Gold is moving steadily toward 3,220 USD as global demand for safe-haven assets remains high. Full details in our analysis for 15 April 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) continues its upward trend, pausing only for brief consolidations

- Global investors remain focused on safe-haven assets

- XAUUSD forecast for 15 April 2025: 3,246

Fundamental analysis

Gold (XAUUSD) is trading near 3,220 USD on Tuesday.

The primary driver for gold remains the heightened level of market uncertainty linked to US trade policy. While new tariffs are currently on pause and trade talks are ongoing, the Trump administration has shifted focus to auto parts — considering removing them from the list of high-tariff items.

Still, that remains speculative. Meanwhile, attention has shifted to key import sectors like pharmaceuticals and semiconductors, which may soon face increased tariffs. These sectors are substantial, and the prospect of new duties has fuelled demand for safe-haven assets like gold.

Another solid support for gold comes from expectations of a Federal Reserve rate cut — markets are currently pricing in around 86 basis points of easing in 2025. Lower interest rates typically benefit gold by reducing the opportunity cost of holding non-yielding assets.

The short-term outlook for XAUUSD remains positive.

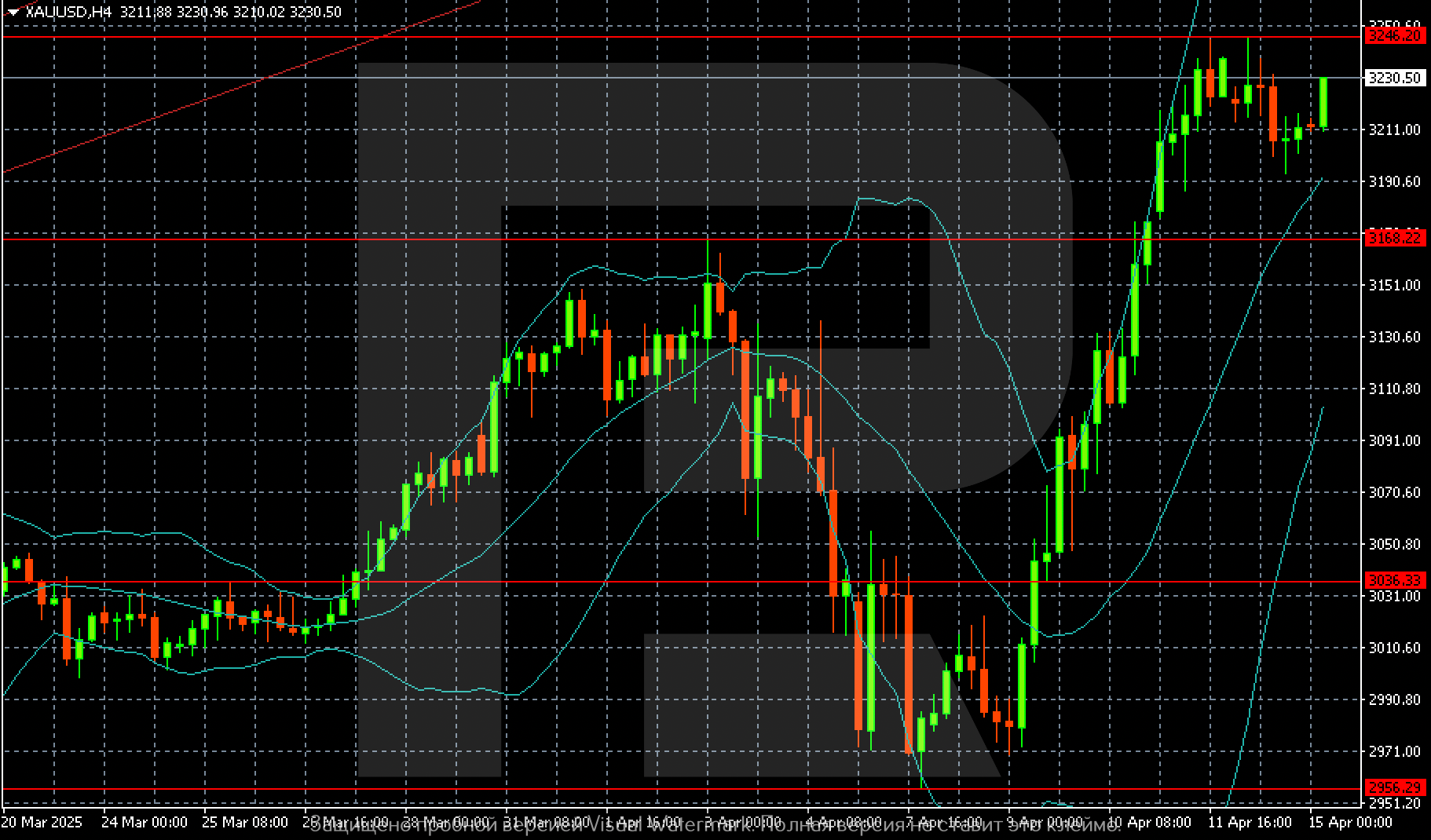

XAUUSD technical analysis

On the H4 chart, Gold (XAUUSD) is forming stable conditions for further gains. The immediate target is 3,246 USD, with a broader upside potential toward 3,300 USD if momentum continues.

Summary

Gold (XAUUSD) maintains its upward momentum, pausing only briefly for consolidation. With trade tensions and interest rate expectations supporting demand, today’s forecast for 15 April 2025 points to a continued rise, with a short-term target of 3,246 USD.