The XAUUSD price rose moderately on Thursday and consolidated above 2,500 USD, creating the conditions for testing the historical high of 2,532 USD. Price growth may be driven by US employment data. Find out more in our XAUUSD analysis for today, 6 September 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting today’s US employment market statistics

- Current trend: gold is trading within an uptrend

- XAUUSD forecast for 6 September 2024: 2,532 and 2,500

Fundamental analysis

XAUUSD quotes are trading within an uptrend, supported by the beginning of US Federal Reserve monetary policy easing. Gold prices dipped below 2,500 USD as part of a correction at the start of the week. However, after encountering active buying interest near this level, they rose above it again.

Yesterday’s ADP employment data came in below the forecast, showing actual growth of only 99,000 against the expected 145,000. Statistics on nonfarm payrolls and the unemployment rate will be presented to market participants today. A decrease in employment will exert pressure on the USD and contribute to strengthening gold. Conversely, job growth will support the US dollar and may drive down XAUUSD quotes.

XAUUSD technical analysis

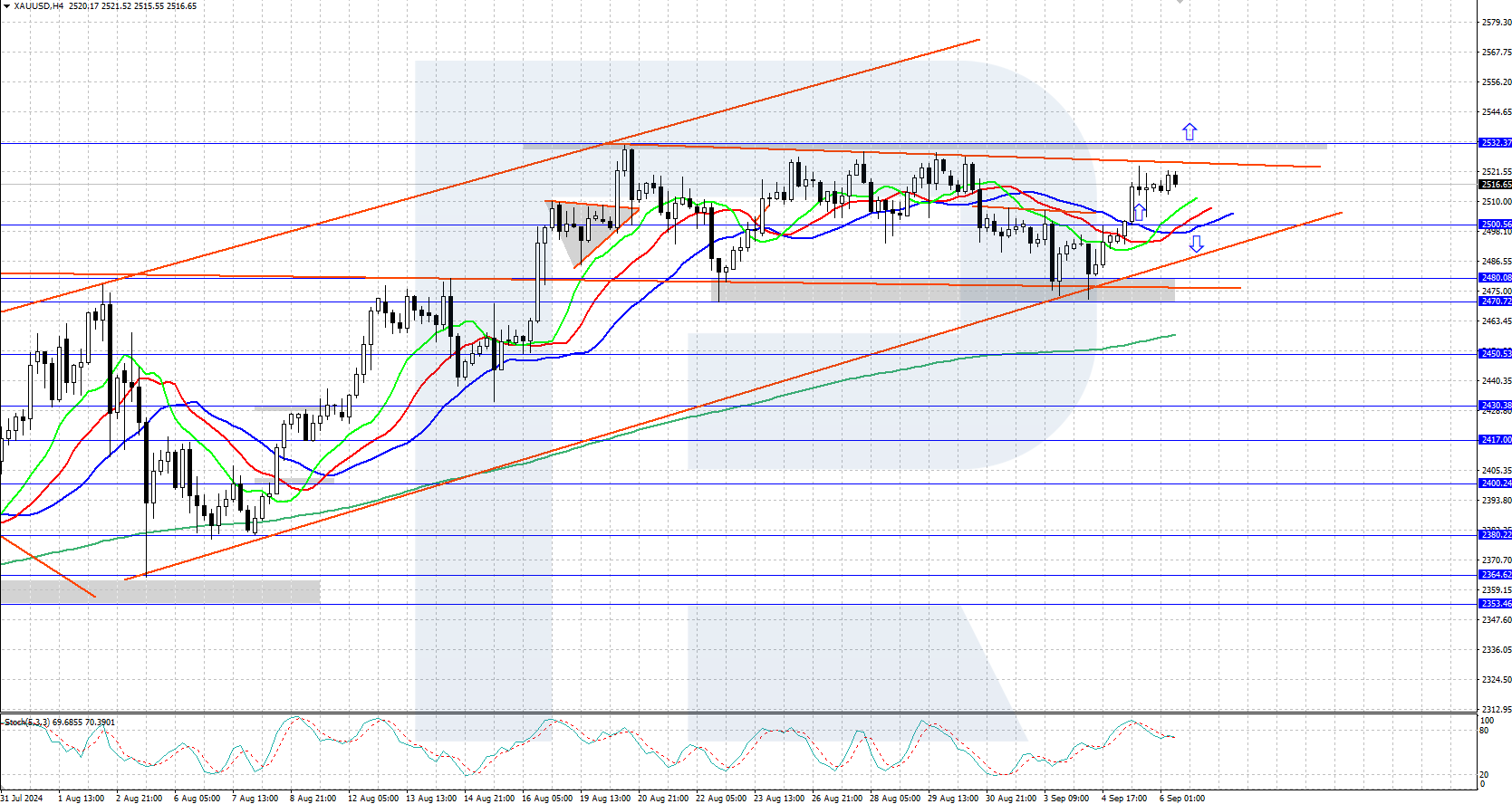

The XAUUSD price is experiencing an uptrend on the H4 chart. There was a downward correction at the beginning of the week, but the quotes managed to hold above the upper boundary of a triangle pattern, coinciding with the crucial 2,470-2,480 USD. The price now trades above 2,500 USD, with prerequisites for further growth.

The short-term XAUUSD price forecast suggests that the price could rise to a high of 2,532 USD and higher if the nonfarm payroll statistics are weak. Robust US employment data will bolster the US dollar and could push gold prices back below the 2,500 USD level.

Summary

Gold prices are experiencing upward momentum, rebounding from the crucial 2,470-2,480 USD support area. Today, the release of US employment market statistics will drive further XAUUSD price movements.