Gold (XAUUSD) has dropped below the key 4,000 USD level amid an ongoing downward correction, as markets await the outcome of U.S.–China trade negotiations. Details — in our analysis for 28 October 2025.

XAUUSD forecast: key trading points

- Market focus: traders await the results of U.S.–China tariff negotiations.

- Current trend: bearish correction.

- XAUUSD forecast for 28 October 2025: 3,900 or 4,000.

Fundamental analysis

Gold prices have fallen to a two-week low near 3,950 USD per ounce, driven by reduced demand for safe-haven assets as optimism grows around a potential new trade agreement between the United States and China.

Officials from both countries announced over the weekend that they had reached a framework agreement covering tariffs and several key economic issues during talks in Malaysia. This progress paves the way for President Donald Trump and President Xi Jinping to finalize a trade deal at their upcoming meeting in South Korea later this week.

The easing of geopolitical tensions has led investors to scale back gold positions, while focus shifts toward risk assets such as equities and commodities.

XAUUSD technical analysis

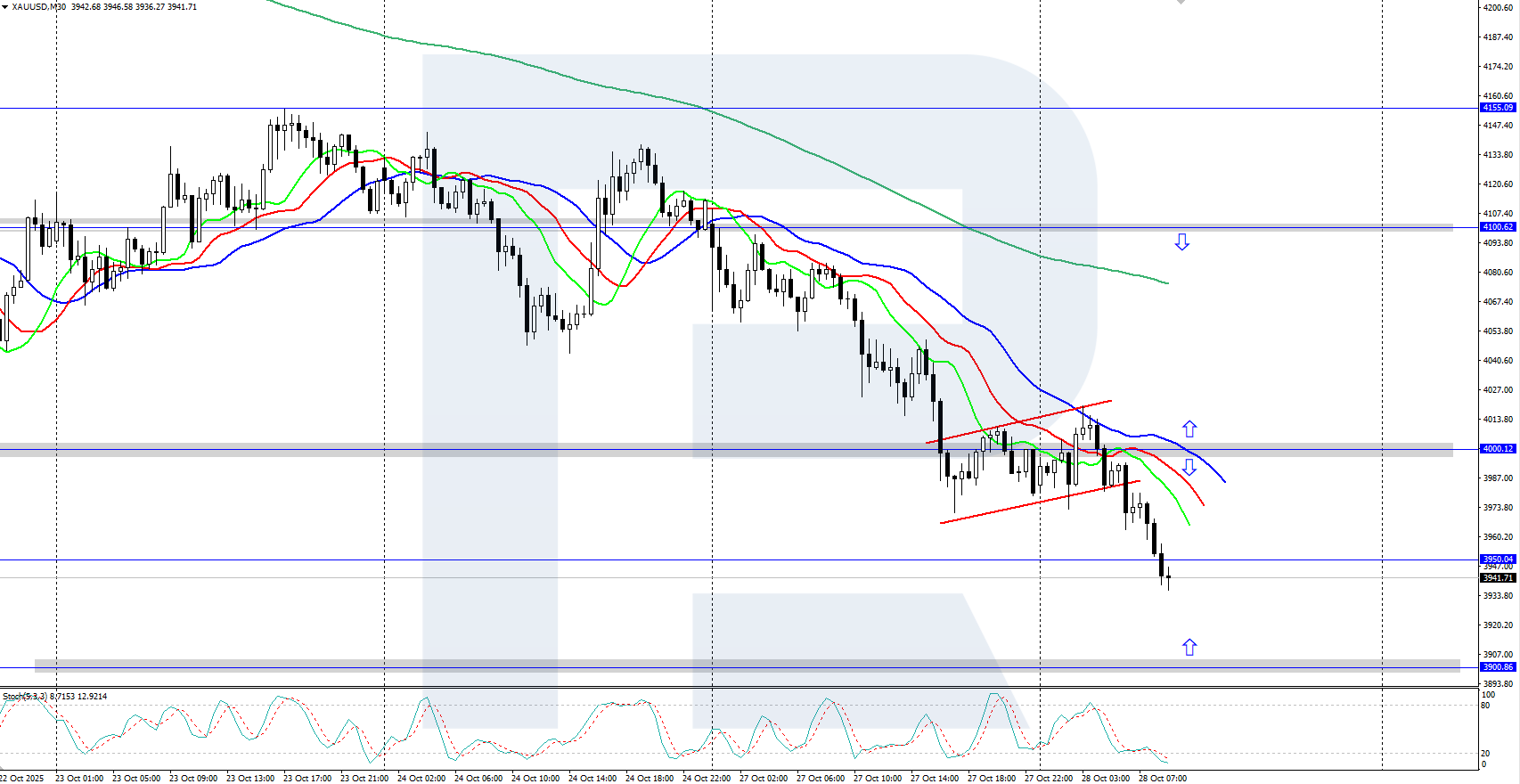

XAUUSD has corrected lower from its record high of 4,380 USD, following a sharp decline in safe-haven demand. The Alligator indicator remains pointed downward, suggesting that the correction could continue in the short term.

If bulls manage to regain control and push prices back above 4,000 USD, the next upside target would be a retest of the previous peak at 4,380 USD. However, if bears maintain pressure and hold the price below 4,000 USD, a further decline toward the 3,900 USD support level becomes increasingly likely.

Summary

Gold (XAUUSD) continues to correct lower, slipping below the psychologically significant 4,000 USD mark as markets focus on U.S.–China trade developments. A rebound above 4,000 USD could trigger renewed bullish momentum, while sustained weakness may push prices toward 3,900 USD.

Open Account