XAUUSD quotes are undergoing a local correction after reaching a new all-time high of 2,942 USD. Today, the focus remains on US inflation statistics. Find out more in our XAUUSD analysis for today, 12 February 2025.

XAUUSD forecast: key trading points

- Market focus: US consumer inflation data will be released today – the Consumer Price Index (CPI)

- Current trend: the uptrend

- XAUUSD forecast for 12 February 2025: 2,850 and 2,942

Fundamental analysis

XAUUSD prices are moderately correcting after reaching a new all-time high of 2,942 USD. Market participants will focus on US inflation data for January during the American trading session today, with the CPI scheduled for release. The indicator is projected to rise by 0.3% month-on-month and 2.9% year-on-year.

The Federal Reserve considers inflation data when deciding whether to change interest rates. Weaker-than-forecast statistics will put pressure on the USD and help strengthen Gold. Conversely, stronger figures will support the US dollar and cause XAUUSD quotes to decline.

XAUUSD technical analysis

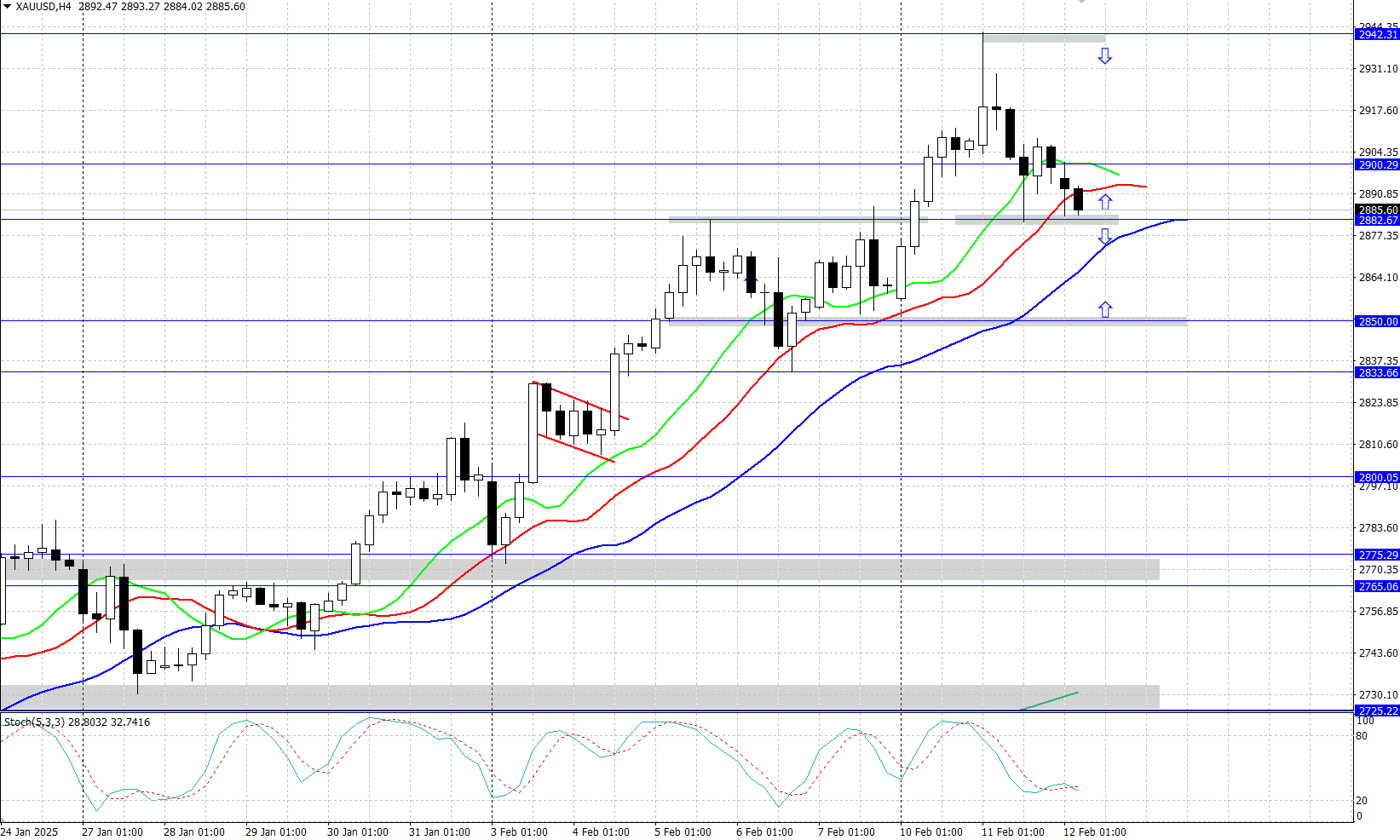

The XAUUSD pair maintains its upward momentum on the daily chart, reaching a new all-time high of 2,942 USD. Subsequently, the asset went into a local correction. Once the correction is complete, the uptrend may continue.

The short-term XAUUSD price forecast suggests further growth, with prices reaching 2,942 USD again, if the bulls retain the initiative. However, the downward correction could develop further if the bears find a foothold below 2,882 USD.

Summary

Gold is undergoing a moderate correction after reaching a new all-time high of 2,942 USD on Tuesday. Today, US consumer inflation data (the CPI) could add to volatility in the asset.