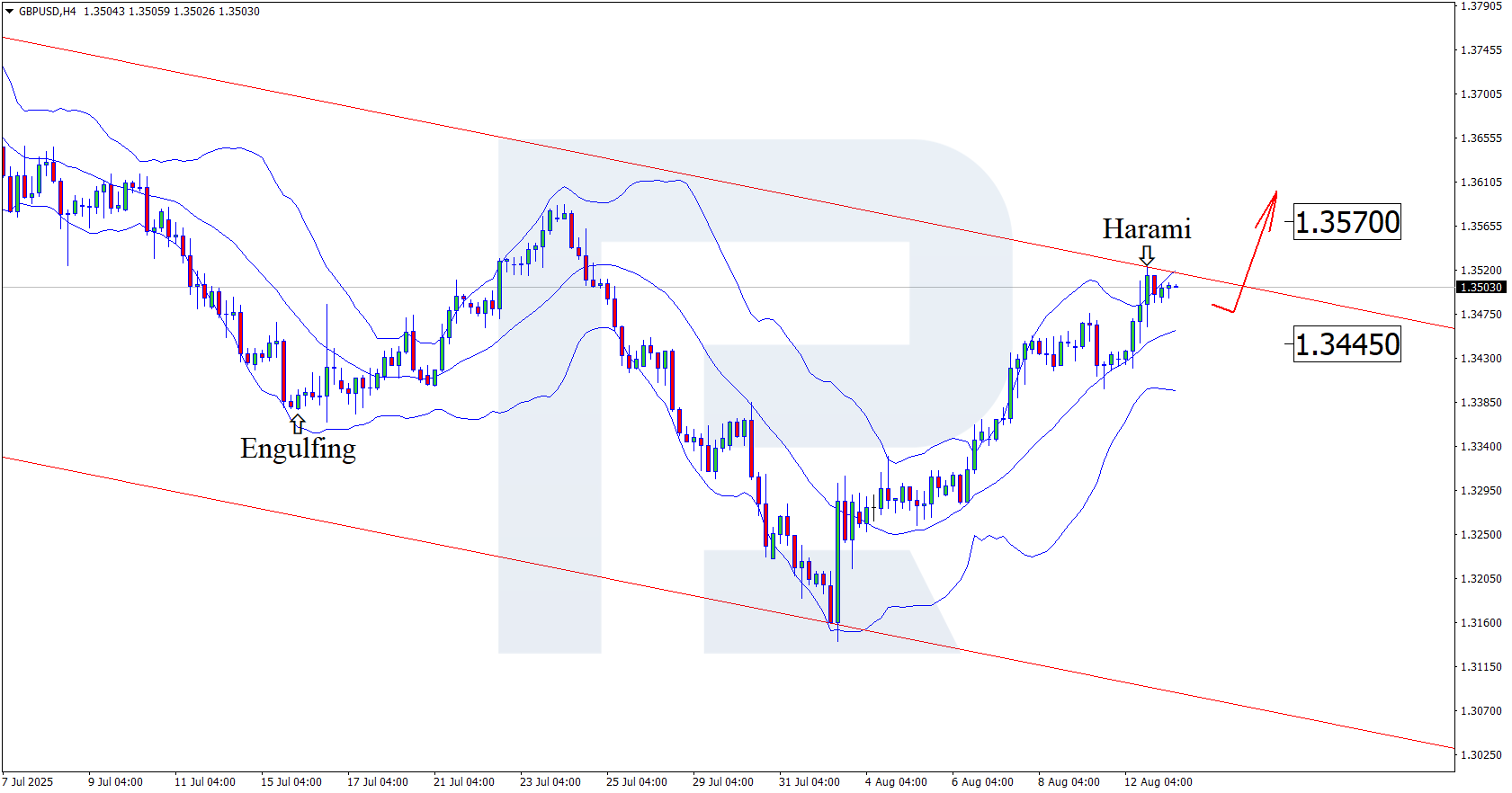

The forecast for 13 August 2025 takes into account that the GBPUSD pair continues its upward trajectory and is near the resistance line of the descending channel.

After softer US inflation data and expectations of a rate change in September, the British currency continues to strengthen against the USD. The pair is trading around 1.3505, with the pound supported by the weak dollar and investor caution over its near-term outlook.

Today’s GBPUSD forecast also considers that average wage growth in the UK remains high despite a fragile labour market. Against this backdrop, the Bank of England takes a cautious stance on interest rate changes, which in turn supports the pound against other currencies.

Despite moderate and partly predictable US inflation, investors still expect a Fed rate cut in September, which continues to weigh on the USD and pushes the GBPUSD rate upwards.

GBPUSD technical analysis

Having tested the upper Bollinger Band, GBPUSD formed a Harami reversal pattern on the H4 chart. At this stage, the pair may develop a corrective wave following the signal from the pattern. Given that the price remains within a descending channel, the corrective wave could extend further.

The target for the pullback is currently at 1.3445. A rebound from the support level could open the way for a stronger upward movement.

The GBPUSD forecast also considers an alternative scenario, where the price rises to 1.3570 without a correction.

Summary

The market is awaiting the Federal Reserve’s decision, while GBPUSD technical analysis suggests a correction towards the 1.3445 support level before further growth.

Open Account