Gold (XAUUSD) has multiple supports: from Fed reshuffles to Trump’s tariffs

Gold (XAUUSD) prices are hovering around 3,380 USD. While fundamental factors favour further growth, there is a nuance. Find more details in our analysis for 8 August 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices react to risks and White House tariffs

- The US decision to impose tariffs on imported gold bars will support prices

- XAUUSD forecast for 8 August 2025: 3,408

Fundamental analysis

On Friday, gold (XAUUSD) prices declined to 3,380 USD per ounce, pulling back slightly from a two-week high due to profit-taking. Nevertheless, the metal still has a chance to finish the week higher for the second consecutive time, bolstered by trade risks and expectations of Fed policy easing.

From midnight, President Donald Trump’s large-scale tariffs – ranging from 10% to 50% on imports from dozens of countries, plus a separate 100% tariff on semiconductor imports – came into effect. This boosted gold’s appeal as a safe-haven asset.

Additional momentum came from Minneapolis Fed President Neel Kashkari, who supported the idea of a rate cut amid signs of economic slowdown. Initial jobless claims exceeded expectations, while continuing claims reached their highest level in three years.

The US also imposed tariffs on imports of one-kilo and 100-ounce gold bars to reduce reliance on foreign supply, especially from Switzerland. This may lower domestic market supply and support prices.

Another demand driver was China’s continued gold buying, with the People’s Bank of China purchasing gold for the ninth consecutive month in July.

The gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

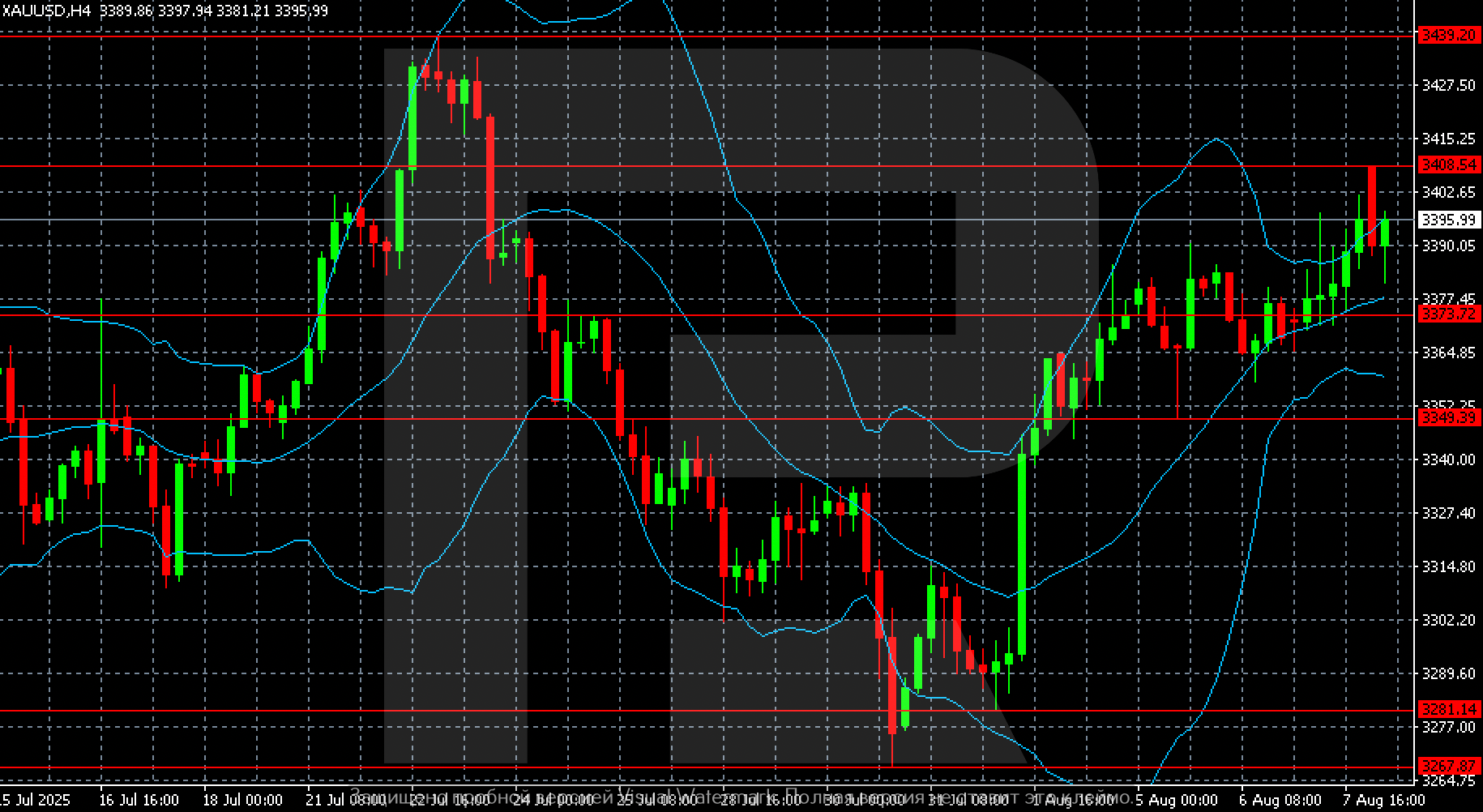

On the H4 chart, gold (XAUUSD) quotes have shown steady growth since 1 August after a late-July decline. The upward impulse began from the 3,280 level and continues towards the current value near 3,396 USD per ounce.

Prices broke above crucial resistance levels at 3,349 and 3,373, which can now act as support areas. At the moment, quotes are approaching the 3,408 level, where selling pressure previously emerged. This is the nearest resistance. The next target is the 3,439 area, the late-July high.

Bollinger Bands are widening, confirming increased volatility. Prices remain above the indicator’s middle line, signalling the strength of the uptrend.

Thus, gold is trading within an ascending channel. If prices confidently consolidate above 3,408, the next target will be 3,439. Otherwise, a pullback towards the 3,373 and 3,349 levels is possible.

Summary

Gold (XAUUSD) prices may resume growth after the morning pause. The gold (XAUUSD) forecast for today, 8 August 2025, suggests a buying wave could develop, with the first target at 3,408.