XAUUSD prices continue trading within a corrective trend following Trump’s victory in the US election. The asset has found temporary support at the 2,600 USD level. More details in our XAUUSD analysis for today, 13 November 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting US inflation data today, with the Consumer Price Index (CPI) scheduled for release

- Current trend: the downward correction continues

- XAUUSD forecast for 13 November 2024: 2,643 and 2,550

Fundamental analysis

XAUUSD quotes are declining further within a downward correction. Gold’s weakening is driven by the strengthening US dollar, which has seen increased demand following the US election. The long-term trend remains upward, so the asset will likely resume its rise once the correction concludes.

Today, the market will focus on US inflation data, particularly the CPI, which is expected to increase by 2.6% year-on-year. Weaker-than-forecasted statistics could pressure the USD and help strengthen Gold. Conversely, higher-than-expected results would strengthen the US dollar and potentially drive XAUUSD prices further down.

XAUUSD technical analysis

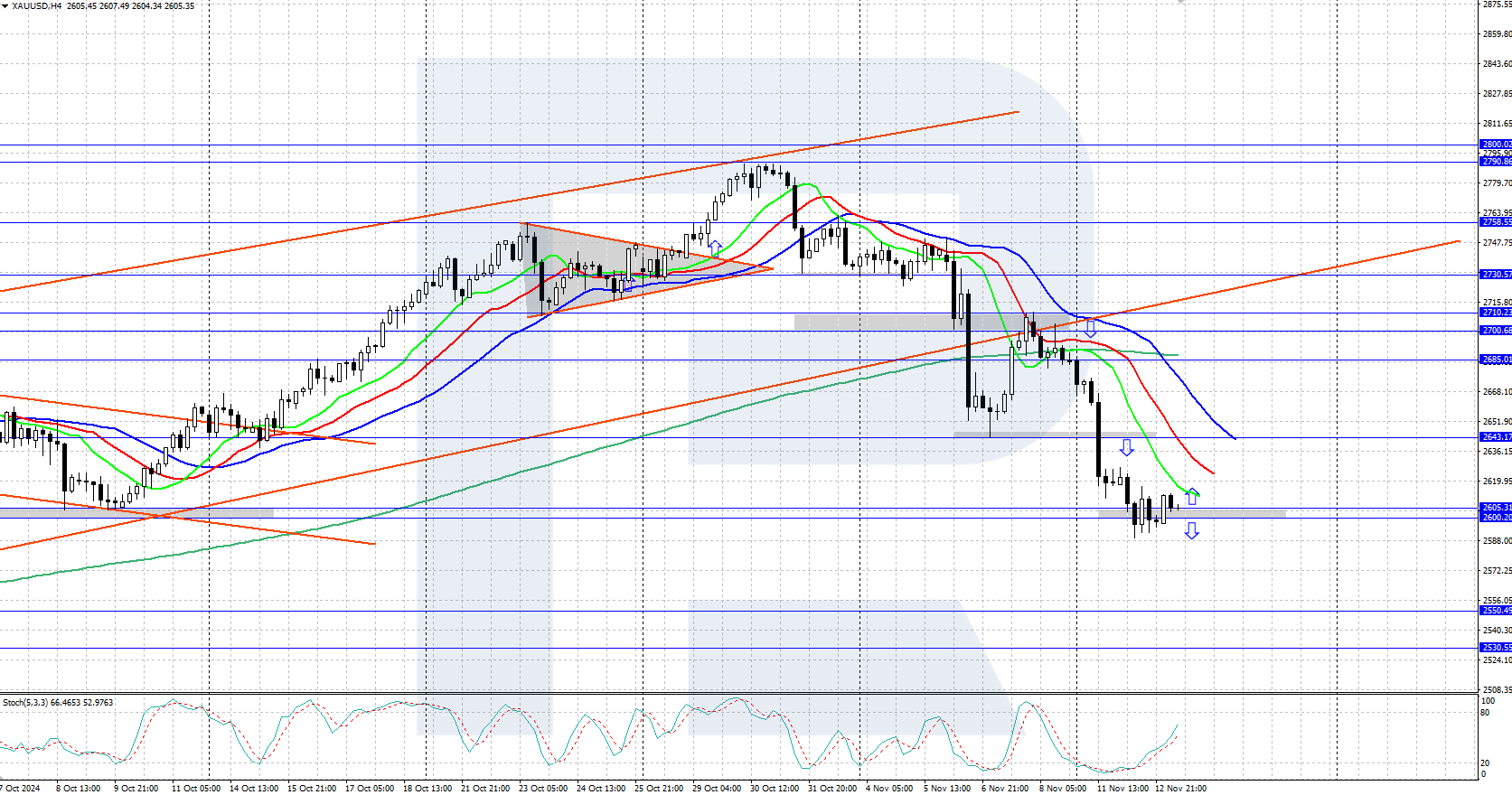

On the H4 chart, the XAUUSD pair is trending downwards, exiting the boundaries of an ascending trend channel. The quotes are now trading around the strong 2,600-2,605 USD support area. Volatility may increase sharply after the release of US inflation statistics.

The short-term XAUUSD price forecast suggests that prices could drop further to 2,550 USD if bears push the quotes below the 2,600-2,605 USD support area. Conversely, if bulls seize the initiative and reverse prices upwards, prices could soon return to an all-time high of 2,790 USD.

Summary

Gold continues its decline amid the broad strengthening of the US dollar following the US election. Today, market participants will focus on US inflation statistics, particularly the CPI.