Gold continues to rise on Thursday, 18 July 2024, offsetting Wednesday’s correction.

XAUUSD trading key points

- The Philadelphia Fed manufacturing index (US): previously at 1.3%, forecasted at 2.7%

- A speech by US Federal Open Market Committee (FOMC) official Mary C. Daly

- XAUUSD price targets: 2,434.84, 2,400.00, and 2,386.50

Fundamental analysis

This week’s economic data showed a slight increase, helping the precious metal strengthen its position against the US dollar. XAUUSD quotes are maintaining their upward trajectory.

US economic data, including the Philadelphia Fed manufacturing index, is scheduled for release today. The indicator is projected to rise to 2.7% but it is difficult to foresee what will come. Weaker-than-expected data may exert pressure on the US dollar and push gold prices further up.

A speech by US FOMC official Mary C. Daly last time negatively impacted the US dollar. Investors expect this speech to answer questions about future interest rate changes and inflation growth or slowdown rates. Any response from Mary C. Daly may trigger an immediate market reaction, potentially pushing the XAUUSD to new all-time highs.

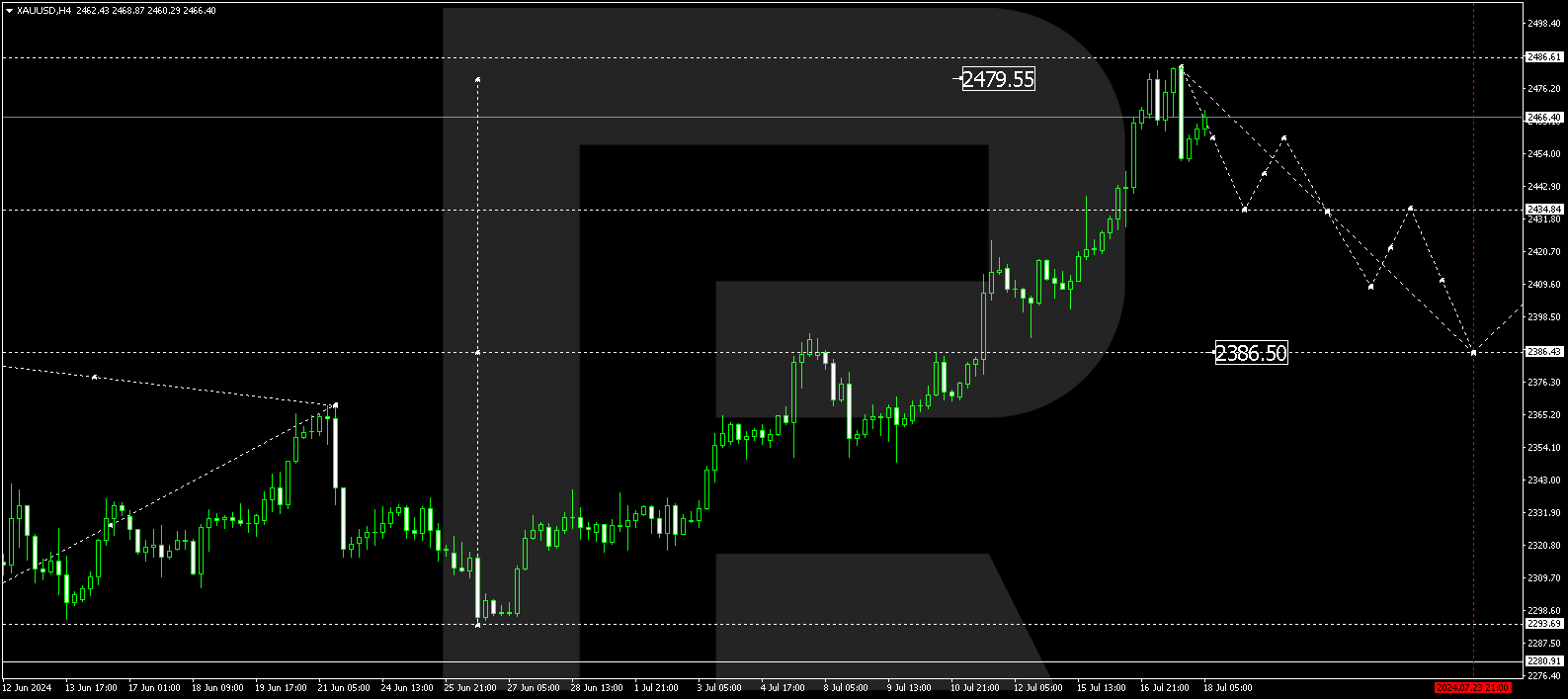

XAUUSD technical analysis

On the H4 chart, the XAUUSD pair has completed a growth wave, reaching 2,483.70. A downward impulse towards 2,452.00 has formed. This is interpreted as a part of a decline wave towards 2,434.84, the first target. Today, 18 July 2024, the price is expected to rise to 2,868.00 before falling to 2,434.84, with the wave potentially extending to the local target of 2,400.00.

Summary

Fundamental data indicates a potential further rise in the XAUUSD pair, while technical indicators point to a possible decline wave in gold prices towards the 2,434.84, 2,400.00, and 2,386.50 targets.