Gold (XAUUSD) quotes corrected to 3,370 USD on Wednesday, but buyers could return at any moment. Discover more in our analysis for 4 June 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) could resume explosive growth at any time

- The main driver behind high gold prices is escalating global trade tensions

- XAUUSD forecast for 4 June 2025: 3,392

Fundamental analysis

Gold (XAUUSD) prices are hovering around 3,370 USD per troy ounce midweek, supported by rising geopolitical and economic risks, which continue to fuel demand for safe-haven assets.

On Tuesday, the OECD lowered its global growth forecast and highlighted mounting pressure on the US economy due to intensifying trade conflicts. This view was reinforced by weak manufacturing orders data, although the labour market has shown resilience.

New US tariffs on steel and aluminium, announced by President Donald Trump, came into effect on Wednesday. This move added to the strain on global trade relations. Talks between Washington and Beijing remain difficult, with both sides accusing each other of violating a previous trade agreement. Investors are now waiting for a potential meeting between Trump and Xi at the end of the week.

The outlook for Gold (XAUUSD) is positive.

XAUUSD technical analysis

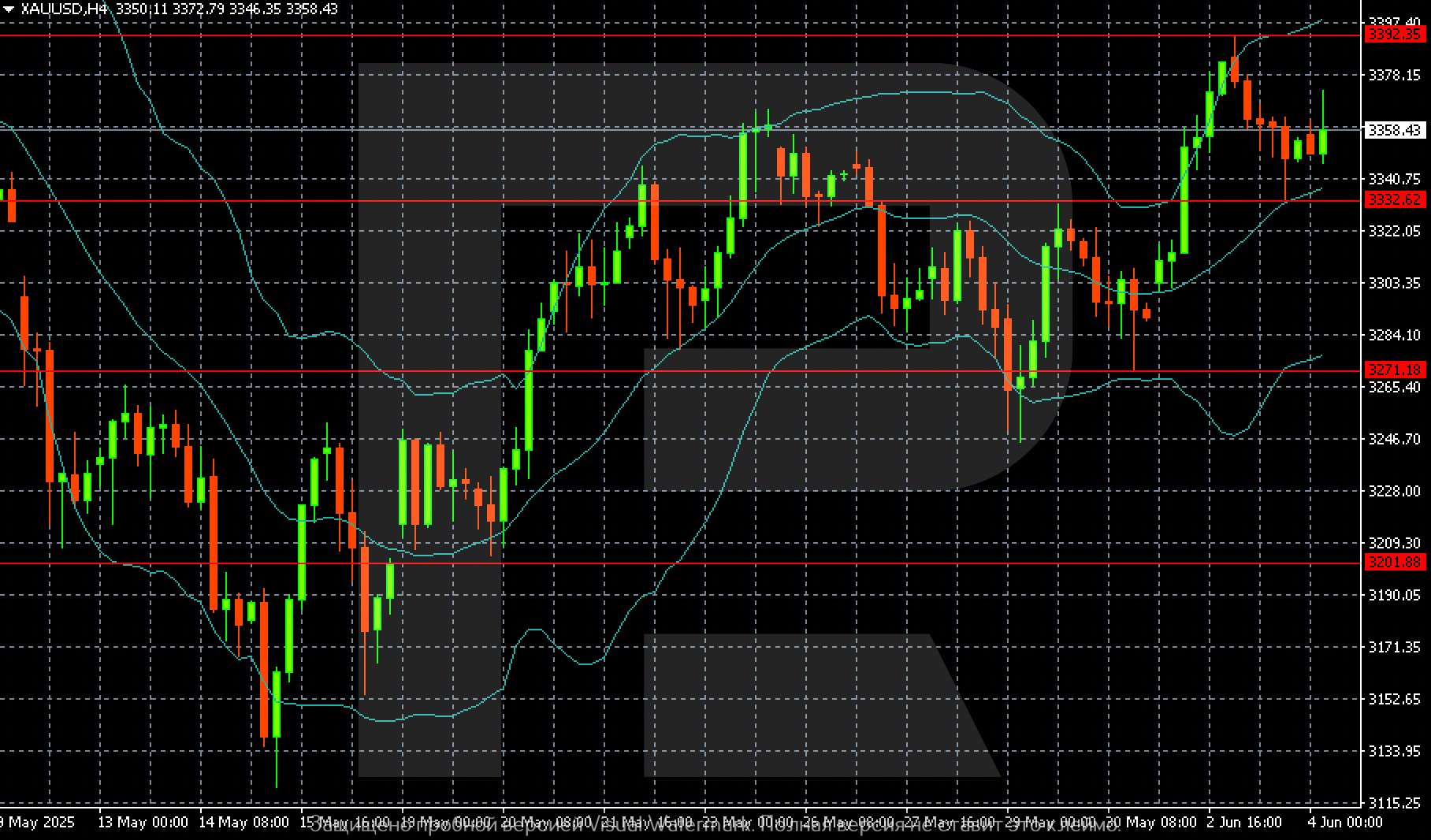

On the Gold (XAUUSD) H4 chart, conditions still support renewed buying interest and growth to 3,392.

Summary

Gold (XAUUSD) prices have pulled back to 3,370 USD per ounce, but buyers may become active again in the near term. The Gold (XAUUSD) forecast for today, 4 June 2025, suggests a potential retest of yesterday’s high at 3,392.