XAUUSD prices continue to correct, falling to the area around 2,730 USD. Once the correction is complete, the pair is expected to maintain its upward trajectory. Discover more in our XAUUSD analysis for today, 4 November 2024.

XAUUSD forecast: key trading points

- Market focus: US labour market statistics were below forecasts

- Current trend: a local correction is underway as part of the uptrend

- XAUUSD forecast for 4 November 2024: 2,730 and 2,758

Fundamental analysis

XAUUSD quotes continue to trade in an uptrend, recently reaching a new all-time high of 2,790 USD. A local correction is underway, after which the rally could continue. Gold prices are bolstered by expectations of further US Federal Reserve interest rate cuts.

According to Friday’s US statistics, job growth slowed sharply in October due to the effects of hurricanes and aerospace workers’ strikes. Nonfarm payrolls rose by only 12,000 jobs, well below the expected 113,000 and following 223,000 in September.

However, the unemployment rate remained unchanged at 4.1%, suggesting that the US labour market is stable and that the weak nonfarm payroll data was attributed to temporary factors (hurricanes and strikes).

XAUUSD technical analysis

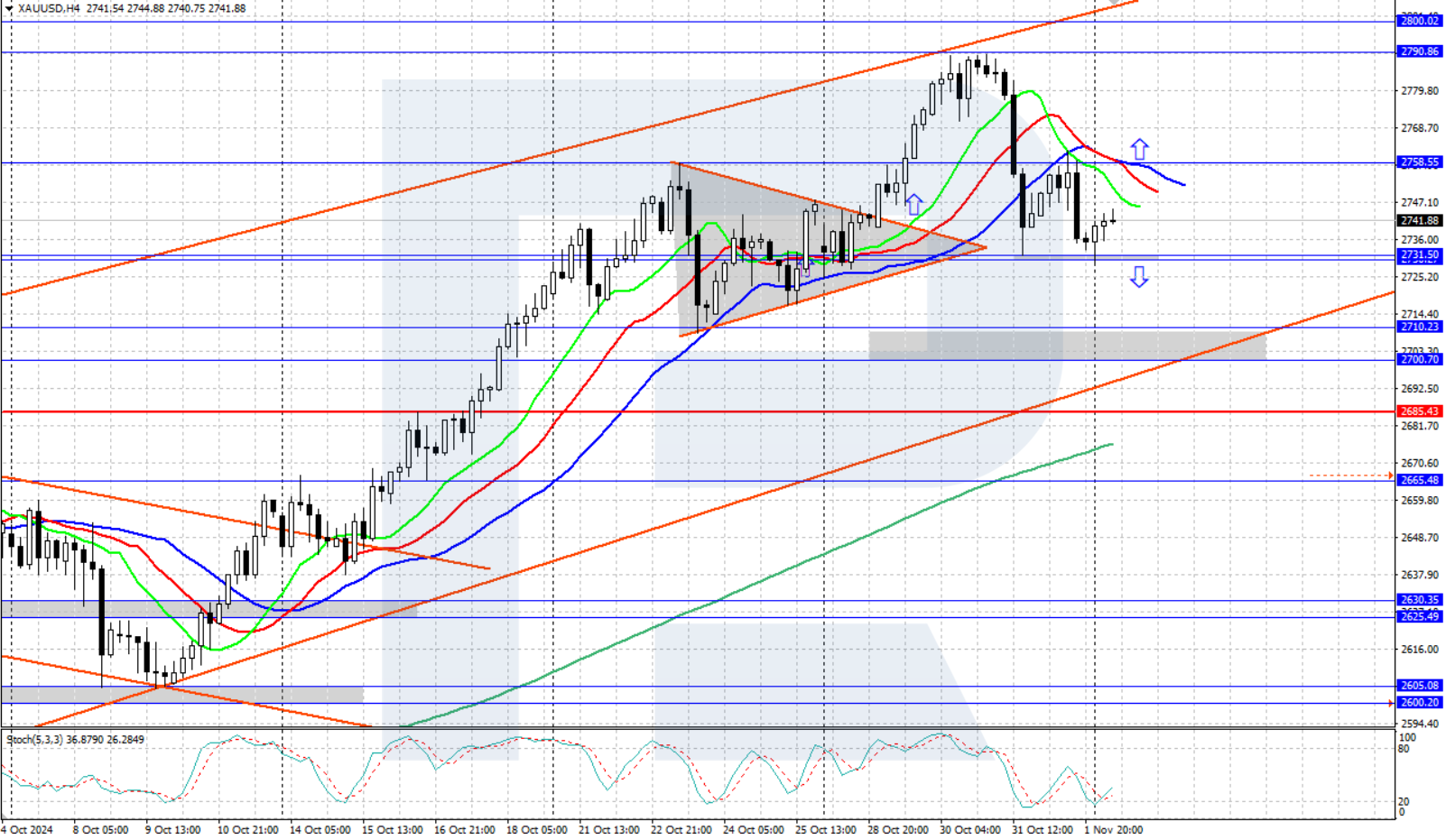

On the H4 chart, the XAUUSD pair continues to correct downwards as part of a strong uptrend. Asset quotes fell to the 2,730-2,731 USD support area during today’s Asian trading session, where they encountered strong demand from buyers and reversed upwards.

The short-term XAUUSD price forecast suggests that prices could correct further towards the 2,700-2,710 USD range if bears push the quotes below the 2,730-2,731 USD support area. Conversely, if bulls seize the initiative and gain a foothold above 2,758 USD, the prices could return to a high of 2,790 USD in the short term.

Summary

XAUUSD quotes continue to correct downwards after reaching a new all-time high of 2,790 USD. The uptrend persists, with the asset expected to resume growth once the correction is complete.