Gold (XAUUSD) prices reached 2,945 USD per troy ounce, with safe-haven assets in demand from the market. Find more details in our analysis for 20 February 2025.

XAUUSD forecast: key trading points

- Gold continues to reach new highs

- The market is interested in safe-haven assets, pushing XAUUSD quotes even higher

- XAUUSD forecast for 20 February 2025: 2,929 and 2,955

Fundamental analysis

Gold (XAUUSD) prices rose to 2,945 USD on Thursday. The market is assessing the minutes of the US Federal Reserve’s January meeting and monitoring external risks. All these factors support the precious metals sector and Gold itself.

The Federal Reserve’s meeting minutes confirmed the need for additional data to corroborate that inflation is steadily declining. Monetary policymakers are clearly concerned that changes in trade policy (for example, higher tariffs) could add to inflationary pressures. The baseline scenario currently suggests just one Fed rate cut in 2025, with one more cut likely only if there are arguments for this.

Gold remains highly attractive as a safe-haven asset amid global uncertainty, including US trade tariffs, geopolitics, and China keeping loan prime rates unchanged.

The Gold (XAUUSD) forecast is optimistic.

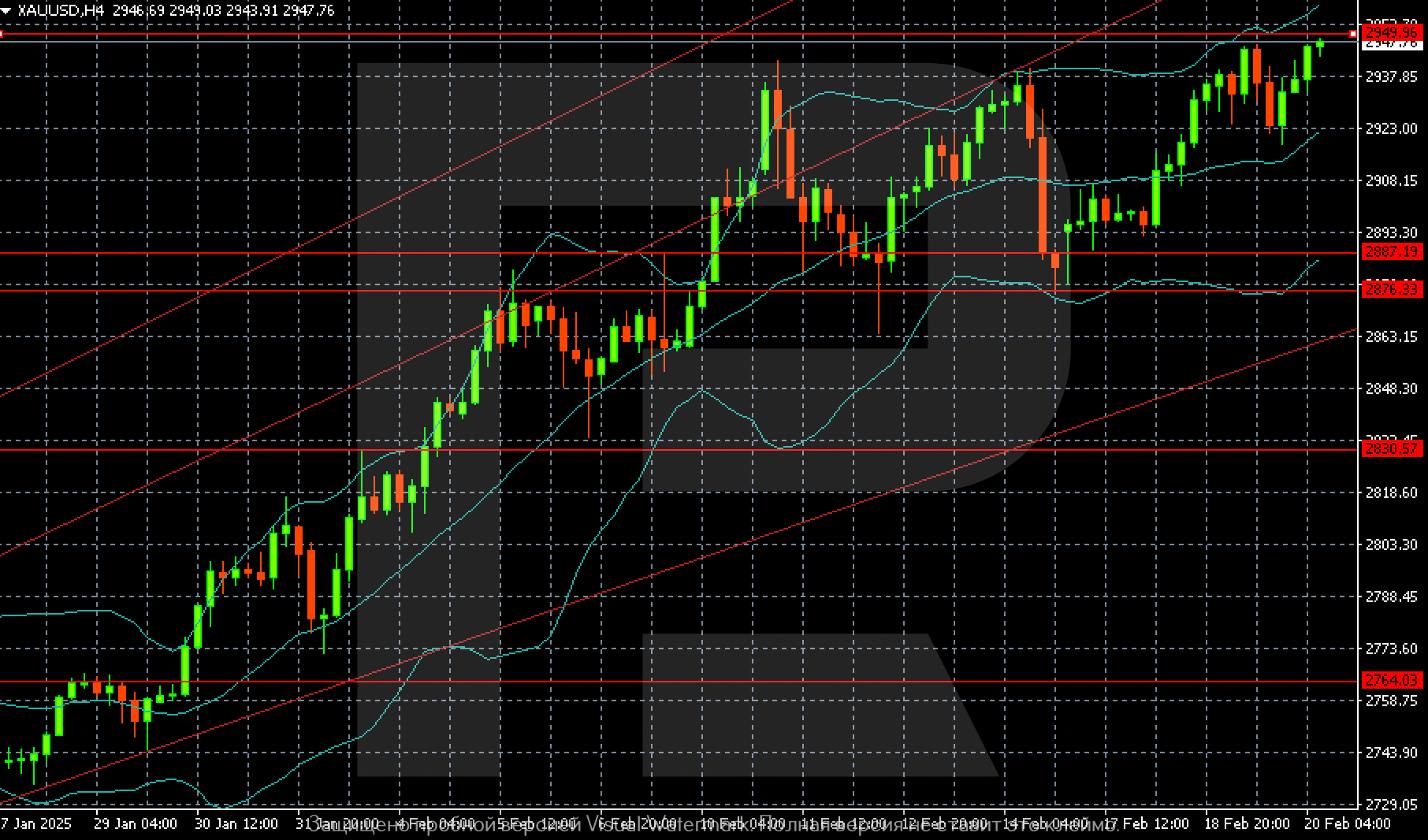

XAUUSD technical analysis

On the H4 chart, XAUUSD has the potential to retest the 2,949 USD level, after which the market could target 2,955 USD.

The 2,887 USD support level should be monitored. If the attack fails and prices go down, this level will be the first to stop them.

Summary

Precious metals are perfectly well. Gold (XAUUSD) prices are rising, with long-term expectations as positive as short-term ones. The Gold (XAUUSD) forecast for today, 20 February 2025, suggests that the growth wave could extend towards 2,949 USD and then towards 2,955 USD.