XAUUSD prices are on the rise, surpassing the 2,900 USD level amid weaker-than-expected US ADP employment statistics. Find more details in our XAUUSD analysis for today, 6 March 2025.

XAUUSD forecast: key trading points

- Market focus: US new jobs increased by 77 thousand in February, according to ADP

- Current trend: trending upwards

- XAUUSD forecast for 6 March 2025: 2,900 and 2,930

Fundamental analysis

Gold is showing steady growth against the US dollar this week, with its prices currently hovering above 2,900 USD. The precious metal is in increased demand from investors and central banks as US President Donald Trump’s tariff wars continue.

The February data released by Automatic Data Processing Inc. (ADP) yesterday during the American trading session showed an increase of 77 thousand in US jobs, well below the expected 140 thousand. Weak data pushed the US dollar lower, with the market now awaiting Friday’s data on Nonfarm Payrolls and the unemployment rate.

XAUUSD technical analysis

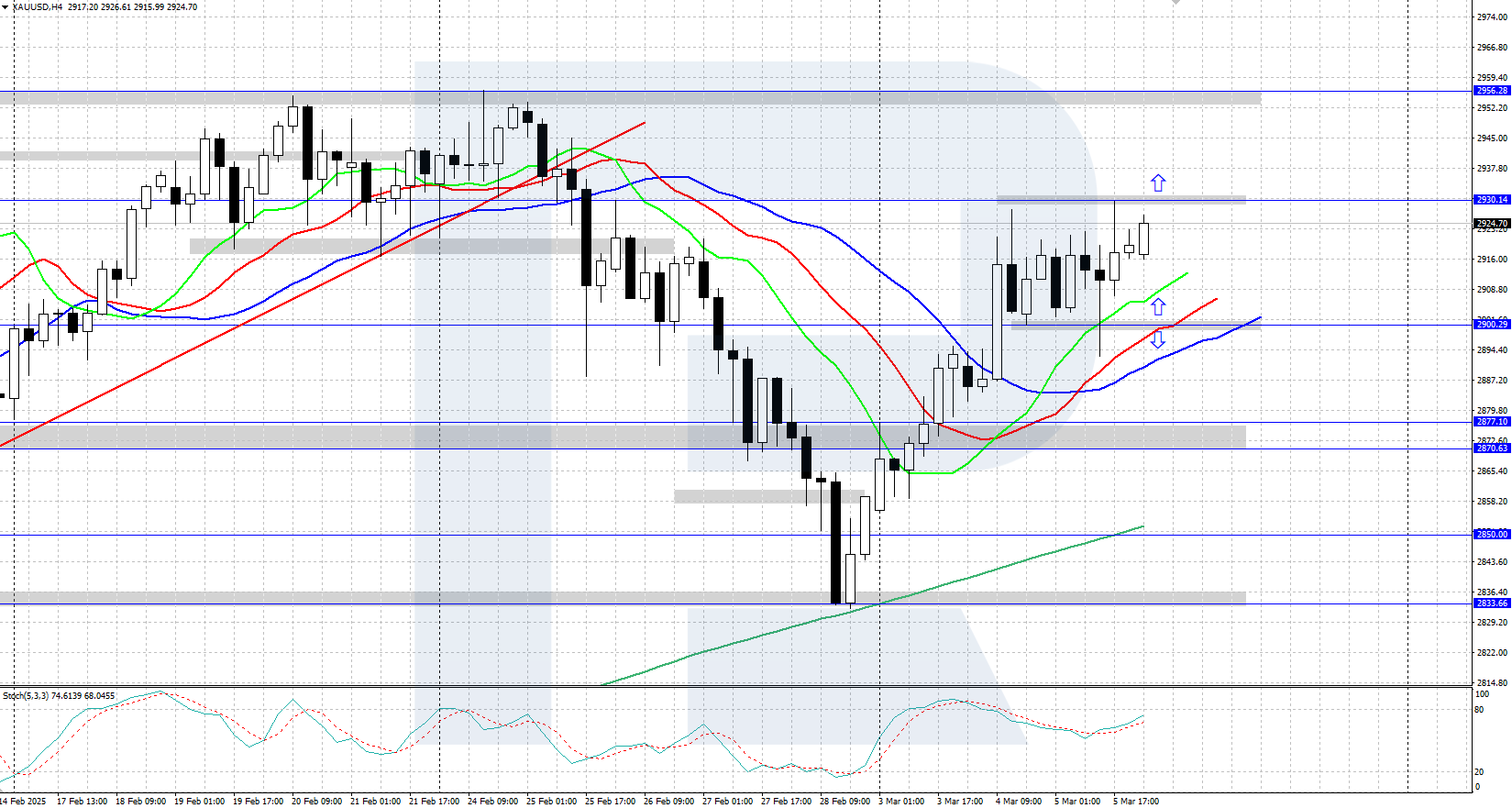

On the daily chart, XAUUSD quotes are on a strong rise, reaching the 2,930 USD resistance level. The Alligator indicator is below the price chart and is moving upwards, confirming the bullish trend, with the pair likely to continue its ascent after some correction.

The short-term XAUUSD price forecast suggests that the pair could maintain its upward momentum and rise to an all-time high of 2,956 USD if the bulls retain the initiative. However, a strong downward correction is possible if the bears gain control and push prices below the 2,900 USD support level.

Summary

XAUUSD quotes are on the rise, having consolidated above 2,900 USD amid the introduction of US trade tariffs and weak ADP data. The market is awaiting tomorrow’s crucial US statistics on Nonfarm Payrolls and the unemployment rate.