Gold (XAUUSD) at a crossroads: Bostic’s speech could change everything

FOMC member Raphael W. Bostic’s upcoming speech may trigger a rise in XAUUSD quotes towards 3,290 USD. Find more details in our analysis for 20 May 2025.

XAUUSD forecast: key trading points

- FOMC member Raphael W. Bostic’s speech

- Current trend: moving upwards

- XAUUSD forecast for 20 May 2025: 3,290 and 3,195

Fundamental analysis

As of today, gold (XAUUSD) is trading around 3,215 USD per ounce, showing moderate losses as the US dollar strengthens. However, the downgrade of the US credit rating by Moody’s to Aa1 restrains further declines and supports safe-haven demand for gold.

On 20 May 2025, Federal Reserve Bank of Atlanta President and FOMC member Raphael Bostic will speak at the Financial Markets Conference. His speech is expected to provide key signals about future US monetary policy.

What to watch in Bostic’s remarks:

- Cautious stance on rate cuts: Bostic has previously said he expects only one rate cut in 2025, stressing the need for more time to assess the economic effects of new tariffs

- Inflation concerns: he expressed concern about persistent inflation, especially in the housing sector, noting that despite progress, the 2% inflation target has yet to be achieved

- Economic resilience: Bostic stated that the economy remains resilient, though less so than expected at the start of the year, highlighting considerable uncertainty in the current outlook

Near-term XAUUSD price forecasts suggest a possible correction towards 3,195 USD. However, in the long term, XAUUSD quotes are expected to rise to 3,900 USD by the end of the year.

XAUUSD technical analysis

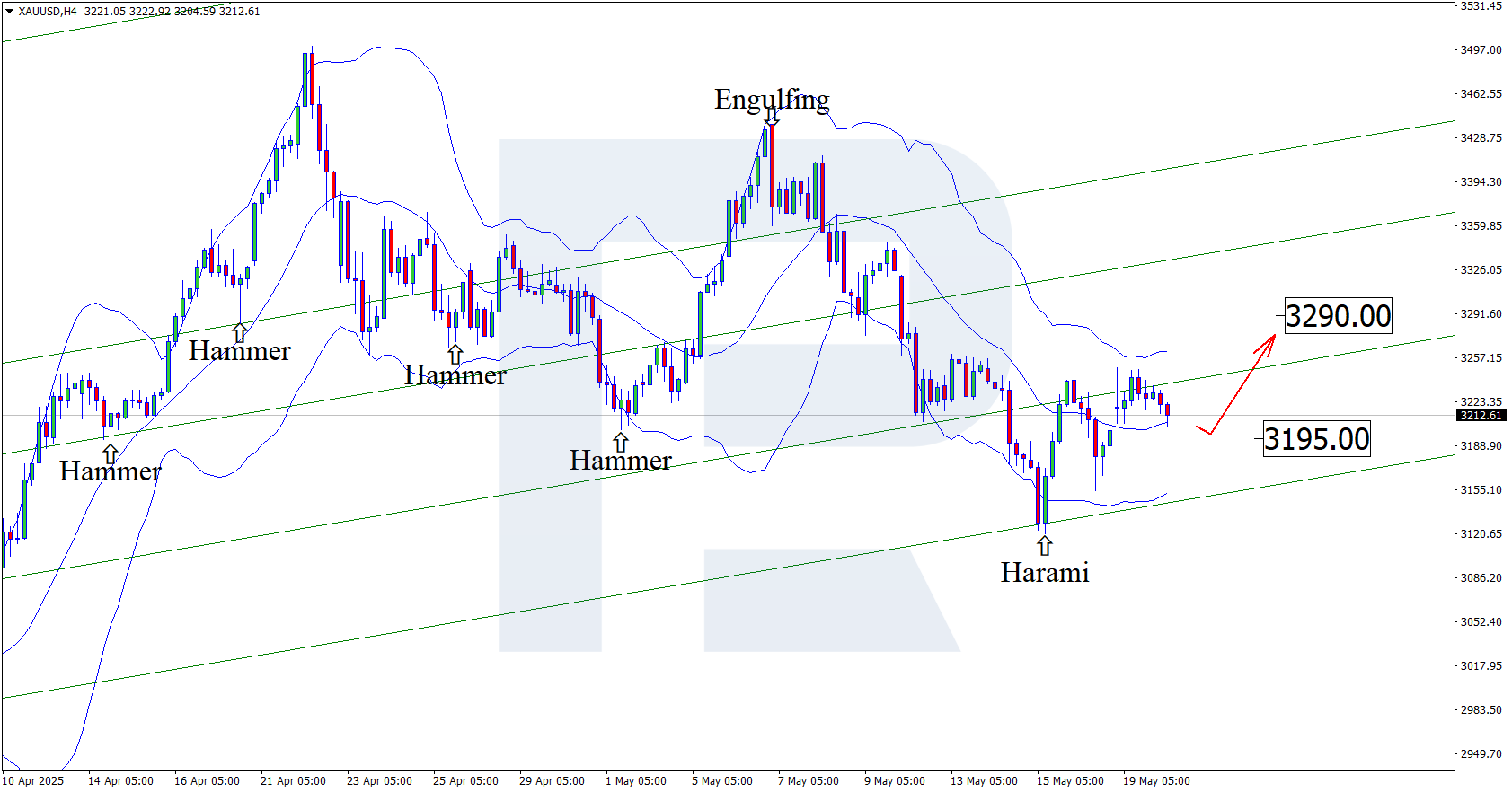

On the H4 chart, XAUUSD prices have formed a Harami reversal pattern near the lower Bollinger Band. They are currently developing an upward wave based on that signal. Since XAUUSD quotes stay within the ascending channel, the bullish trend is expected to develop further. The immediate upside target could be the 3,290 USD resistance level.

At the same time, today’s XAUUSD technical analysis also considers an alternative scenario, with prices correcting towards 3,195 USD before the next upward move.

Once the correction completes, XAUUSD prices could aim for a new all-time high, targeting the 3,900 USD level.

Summary

The US credit rating downgrade, combined with technical analysis, supports a potential XAUUSD rise towards 3,290 USD following a correction.