Gold is consolidating around 2,610 USD after a collapse, with prices facing significant pressure from the Federal Reserve’s stance. Discover more in our analysis for 19 December 2024.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices fell by more than 2% yesterday

- The US Federal Reserve’s consistent stance for 2025 suggests only two rate cuts, which is negative news for Gold prices

- XAUUSD forecast for 19 December 2024: 2,579

Fundamental analysis

The situation in Gold (XAUUSD) deteriorated significantly due to the US Federal Reserve’s hawkish sentiment. Gold prices fell by more than 2% during yesterday’s session. Today, they are recovering, but the fundamental situation does not favour Gold.

At its meeting yesterday, the Federal Reserve announced fewer rate cuts in 2025 than anticipated, with its dot plot indicating just two rate cuts next year. This position is based on robust US GDP and data showing stable inflation.

Such forecasts are unfavourable for Gold. Limited easing of monetary policy makes assets that do not generate coupon income less attractive.

The Gold (XAUUSD) forecast is moderately negative.

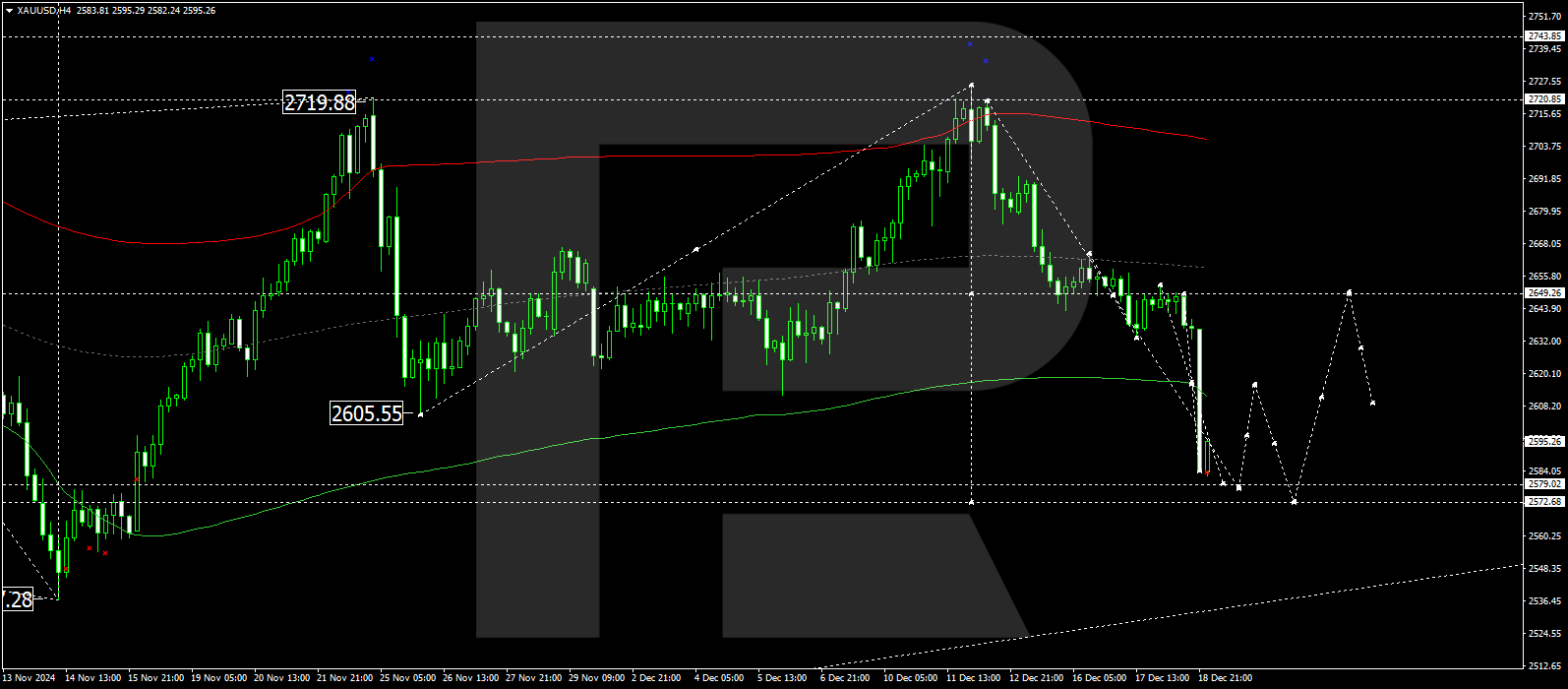

XAUUSD technical analysis

The XAUUSD H4 chart shows a persistent tendency towards a gradual price decline from the current level of 2,605 to 2,579, where there may be conditions for the first significant stop for sellers. The downward wave could continue to 2,579 today, 19 December 2024. After testing this level, the market might move to 2,595 for a short period and then to 2,620. Subsequently, Gold might have a reason to retest the 2,572 level.

Summary

Gold (XAUUSD) gains downward momentum, driven by the Federal Reserve’s hawkish stance and a strong US dollar. Technical signals for today’s XAUUSD forecast suggest a price decline to the 2,579 level.