The GBPUSD pair remains under pressure near 1.3440. Macroeconomic data and lingering trade deal uncertainties with the US weigh on the pound. Discover more in our analysis for 18 June 2025.

GBPUSD forecast: key trading points

- The GBPUSD pair tested May lows and paused

- Investors await UK inflation data for May

- GBPUSD forecast for 18 June 2025: 1.3414

Fundamental analysis

The GBPUSD rate attempts to stabilise near 1.3440 on Wednesday after recent heavy selling.

Markets are keeping a close eye on Middle East tensions while also awaiting May inflation data, due later today, and a possible rate change on Thursday.

The pound remains weighed down by recent data and external factors such as US trade tariffs. Earlier, US President Donald Trump signed a deal easing some tariffs on British goods, confirming quotas and duties on vehicles and eliminating aerospace sector tariffs. However, steel and aluminium issues remain unresolved.

Today’s inflation data in the UK could show a slight decline to 3.4%, which would be a moderately positive signal. Overall, current high inflation is seen as temporary, and a comprehensive US-UK trade agreement could help reduce associated risks.

The GBPUSD forecast is negative.

GBPUSD technical analysis

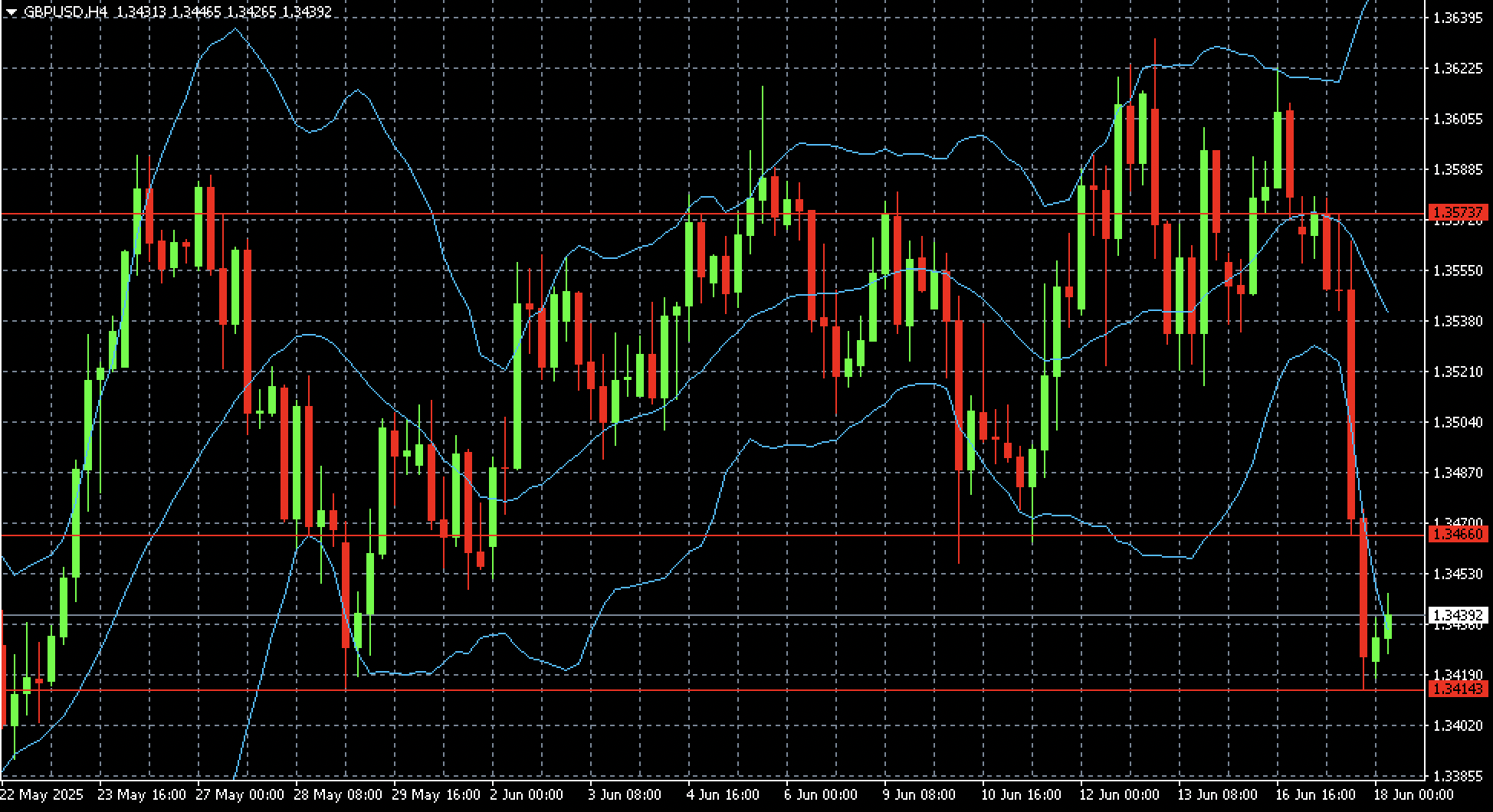

On the H4 chart, GBPUSD shows potential to retest the local low at 1.3414.

However, if the market maintains the current rebound momentum, the price could recover towards 1.3466 and then possibly move further up to 1.3573.

Summary

The GBPUSD pair remains weak on Wednesday. The GBPUSD forecast for today, 18 June 2025, suggests renewed selling pressure with a retest of the 1.3414 low.