XAUUSD prices rose above 2,720 USD last week but could not sustain that level, entering a correction. This week, the market will focus on the US Federal Reserve’s interest rate decision. More details in our XAUUSD analysis for today, 16 December 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting a Federal Reserve interest rate decision at a meeting on Wednesday

- Current trend: downward correction

- XAUUSD forecast for 16 December 2024: 2,720 and 2,630

Fundamental analysis

Gold showed mixed movements last week. It rose steadily at the beginning of the week but then retraced back as part of a correction following the release of US inflation statistics (the CPI and PPI), which recorded higher-than-expected growth rates.

The US Federal Reserve is scheduled to hold its regular meeting this week, during which a 25-basis-point interest rate cut is anticipated. According to the CME FedWatch Tool, markets currently assign a 97.1% probability to this cut. Subsequent comments from the regulator regarding future interest rate plans will be crucial for Gold prices.

XAUUSD technical analysis

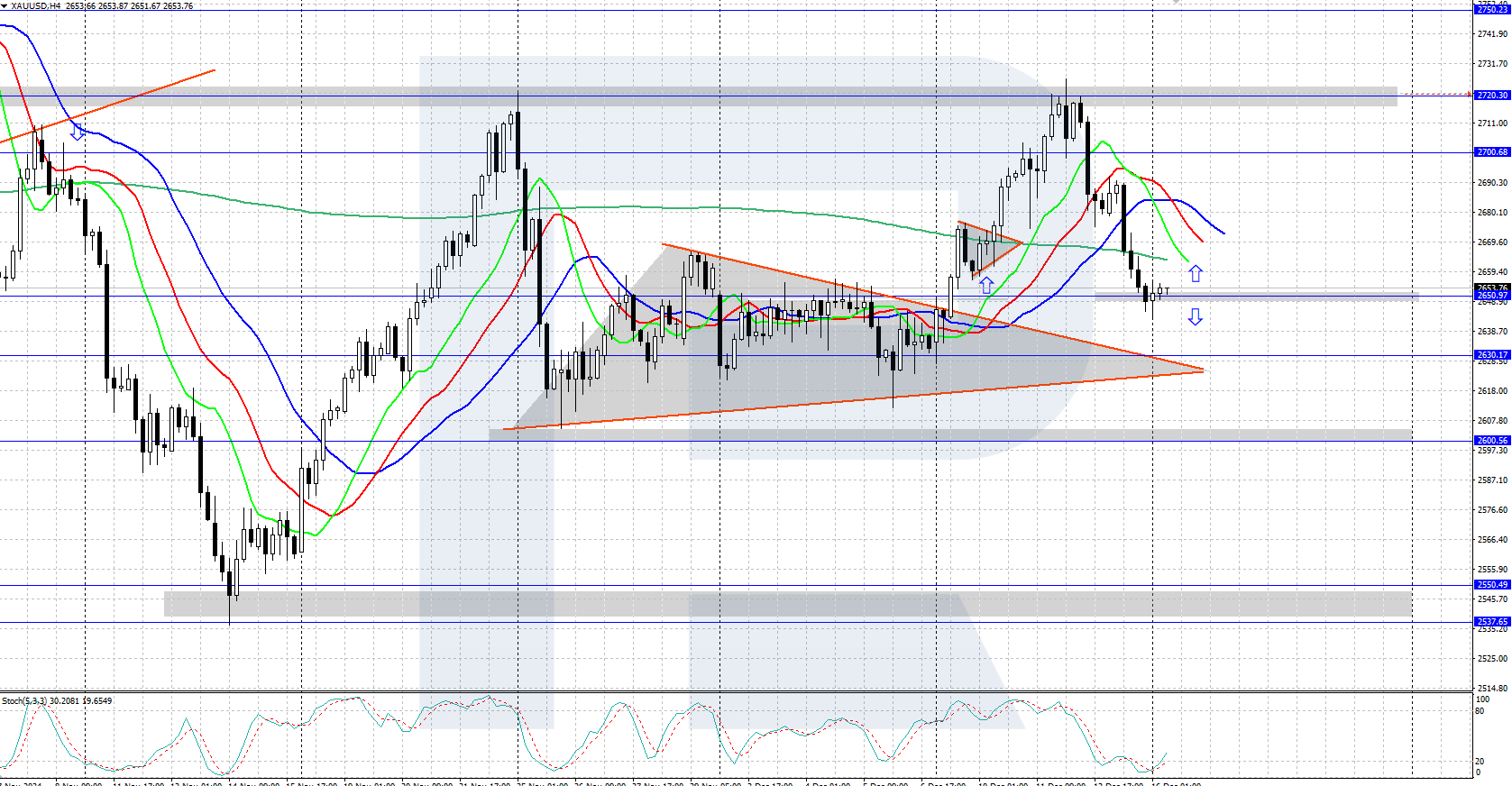

The XAUUSD H4 chart shows a downward reversal from the 2,700-2,720 USD resistance area. A downward correction is underway, after which the asset may resume strengthening. The nearest support level is at 2,650 USD.

The short-term XAUUSD price forecast suggests that if bulls reverse the price upwards and secure a foothold above 2,700-2,720 USD, it could pave the way towards the all-time high of 2,790 USD. However, the decline may continue if bears establish themselves below the 2,650 USD support level.

Summary

XAUUSD prices continue to correct following last week’s release of US inflation data. This week, all eyes will be on the Federal Reserve interest rate decision and related comments from the regulator’s chief, Jerome Powell.