XAUUSD quotes are rising moderately, surpassing 2,680 USD after the release of the US Producer Price Index (PPI) statistics. More details in our XAUUSD analysis for today, 15 January 2025.

XAUUSD forecast: key trading points

- The US PPI rose by 0.2% month-on-month and by 3.3% year-on-year

- Market participants are awaiting US consumer inflation data (the CPI) today

- XAUUSD forecast for 15 January 2025: 2,650 and 2,720

Fundamental analysis

Gold is moderately rising today, maintaining a position above 2,650 USD following the recent downward correction. Yesterday’s US PPI data came out below forecasts, putting pressure on the US dollar and driving growth in XAUUSD quotes.

Today, the market will focus on US consumer inflation data, with the CPI expected to rise 0.3% month-on-month and 2.9% year-on-year. Weaker-than-forecast readings will exert pressure on the USD and help strengthen the pair. Conversely, growth will support the US dollar, leading to a decline in XAUUSD prices.

XAUUSD technical analysis

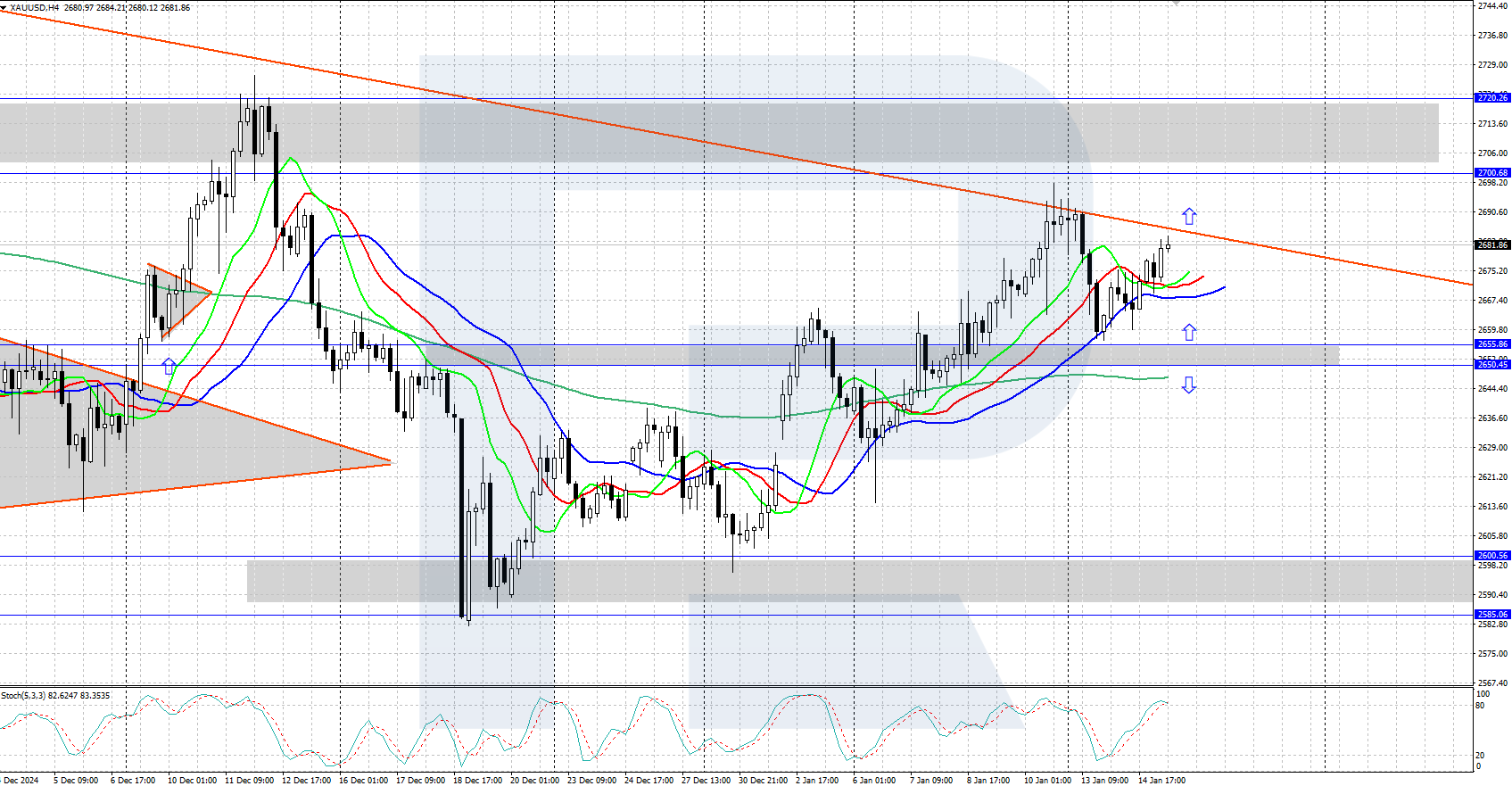

On the H4 chart, the XAUUSD pair firmly holds above the 2,650 support level. The Alligator indicator below the price chart indicates an upward movement; the asset could continue its ascent to the 2,700-2,720 USD resistance area. Today’s US inflation statistics could drive the pair’s further price movements.

The short-term XAUUSD price forecast suggests that if the bulls manage to keep the price above 2,650 USD, the pair may continue to rise. The nearest target is the resistance area between 2,700 and 2,720 USD. A downward correction is possible if the bears secure a foothold below 2,650 USD.

Summary

Gold quotes are rising, establishing support above 2,650 USD. XAUUSD prices are expected to see increased volatility during the American session when the CPI is released.