Gold prices are falling, as they cannot hold above 2,400 USD. Market participants await today’s release of US GDP data. Find out more in our analysis dated 25 July 2024.

XAUUSD trading key points

- Market focus: the market awaits US Q2 GDP data release today

- Current trend: a downward correction is underway following an all-time high of 2,483 USD

- Market focus: volatility is expected to rise based on US GDP statistics

- XAUUSD forecast for 25 July 2024: 2388 and 2350

Fundamental analysis

Gold prices continue to correct after reaching an all-time high of 2,483 USD per troy ounce. The strengthening of the US dollar against major currencies exerts pressure on gold. Today, the market focuses on US Q2 GDP.

The indicator is projected to increase by 2.0%, up from 1.4% in Q1. A higher US GDP percentage benefits the US dollar, so GDP growth exceeding 2.0% would strengthen the US dollar and push the XAUUSD pair lower. Conversely, GDP readings below 2.0% could weaken the USD, helping gold strengthen.

XAUUSD technical analysis

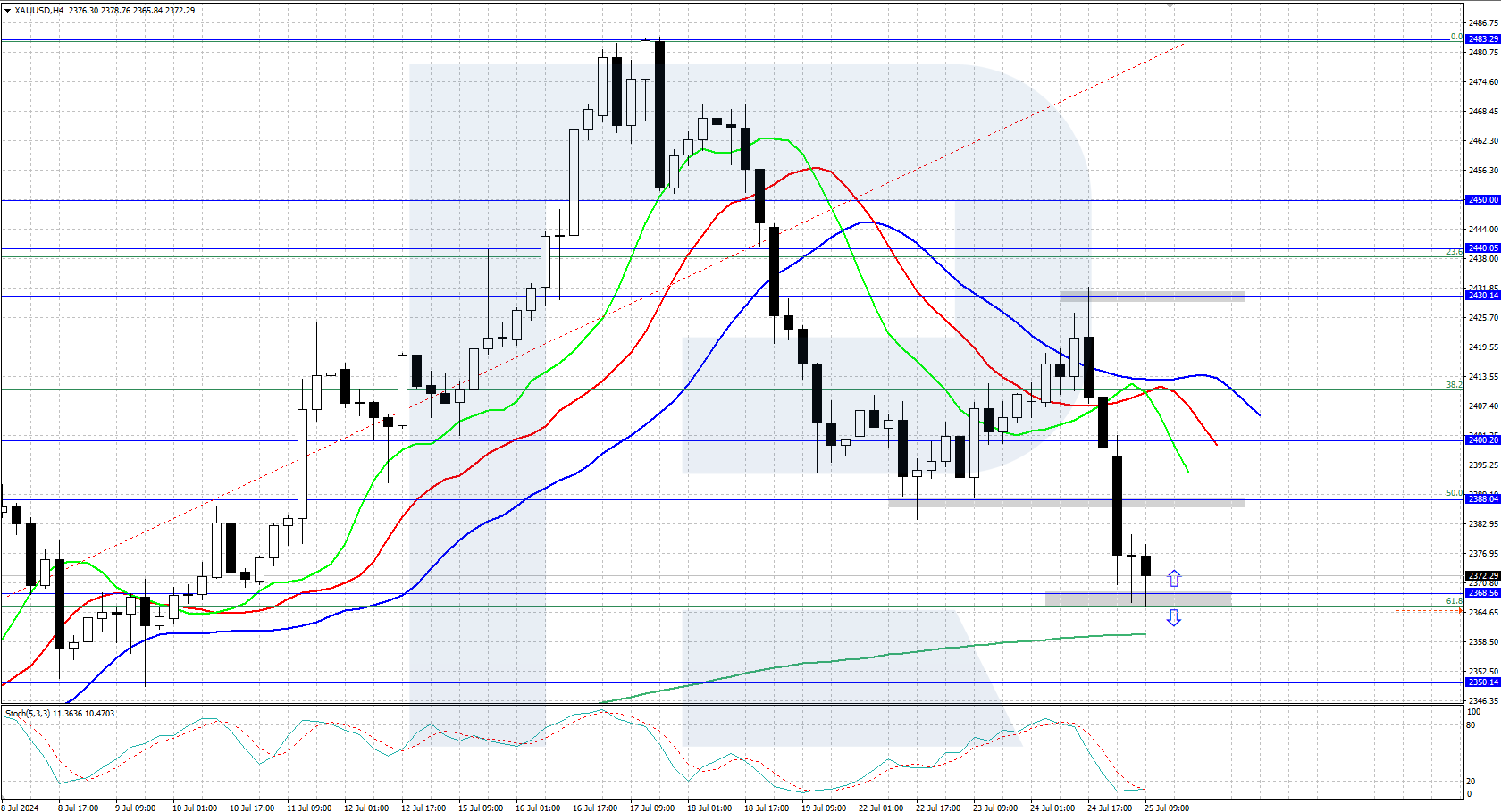

On the H4, XAUUSD demonstrates a downward movement. Yesterday, bulls attempted to seize the initiative and reverse the price up from the 2,388 support level, which aligns with the 50.0% Fibonacci retracement level. Although they pushed the price to 2,430, they could not maintain these levels, so the price fell back below 2,400.

Gold is trading near the 2,368 support level, corresponding with the 61.8% Fibonacci retracement level. The mid-term XAUUSD forecast for 25 July 2024 suggests that if bears break and hold below this support, the decline might continue, potentially pushing the XAUUSD price down to 2,350 USD or lower.

Summary

Gold is undergoing a downward correction after reaching an all-time high of 2,483 USD last week. The precious metal faces pressure from a strengthening US dollar. The future directions of XAUUSD will depend on US GDP statistics.