Gold (XAUUSD) prices hold steady around 3,364 USD after yesterday’s surge. Investors are flocking to safe-haven assets. Find more details in our analysis for 3 June 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices surged to a four-week peak as investors flee risk

- Markets are hedging against rising trade and geopolitical tensions

- Focus remains on the US and China

- XAUUSD forecast for 3 June 2025: 3,392

Fundamental analysis

Gold (XAUUSD) prices are consolidating around 3,364 USD per troy ounce on Tuesday. The metal soared by nearly 3% in the previous session, marking its biggest one-day gain in almost a month, as markets reacted to intensifying trade and geopolitical tensions.

The primary driver has been surging demand for safe-haven assets.

Market pressure increased after US President Donald Trump vowed to double tariffs on steel and aluminium imports starting Wednesday. This move escalates trade tensions and presents a major risk to financial markets.

Additionally, tensions between Washington and Beijing have worsened after Trump accused China of breaching the trade deal.

The Gold (XAUUSD) forecast is moderately positive.

XAUUSD technical analysis

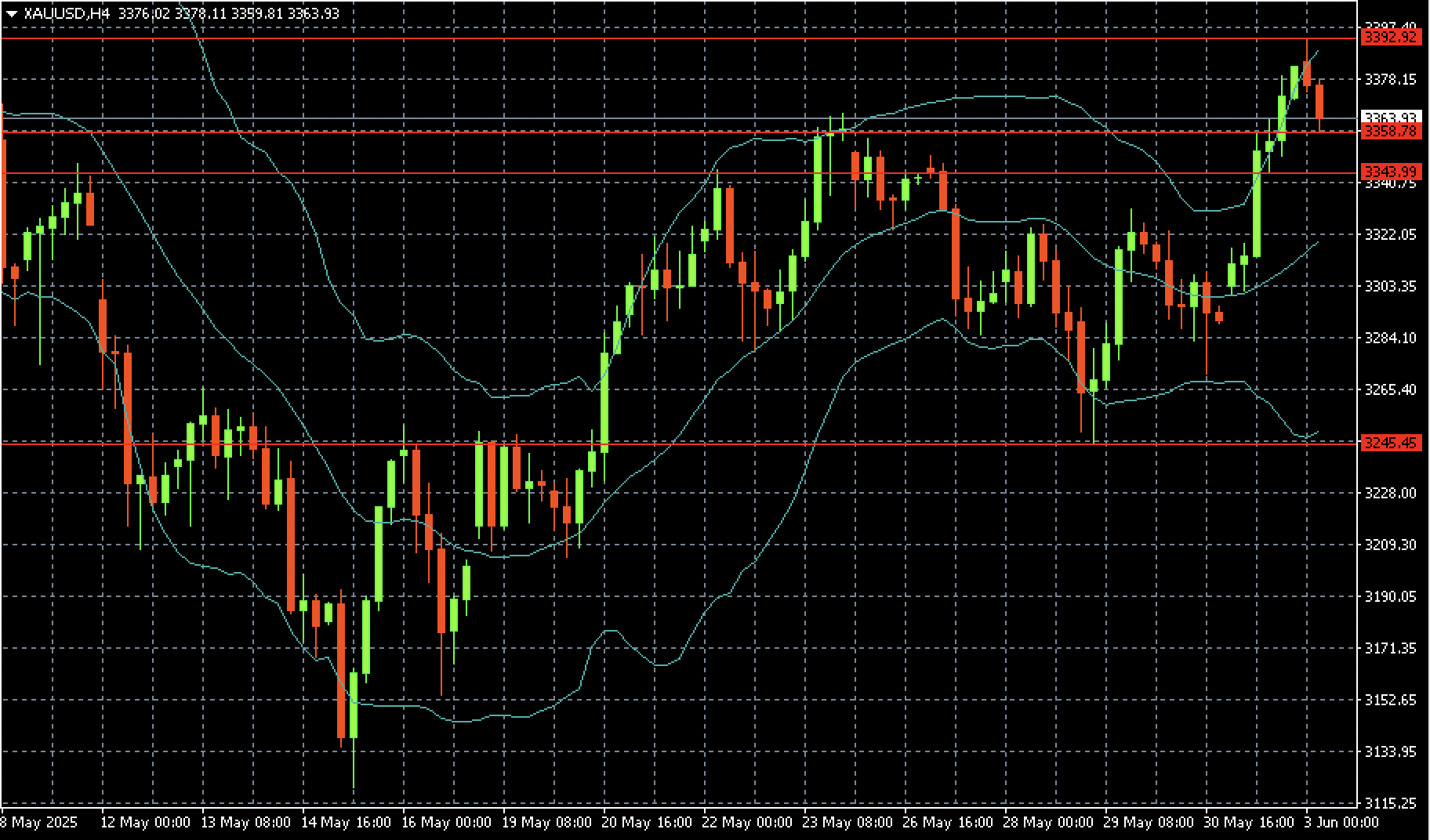

On the H4 chart, Gold (XAUUSD) is shedding some overbought pressure and may consolidate around 3,366. The most likely scenario is resumed growth towards 3,392.

Summary

Gold (XAUUSD) reached a four-week high by Tuesday, driven by the market’s strong appetite for safe-haven assets. With risk aversion dominating investor behaviour, the Gold (XAUUSD) forecast for today, 3 June 2025, anticipates a retest of the current high near 3,392.