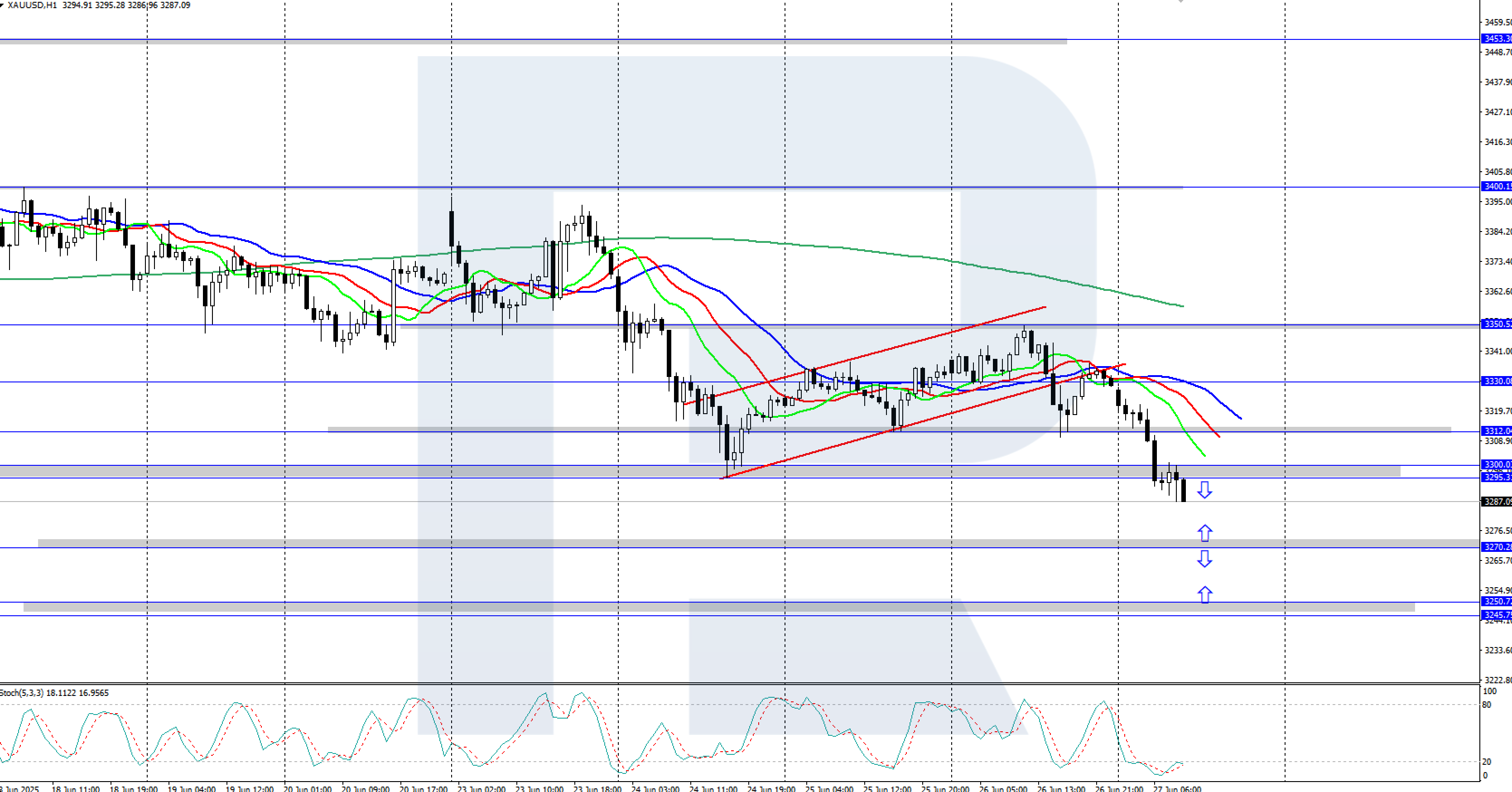

The Gold (XAUUSD) price fell below the support level of 3,300 USD amid the negotiation process in the Middle East. Details – in our analysis for 27 June 2025.

XAUUSD forecast: key trading points

- Market focus: today the market awaits US inflation statistics – PCE Price Index

- Current trend: a downward trend is observed

- XAUUSD forecast for 27 June 2025: 3,250 and 3,312

Fundamental analysis

The situation in the Middle East is becoming less tense after the announcement of upcoming negotiations between the US and Iran. The parties intend to discuss issues related to Iran’s nuclear programme as well as measures to reduce military confrontation in the region.

Today, the key event for the markets will be the publication of the PCE index – a US inflation indicator. A moderate growth of 0.1% is forecast. If the data confirms a slowdown in price pressure, it will strengthen expectations of an imminent easing of the Fed’s monetary policy, possibly as early as the next meeting.

XAUUSD technical analysis

XAUUSD quotes are showing a downward dynamic, falling below the support at 3,300 USD. The Alligator indicator is declining, confirming the current downward trend. The key support now stands at 3,250 USD.

Within the framework of the short-term forecast for XAUUSD, if the bears manage to maintain their initiative, a further decline to 3,250 USD may follow. However, if the bulls manage to reverse the quotes upwards, growth to the resistance level at 3,312 USD is possible.

Summary

Gold is declining amid the negotiation process in the Middle East. Today, US inflation data – PCE Price Index – may add volatility to the XAUUSD pair.