GBPUSD: the British pound continues to strengthen

Amid the Fed chair’s speech, the GBPUSD forecast for today appears rather optimistic for the pound, with the price likely to continue its ascent towards 1.2550. Discover more in our analysis for 12 February 2025.

GBPUSD forecast: key trading points

- US Consumer Price Index (CPI): previously at 2.9%, projected at 2.9%

- US Federal Reserve Chairman Jerome Powell’s speech

- GBPUSD forecast for 12 February 2025: 1.2550 and 1.2391

Fundamental analysis

The US CPI reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A higher-than-forecast reading typically has a positive effect on the USD. A weaker-than-expected reading could push the GBPUSD rate up.

The forecast for 12 February 2025 suggests that in January 2025, the CPI could remain unchanged from the previous reading of 2.9%. The CPI reading is projected at 2.9%.

Fundamental analysis for 12 February 2025 takes into account that US Federal Reserve Chairman Jerome Powell will speak today. Amid the current economic uncertainty, his speech could provide insight into the future monetary policy direction.

It is worth paying special attention to Powell’s comments on inflation, the labour market, and possible interest rate changes. His speech could provide key signals on how the Federal Reserve plans to respond to current economic challenges and manage inflation risks in the future.

Markets may react to his comments with increased volatility, especially if his comments differ from investor expectations.

Today’s speech by Jerome Powell is a crucial event that could significantly impact financial markets and economic expectations.

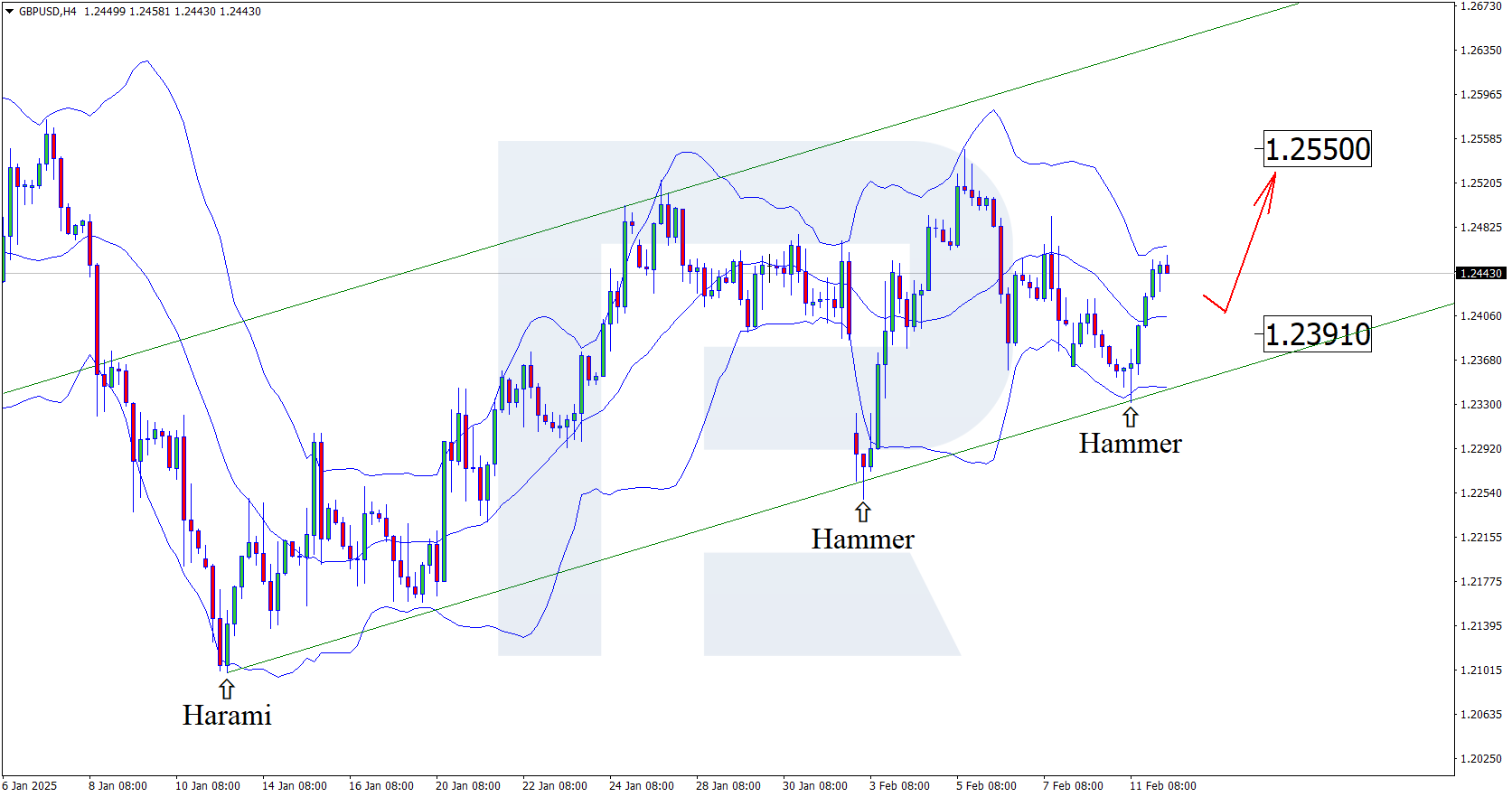

GBPUSD technical analysis

Having tested the lower Bollinger band, the GBPUSD price has formed a Hammer reversal pattern on the H4 chart. At this stage, it maintains its upward momentum following the signal received. Since the quotes remain within the ascending channel and given the upcoming release of US fundamental data, a growth wave is expected to develop to 1.2550, with the quotes breaking above it and maintaining their upward trajectory.

The upside target is the 1.2550 resistance level. A breakout above this level could pave the way for a more substantial upward movement.

The GBPUSD forecast also takes into account an alternative scenario, where the price pulls back to 1.2391 before continuing its upward momentum.

Summary

Along with the GBPUSD technical analysis, Powell’s speech suggests further growth to the 1.2550 resistance level.