The GBPUSD pair has risen for four consecutive trading days, improving market sentiment. Find out more in our analysis dated 12 August 2024.

GBPUSD trading key points

- The GBPUSD pair is regaining ground

- The pace of monetary policy easing by the Bank of England will remain moderate

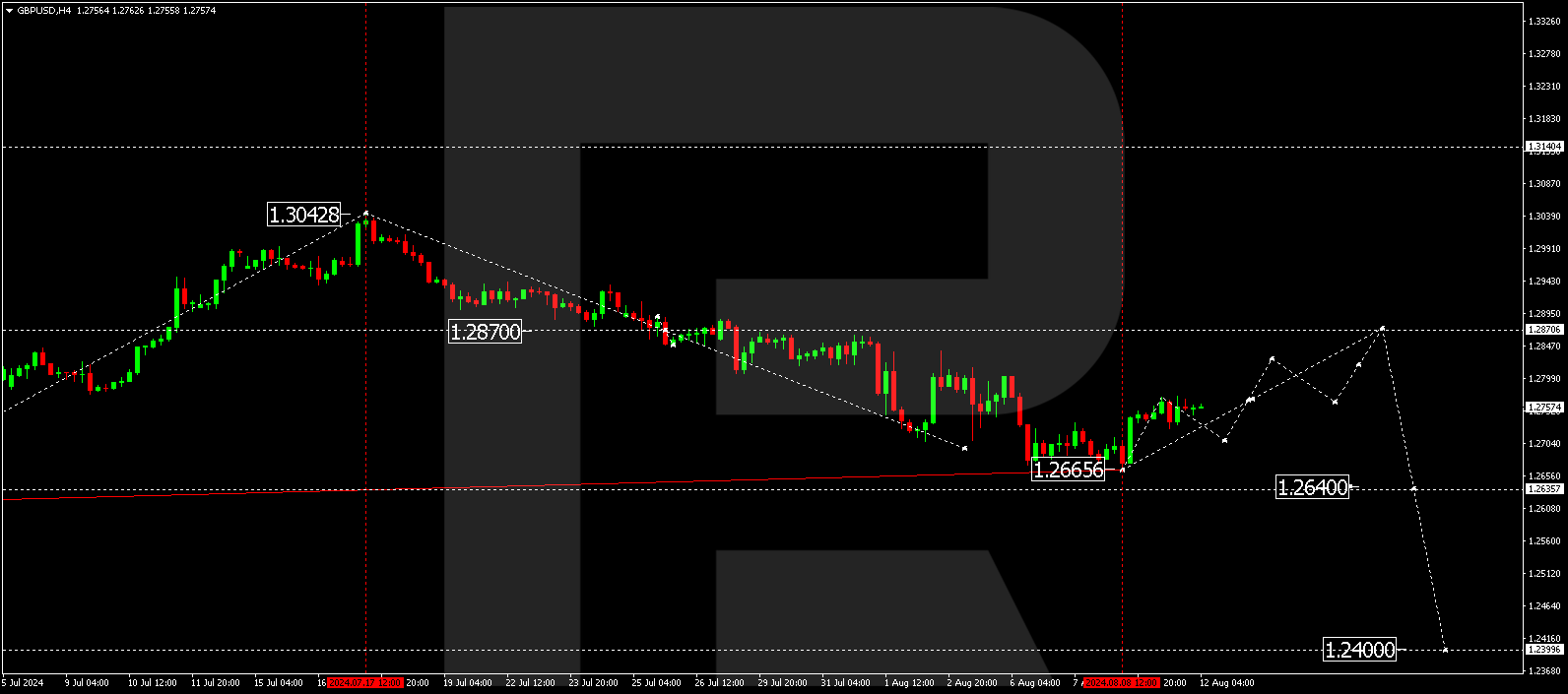

- GBPUSD forecast for 12 August 2024: 1.2870, 1.2640, and 1.2400

Fundamental analysis

The GBPUSD rate rose to 1.2766 on Monday. The market continues its recovery from the local low reached last week.

Investors are assessing the likelihood of a Bank of England interest rate cut soon. Due to the specific nature of UK inflation, the pace of monetary policy easing might be half that of the Federal Reserve.

The BoE will likely announce a 100-billion-pound (127 billion USD) asset reduction in its balance sheet over the 12 months from October 2024 to September 2025. This represents a very gradual pace of winding down stimulus. If the volume is reduced by 100 billion pounds, debt sales will amount to less than 13 billion. The balance sheet reduction will take considerable time.

This confirms that the Bank of England will not rush to ease monetary conditions and will keep a comfortable pace.

GBPUSD technical analysis

Analysis for 12 August 2024 indicates that the GBPUSD pair has completed its first downward wave, reaching 1.2666. The market then rose to 1.2771. A consolidation range is expected to develop above this level today. If there is an upward breakout, a correction could extend to 1.2870. Once the correction is complete, a new downward wave might begin, aiming for 1.2640. A breakout below this level would open the potential for a wave towards the local target of 1.2400, aligning with the trend.

Summary

The GBPUSD pair is recovering steadily. However, technical indicators in today’s GBPUSD forecast suggest a correction towards 1.2870, followed by a potential decline in the GBPUSD rate to the 1.2640 and 1.2400 levels.