Gold (XAUUSD) prices rose to the 3,340 USD area, although the pullback may resume as Middle East negotiations begin. Find out more in our analysis for 26 June 2025.

XAUUSD forecast: key trading points

- Market focus: US Q1 GDP growth data is due today

- Current trend: correcting upwards

- XAUUSD forecast for 26 June 2025: 3,312 and 3,350

Fundamental analysis

Geopolitical tensions in the Middle East continue to ease, as US and Iranian officials prepare to meet next week. The planned talks aim to address Iran’s nuclear programme and outline de-escalation measures for the ongoing conflict in the region.

Today, market participants focus on upcoming macroeconomic data from the US, with final Q1 2025 GDP figures due during the American session. Analysts expect a 0.2% quarterly drop.

XAUUSD technical analysis

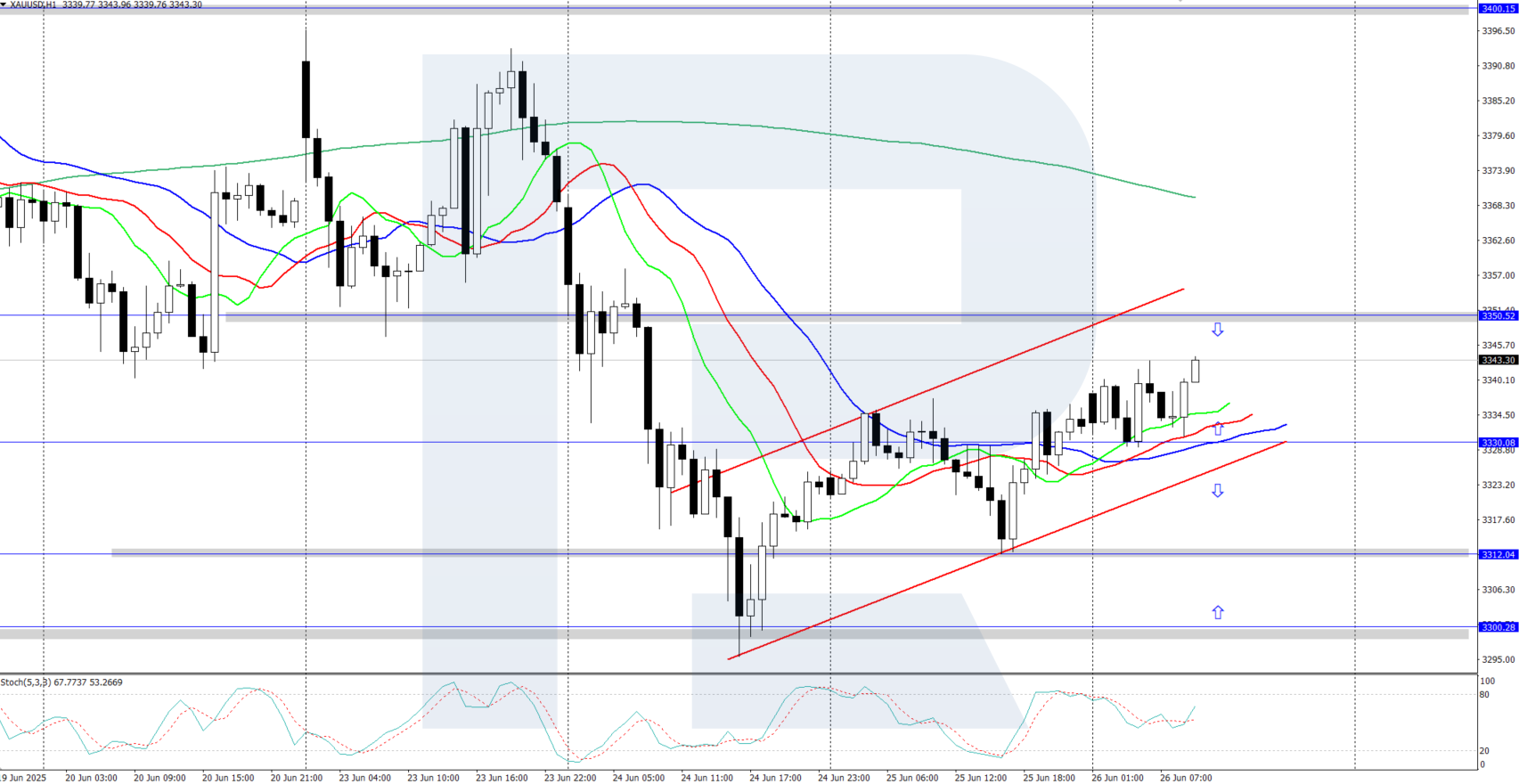

XAUUSD quotes are undergoing an upward correction after rebounding from the daily support level at 3,300 USD. The Alligator indicator is rising, confirming the current bullish momentum. However, once the correction ends, the precious metal could resume its downward trajectory.

The short-term XAUUSD price forecast suggests further growth towards 3,350 USD if bulls retain control. Conversely, if bears regain the upper hand, prices could pull back to the 3,300 USD support level.

Summary

Gold is undergoing an upward correction amid the current US dollar weakness. Today’s key driver will be the release of US Q1 GDP growth data.