Gold (XAUUSD) found support around 2,643 USD

XAUUSD prices declined to 2,643 USD as part of a correction amid the US dollar’s strengthening, driven by the US election. The asset encountered strong demand at this level and is attempting to reverse upwards. More details in our XAUUSD analysis for today, 8 November 2024.

XAUUSD forecast: key trading points

- Market focus: Donald Trump confidently won the US presidential election

- Market focus: the US Federal Reserve lowered the interest rate by 0.25%

- Current trend: a local correction is underway as part of the uptrend

- XAUUSD forecast for 8 November 2024: 2,643 and 2,710

Fundamental analysis

XAUUSD quotes continue to trade within a local correction, after which upward momentum is expected to resume. The decline in Gold prices was due to the growth of the US dollar, supported by Donald Trump’s victory in the US presidential election.

At yesterday’s meeting, the Federal Reserve unanimously decided to lower the interest rate by 0.25%, aligning with market expectations. In its accompanying statement, the US Fed noted that labour market conditions have generally improved, and inflation continues to gradually move towards the 2.0% target.

XAUUSD technical analysis

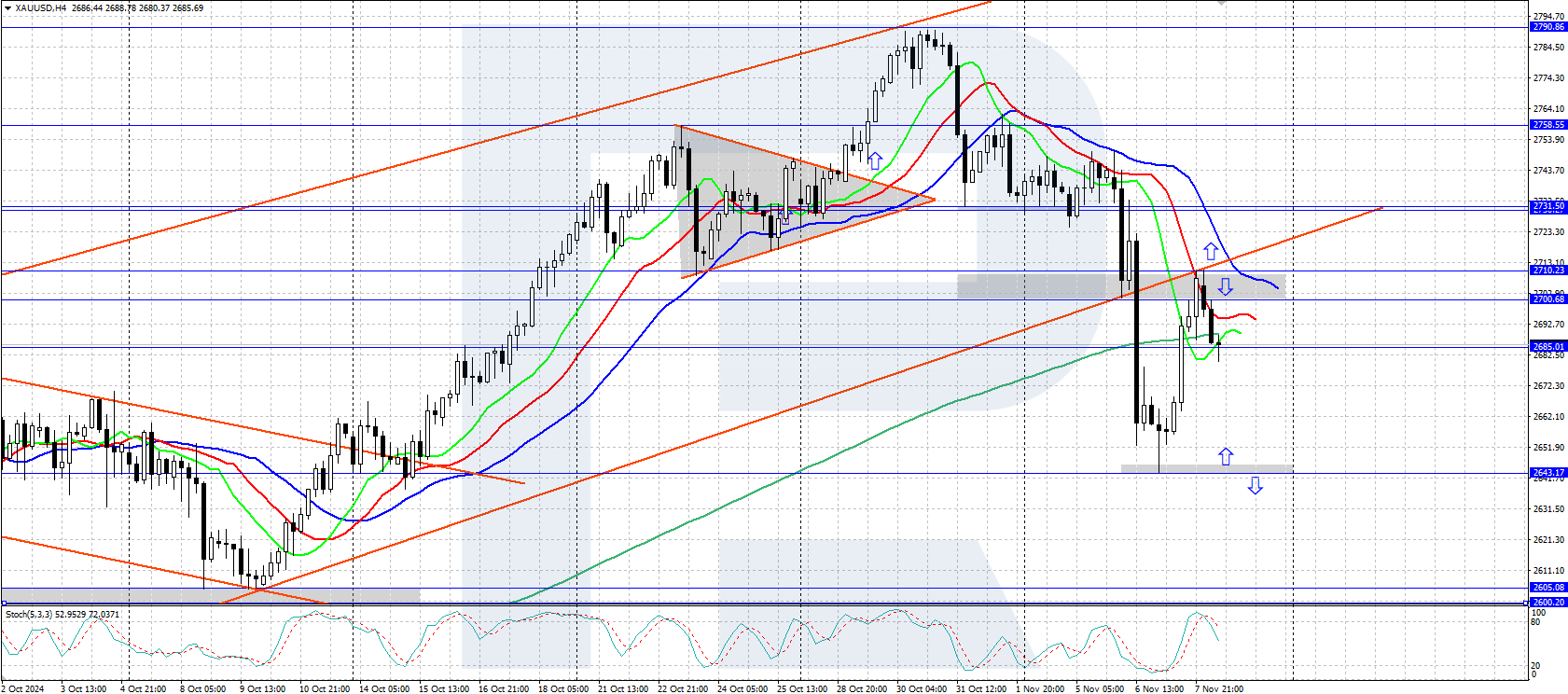

On the H4 chart, the XAUUSD pair is correcting within the uptrend. Yesterday, the asset’s prices fell to the 2,643 USD support level, where they encountered strong buyer demand and reversed upwards. They closed the day with steady growth towards the 2,700-2,710 USD resistance area. Yesterday’s strengthening of Gold creates the conditions for completing the correction and further growth.

The short-term XAUUSD price forecast suggests that if bears push the quotes below the 2,643 USD level, the correction could continue towards the 2600-2605 USD area. Conversely, if bulls seize the initiative and secure a position above 2,710 USD, prices could return to an all-time high of 2,790 USD in the short term.

Summary

Gold prices declined to 2,643 USD as part of a correction yesterday, where they encountered strong demand from buyers. The long-term trend is upward, with growth likely to resume once the correction is complete.