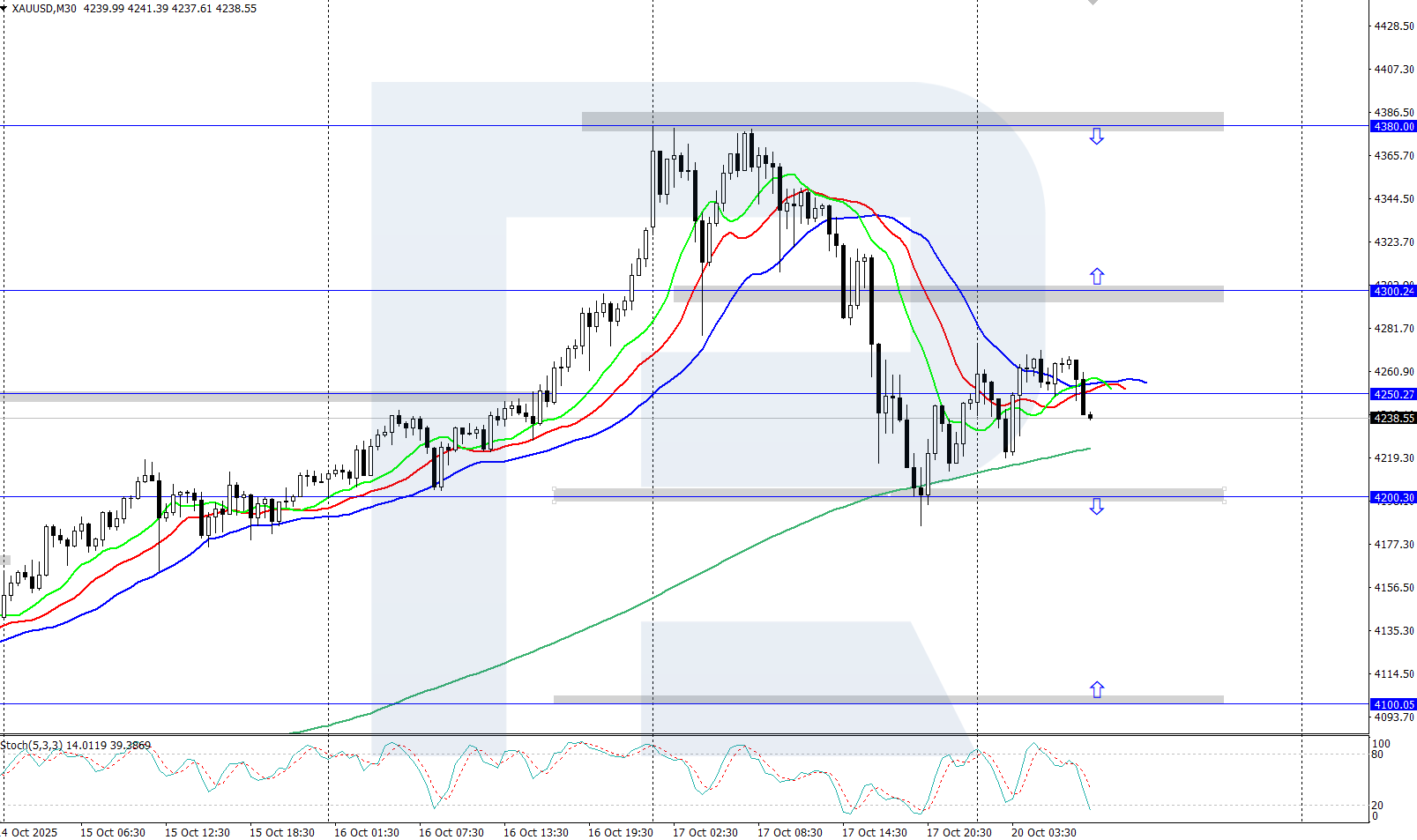

XAUUSD prices have declined to around 4,250 USD after last week’s strong rally, when a new all-time high of 4,380 USD was reached. Discover more in our analysis for 20 October 2025.

XAUUSD forecast: key trading points

- Market focus: the market is awaiting continued US-China trade tariff negotiations

- Current trend: moderate correction in progress

- XAUUSD forecast for 20 October 2025: 4,380 or 4,100

Fundamental analysis

XAUUSD prices have stabilised near 4,250 USD as investors closely monitor the upcoming US-China trade talks. US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are expected to meet this week in Malaysia to resume discussions following last week’s escalation in trade tensions.

This came after President Donald Trump expressed optimism about reaching an agreement during the talks and called his earlier threats of steep tariffs on Chinese goods ‘unsustainable’. Since the start of the year, gold prices have risen more than 60%, driven by expectations of further US rate cuts, the ongoing government shutdown, and heightened geopolitical uncertainty.

XAUUSD technical analysis

XAUUSD quotes have corrected from their record high of 4,380 USD amid easing US-China tensions. The chart shows early signs of a downward reversal, suggesting a possible continuation of the current correction phase.

The short-term XAUUSD price forecast suggests further growth towards the previous high near 4,380 USD or higher if bulls maintain momentum. However, if bears push prices below 4,200 USD, the decline may extend towards the 4,100 USD support level.

Summary

Gold is undergoing a moderate correction after a strong rally and a new all-time high at 4,380 USD. The market’s focus now shifts to the outcome of US-China trade tariff negotiations.

Open Account