GBPUSD: UK economic growth may support the pound

The GBPUSD rate is attempting to rise for the second consecutive session. Find out more in our analysis for 14 October 2024.

GBPUSD forecast: key trading points

- The UK’s trade deficit reduced to 0.96 billion GBP in August 2024, the lowest level since February

- Although the UK economy shows growth in Q3, the pace has slowed compared to the beginning of the year

- The UK industrial output increased by 0.5% in August 2024, exceeding forecasts and offsetting the previous decline

- GBPUSD forecast for 14 October 2024: 1.2960

Fundamental analysis

The GBPUSD rate is trading near the crucial 1.3035 support level, with pressure from sellers easing. However, investors expect more decisive actions from the Bank of England to cut interest rates. These expectations rose following a statement from the regulator’s chief, Andrew Bailey, who allowed for a potential cut if inflationary pressures continue to ease. Traders forecast two more BoE interest rate cuts in 2024, which may support the US dollar as part of today’s GBPUSD forecast.

Recent data shows that the UK trade deficit decreased to 0.96 billion GBP in August 2024 from the revised 4.71 billion GBP in July, marking the lowest deficit since February.

Meanwhile, UK GDP rose by 0.2% in August, aligning with market expectations and indicating that the economy is growing in Q3. However, the current economic growth is slower than at the beginning of the year. Industrial production also increased by 0.5% month-on-month in August 2024, recovering from the revised 0.7% decline last month and surpassing market expectations.

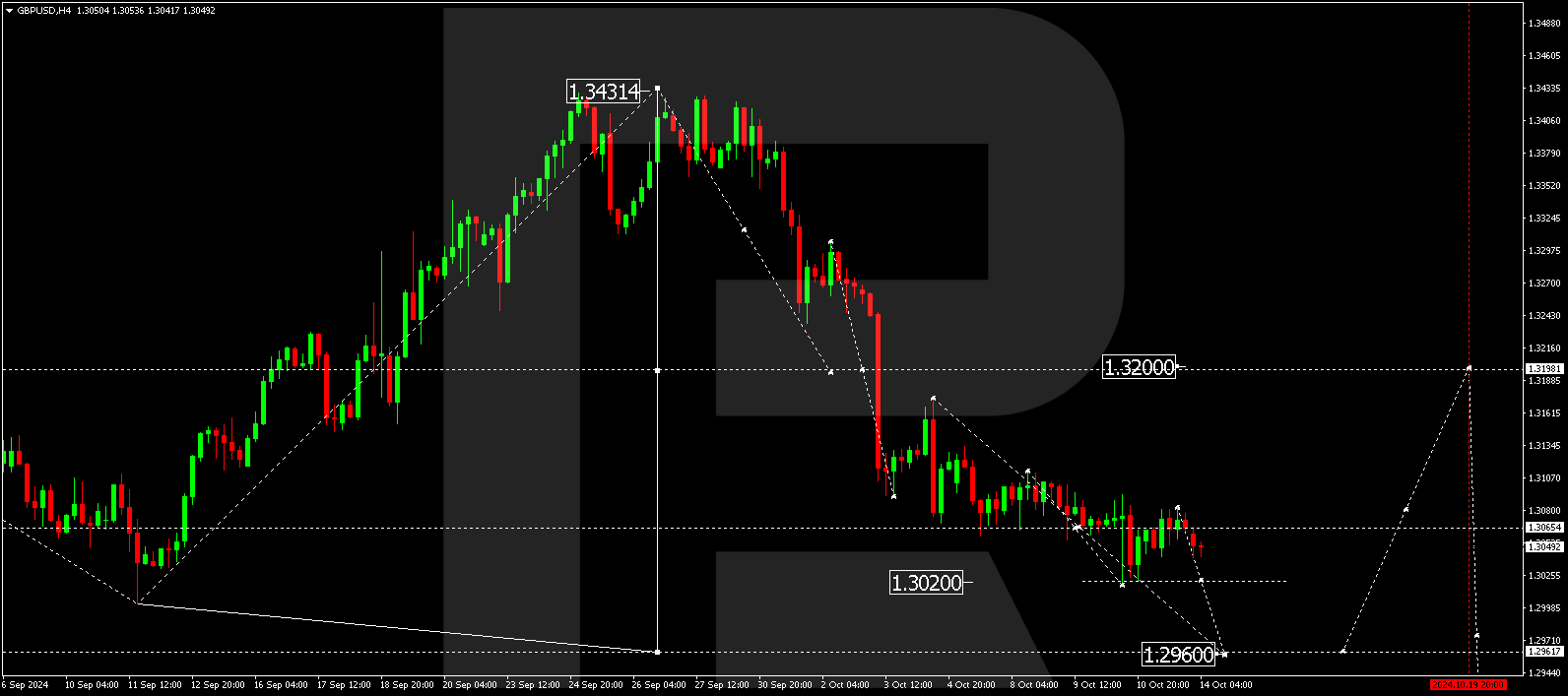

GBPUSD technical analysis

The GBPUSD H4 chart shows that the market has completed a downward wave, reaching 1.3017. A consolidation range is forming above this level today, 14 October 2024. A decline and a breakout below the 1.3017 level will open the potential for a further wave towards 1.2960. Conversely, a rise and a breakout above the 1.3080 level will open the potential for a correction towards 1.3200. Once the correction is complete, the price is expected to fall to 1.2960, the first target, before rising to 1.3200. After the price reaches this level, the next downward wave could start, aiming for 1.2830, the local target.

Summary

The UK’s economic strengthening, including GDP and industrial production growth, creates conditions for a potential rise in the GBPUSD rate. However, further movements of the currency pair will depend on the Bank of England’s actions and traders’ expectations about future interest rate cuts in 2024. Technical indicators in today’s GBPUSD forecast suggest the trend is continuing, with the GBPUSD rate likely to decline to the 1.2960 level.